Advanced Micro Devices (AMD) will announce its fiscal year 2025 second-quarter earnings report after the U.S. stock market closes on August 5, Eastern Time.

According to Bloomberg analysts’ consensus, the company’s revenue is expected to reach $7.419 billion, a year-on-year increase of 27.15%; adjusted net profit is forecasted to be $796.1 million, a year-on-year decrease of 29.3%; adjusted earnings per share are expected to be $0.486.

Last Quarter Review

AMD delivered impressive results in the first quarter of 2025, with several key indicators surpassing market expectations:

Revenue Performance: Achieved revenue of $7.438 billion, a year-on-year increase of 36%, significantly higher than analysts’ expectations of $7.12 billion.

Profitability: Non-GAAP earnings per share of $0.96, a year-on-year increase of 55%, surpassing market expectations.

Segment Performance:

Growth Drivers: Data center business revenue of $3.7 billion (year-on-year +57%), client business revenue of $2.3 billion (year-on-year +68%), continuing the rapid growth trend;

Pressure Areas: Gaming business revenue of $647 million (year-on-year -30%), embedded business revenue of $823 million (year-on-year -3%).

Future Guidance:

Q2 revenue expected to be $7.1–7.7 billion (median $7.4 billion, in line with market expectations of $7.24 billion);

Gross margin differentiation is evident: including $800 million export control expenses, gross margin is 43%; excluding it, gross margin maintains a healthy level of 54%.

This Quarter Highlights

Data Center: Short-Term Pressure, Long-Term Outlook Remains Clear

As the core pillar of AMD's growth strategy, the data center business is expected to face a 5–7% quarter-on-quarter decline this quarter. Key reasons include:

MI300 Series AI accelerator card delivery schedule adjustments;

Structural compression of orders from some hyperscale customers.

Despite this, the long-term growth logic remains clear. The new generation MI350 chips have entered the wide sampling stage among customers this quarter and will achieve mass production in mid-year. The planned MI400 Series set to release in 2026 will further support rack-scale architecture, catering to next-generation large model inference and training needs. Its technological potential is highly anticipated.

Specific Market Export Restrictions: Stage Impact Persists, Marginal Improvement

Since the beginning of the second quarter of this year, AMD’s high-end AI chip products (such as MI308) for certain Asia-Pacific markets have been subject to policy adjustments requiring additional export permits. The company expects this change to impose a $700 million pressure on Q2 revenue, with annual cumulative impact possibly reaching $1.5 billion, which may drag down overall gross margin performance.

Including such impacts, gross margin is expected to fall to 43%;

Excluding it, core business gross margin is expected to remain stable at around 54%.

It's noteworthy that AMD recently stated its related export permit application has entered the review process. Market expectations suggest these restrictions may show marginal improvement in the future, particularly in terms of policy negotiations or the establishment of temporary channels.

If shipments resume, the related business will rebound quickly, supporting the company's profitability recovery in the second half of the year and inject new momentum into long-term market expansion.

PC / Gaming / Embedded Business: Structural Pressure Continues

Although the client business (including PC) performed well last quarter, the gaming and embedded sectors remain in the adjustment phase:

Gaming Revenue dropped 30% year-on-year, reflecting the late-cycle demand decline for consoles and slow inventory digestion in channels;

Embedded Revenue decreased 3% year-on-year, mainly due to delayed enterprise procurements and slow recovery in the industrial market.

Overall, these two segments are unlikely to constitute significant growth engines in the short term, and Q2 performance is expected to remain weak.

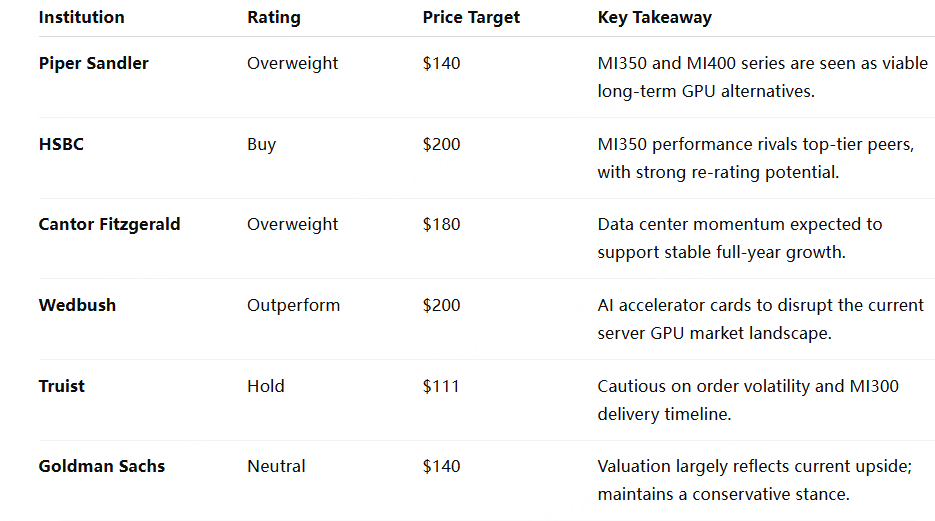

Analysts' Opinions: Short-Term Bearish, Long-Term Bullish, Intense Valuation Game

Currently, the market shows a noticeable split in opinions regarding AMD's future trends. Some institutions believe its AI business layout has reached a critical implementation phase, while others worry about short-term policy restrictions and delivery schedule uncertainties.

Overall, although the market generally expects AMD’s revenue to face certain pressure this quarter, institutional investors remain strongly confident in its AI chip iteration capabilities and long-term competitiveness in the high-performance CPU ecosystem.

Currently, AMD is in a critical transition period of its artificial intelligence strategic transformation, and this upcoming earnings report will be a key reference for the market to assess its capability to handle external policy shocks, control the pace of data center product delivery, and maintain stable profitability.

If the company can smoothly advance the large-scale deployment of the MI350 series AI accelerator cards, resume critical regional export growth, and further consolidate EPYC and Ryzen’s leading position in the server and PC markets, its long-term growth logic is expected to be further validated and strengthened.

Whether in terms of industry status, product iteration speed, or as a crucial participant in the fundamental computing architecture of the AI era, AMD's quarterly earnings report is not just a performance report, but a vital benchmark for the market to reevaluate its valuation system and growth potential.

This content is generated based on tiger AI and Bloomberg data, and is for reference only.