Summary: Macy's will release its second-quarter 2025 results before the market opens on September 3rd. Amidst a complex trade environment, Macy's sales and gross profit margins may provide insights into U.S. inflation and macroeconomic trends.

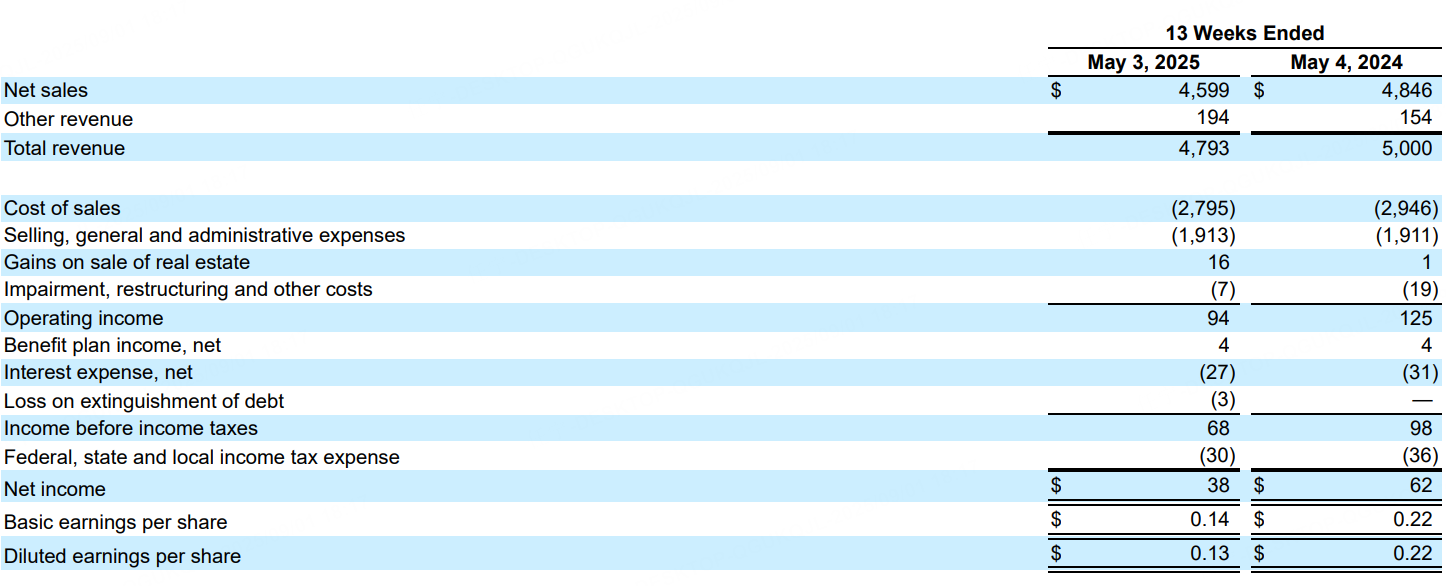

• Macy’s, Inc. achieved net sales of $4.6 billion, exceeding the company’s prior guidance range.

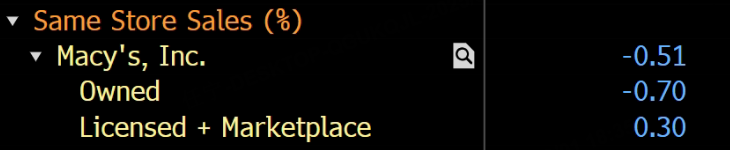

• Macy’s, Inc. comparable sales were down 2.0% on an owned basis and down 1.2% on an owned-pluslicensed-plus-marketplace basis, surpassing the company’s prior guidance range, benefiting from better than expected performance across all nameplates.

• The company reported GAAP diluted earnings per share of $0.13; Adjusted diluted earnings per share of $0.16, above the company’s prior guidance range.

• Bloomingdale’s reported comparable sales growth on an owned and owned-plus-licensed-plusmarketplace basis of 3.0% and 3.8%, respectively.

• Bluemercury reported comparable sales growth of 1.5%, its 17th consecutive quarter of comparable sales growth.

• The company returned approximately $152 million to shareholders, consisting of $51 million in quarterly cash dividends and $101 million of share repurchases.

According to Bloomberg data, analysts generally expect Macy's to report revenue of $4.743 billion and adjusted diluted earnings per share of $0.18 in the second quarter.

Macy's private-label same-store sales are expected to fall 0.7% in the second fiscal quarter.

Key Highlights

Store Renovation Results

The store renovation and "selective investment" strategies are entering a testing phase. The second quarter typically coincides with seasonal promotions, making the balance between customer traffic and discounting particularly critical. Institutional analysts generally believe that the visual merchandising and staffing optimizations in the renovated sample stores have resulted in a better shopping experience, but improved conversion rates require a more precise assortment mix. Single-store efficiency is expected to improve quarter-over-quarter in the second quarter, laying a solid foundation for the peak season in the second half of the year.

Gross Margin Recovery

In the first quarter, the company implemented more aggressive promotions to generate sales, which put pressure on gross margins. A slight year-over-year decline in gross margins is expected in the second quarter, but the decline is manageable. Key variables will depend on the depth of clearance, the cadence of releases, and whether the increased proportion of high-margin categories can offset some of the discounting pressure. Gross margins are expected to recover in the second half of the year.

Improving Online Sales Efficiency

The proportion of online orders continued to increase in the first quarter. In the second quarter, attention will need to be paid to balancing online customer acquisition costs with offline fulfillment efficiency. Improving the efficiency of using stores as forward warehouses, optimizing return and exchange processes, and enhancing the in-store pickup experience will directly impact order fulfillment costs and customer satisfaction. Continued iteration of algorithmic product selection and regionalized replenishment will help reduce end-of-season clearance pressure and maintain gross profit margins. Strengthening the "online first launch + in-store experience" strategy for high-margin small-item products may lead to higher conversions and improved single-item profits.

Impact of Tariffs

US consumers are facing a new round of price increases, and major retailers have warned that tariff costs are beginning to be passed on to retail outlets. Macy's is expected to mitigate the impact of tariffs by adopting a strategy of "modest price increases, product category changes, and discontinuing sales of some low-margin items." In the short term, price increases will introduce sales uncertainty, but optimizing product assortment will also help stabilize overall gross profit margins.