GE Vernova Inc. (NYSE:GEV) reported mixed third-quarter 2025 financial results on Wednesday.

The company reported GAAP earnings per share of $1.64, missing the consensus estimate of $1.92, while total revenue reached $9.969 billion, exceeding the forecast of $9.158 billion.

"GE Vernova delivered another productive quarter with strong financial results. Our growth trajectory is accelerating and the demand environment for our equipment and services remains strong with $16 billion in backlog growth year-to-date. Our Gas Power equipment backlog and slot reservation agreements increased from 55 to 62 gigawatts sequentially, and our Electrification equipment backlog increased $6.5 billion year-to-date, to approximately $26 billion," said GE Vernova CEO Scott Strazik.

GE Vernova reaffirmed its full-year 2025 guidance, expecting revenue to reach the higher end of the $36.0–$37.0 billion range, slightly below the $37.186 billion consensus estimate.

GE Vernova shares closed at $576.00 on Wednesday.

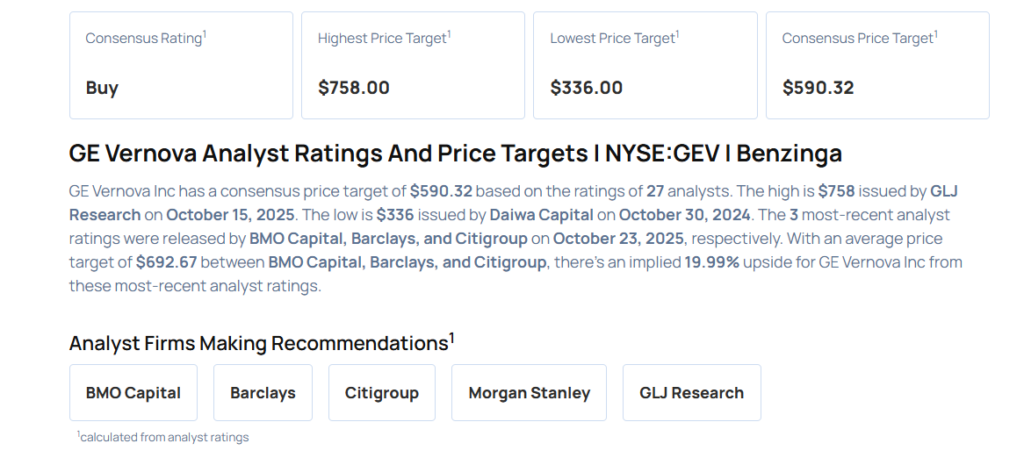

These analysts made changes to their price targets on GE Vernova following earnings announcement.

- Citigroup analyst Andrew Kaplowitz maintained GE Vernova with a Neutral and lowered the price target from $670 to $658.

- Barclays analyst Julian Mitchell maintained the stock with an Overweight rating and raised the price target from $706 to $710.

- BMO Capital analyst Ameet Thakkar maintained GE Vernova with an Outperform rating and raised the price target from $690 to $710.

Considering buying GEV stock? Here’s what analysts think:

Read This Next:

- Top 2 Materials Stocks That Are Ticking Portfolio Bombs

Photo via Shutterstock