Super Micro Computer, Inc. (NASDAQ:SMCI) will release earnings results for the first quarter, after the closing bell on Tuesday, Nov. 4.

Analysts expect the Boston, Massachusetts-based company to report quarterly earnings at 39 cents per share, down from 74 cents per share in the year-ago period. The consensus estimate for Super Micro Computer's quarterly revenue is $5.8 billion, compared to $5.94 billion a year earlier, according to data from Benzinga Pro.

On Oct. 29, Super Micro Computer announced the creation of a federal subsidiary called Super Micro Federal LLC, which will accelerate its expansion into the federal market.

Super Micro Computer shares fell 2.3% to close at $50.75 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

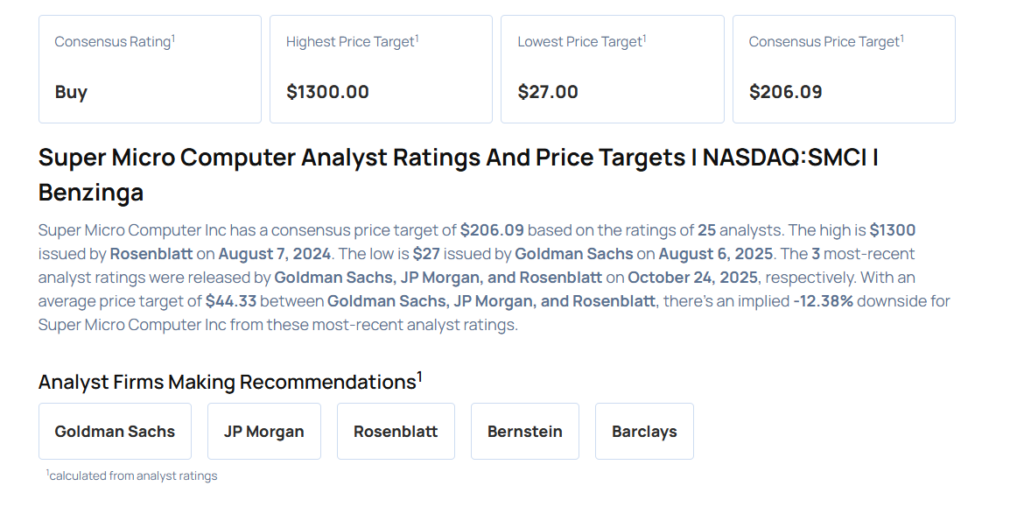

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Goldman Sachs analyst Michael Ng maintained a Sell rating and raised the price target from $27 to $30 on Oct. 24, 2025. This analyst has an accuracy rate of 75%.

- JP Morgan analyst Samik Chatterjee maintained a Neutral rating and cut the price target from $45 to $43 on Oct. 24, 2025. This analyst has an accuracy rate of 79%.

- Rosenblatt analyst Kevin Cassidy maintained a Buy rating and raised the price target from $50 to $60 on Oct. 24, 2025. This analyst has an accuracy rate of 84%.

- Bernstein analyst Mark Newman initiated coverage on the stock with a Market Perform rating and a price target of $46 on Sept. 16, 2025. This analyst has an accuracy rate of 75%.

- Barclays analyst Tim Long maintained an Equal-Weight rating and raised the price target from $29 to $45 on Aug. 7, 2025. This analyst has an accuracy rate of 72%.

Considering buying SMCI stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says Stay Away From AT&T, Calls Nextracker ‘Tremendous’

Photo via Shutterstock