QMCO Q4 Preview: Expected To Catch The "AI Express", And Enterprise Market Expansion Is An Important Focus

Abstract

Quantum(QMCO) will disclose its fourth quarter financial report for fiscal year 25 after the market closes on June 30, local time in the United States. The company has recently continued to advance its overall layout in the fields of data management and AI. The AI concept and quantum computing sectors have also been very active this year, and this performance is particularly exciting.

Performance Review

Quantum's revenue in the first three quarters of fiscal year 2025 totaled $214 million, a year-on-year decrease of 10.72%. The cumulative net loss in the first three quarters was $106 million, a year-on-year increase of 373.46%.

The company's overall revenue is still under pressure, but it is using a variety of methods to control costs and strive to keep losses within an acceptable range. In terms of the main business, it is still relatively stable in the field of large-capacity storage and solutions for enterprise users, and the market continues to pay attention to this part of the business with better prospects.

Fourth quarter performance forecast

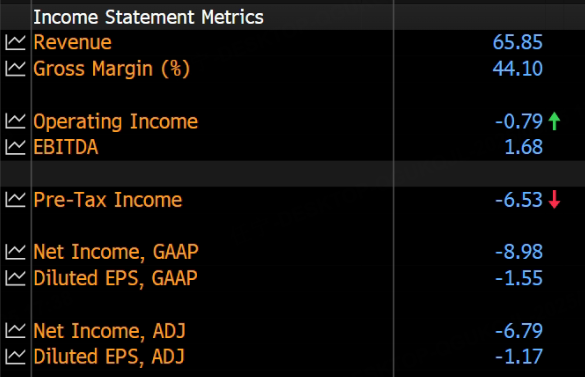

According to Bloomberg data, the current market generally expects Quantum's revenue in the fourth quarter of fiscal year 25 to be US$65.85 million, a year-on-year decline of about 7%. Earnings before interest, taxes, depreciation and amortization (EBITDA) are US$1.68 million, and diluted earnings per share are -US$1.55.

The company's main business is currently large-capacity data storage and big data management. Relying on excellent hardware equipment and management solutions, the outside world generally predicts that this revenue will still be a potential engine for future growth. Judging from the existing scale and customer situation, the business in the enterprise market is expected to maintain a moderate expansion, and there is room for imagination for the year-on-year growth rate.

Focus

Adapting to the data management needs of the AI era

Quantum has long accumulated experience in the research and development and deployment of data management systems, especially the efficient processing of massive data and multi-protocol compatibility, which has always been the company's main technical advantage. The current market has a high demand for big data management in AI training. If the company can implement specific progress in this area this quarter and further improve functions and security, it will help increase customer repurchase rates and shorten the negotiation cycle of potential contracts. The resulting scale effect will also support profit margins to a certain extent, making profits no longer too dependent on a single product.

Implementation of higher-level AI solutions

In the process of welcoming the wave of AI technology, Quantum has always maintained its own characteristics in the management and optimization of unstructured data. If we can make full use of the surge in demand for AI in the digital transformation of enterprises this quarter, assist customers in establishing a stable data carrier layer, and provide necessary storage expansion and computing power allocation, then data management is no longer just installation and maintenance, but also a "total solution loop" that runs through the front and back ends. This platform-based solution can not only bring new orders, but also lock in later paid services, thereby increasing the company's revenue.

Balance between investment and cost

The company may continue to increase R&D investment this quarter and explore pre-upgrades of some data management facilities. Although this investment will increase operating costs in the short term, if it can be combined with a flexible cost control strategy, it may be converted into long-term benefits.

Deeply tap the potential for cooperation with major customers

In the previous quarters, Quantum has carried out in-depth project cooperation with some major customers, especially in areas such as security and finance that require long-term and stable support, laying a good foundation for future development. If we can launch subsequent value-added services or a richer product portfolio for key major customers this quarter, it will not only increase revenue, but also attract new customers through demonstration effects.

Analysts' views

Many institutions are more cautious about Quantum's fourth quarter financial report for fiscal year 25.

Some research institutions said that the penetration rate of AI in enterprises, government departments, medical and financial industries is increasing, and Quantum's accumulation in massive data processing and high-reliability storage will help it obtain potential orders. However, some analysts also emphasized that for companies that have been under revenue pressure for several consecutive quarters, it will take time to achieve breakthrough improvements.

In short, the development of the AI era requires an integrated storage solution with high reliability. If Quantum can give a clear signal this quarter, the market's feedback on the company's stock price may be more positive.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10