HSA vs. PPO Plans: Which Benefits You More?

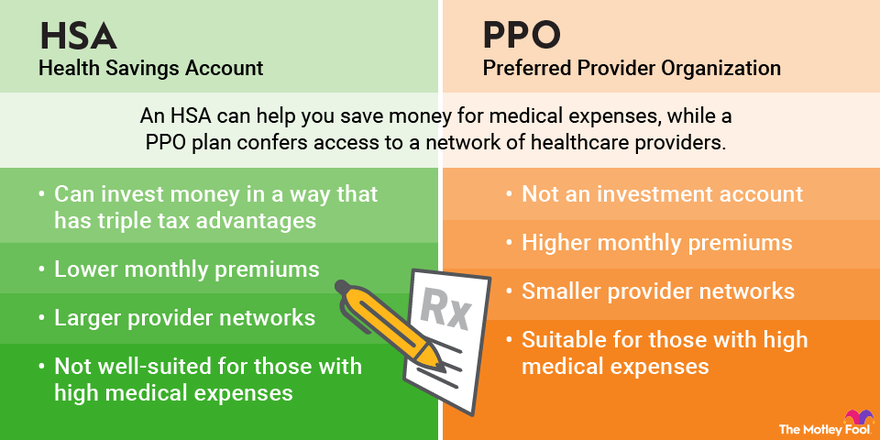

If you're choosing among different types of health insurance plans, then you may be weighing a health savings account (HSA) versus a preferred provider organization (PPO) plan. An HSA can help you to save money for medical expenses, while a PPO plan confers access to a network of healthcare providers.

While HSAs and PPO plans serve distinct purposes, here is a summary of their respective benefits and drawbacks:

| Plan Type | Advantages | Disadvantages |

|---|---|---|

| HSA | Can invest money in a way that has triple tax advantages. Low premiums. Greater flexibility for how money can be spent. Can be rolled over. | Higher out-of-pocket healthcare costs. 20% early withdrawal penalty for non-medical expenses. Typically not well-suited for those with high medical expenses. |

| PPO | Lower out-of-pocket costs for medical expenses. Easier to access medical specialists. Suitable for those with high healthcare costs. | Higher premiums. Expenses such as dental and vision care usually not covered. Not an investment account. |

What is an HSA?

A health savings account is a tax-advantaged investment account designed to help you pay for medical expenses. HSAs are similar to 401(k) plans except they are used for healthcare, including medications, dental care, and vision care.

You're allowed to contribute to an HSA only if you have a high-deductible health plan (HDHP). Any type of health insurance plan, including one from a PPO, can be an HDHP. If your annual deductible exceeds the relevant amount below, then you have an HDHP:

| Insurance Holder Type | 2023 Minimum Deductible |

|---|---|

| Individual | $1,500 ($1,400 in 2022) |

| Family | $3,000 ($2,800 in 2022) |

Many employers that offer high-deductible health plans also offer HSAs. If your employer doesn't offer an HSA alongside its high-deductible plan, then you can still open one independently.

What is a PPO?

A PPO plan is a type of health insurance that affords the greatest access to a large network of medical providers or specialists. A PPO typically is not, but can be, an HDHP, which is the necessary condition for establishing an HSA. Most people insured by PPO plans are not eligible to open HSAs.

While the option of opening an HSA is attractive to many people, choosing a PPO plan may be the best option if you have significant medical expenses. Not facing high deductible payments makes it easier to receive the medical treatment you need, and your healthcare costs are more predictable.

Unlike HSAs, PPO plans are not investment accounts. They also generally do not cover over-the-counter medications or dental or vision care.

Related investing topics

HDHP vs. PPO: Which Is the Right Choice for You?

This primer on different plans can help you find the right healthcare coverage for you.

What Is An HSA & How Does It Work?

Health savings accounts can help you pay for your medical expenses with pre-tax money.

HSA Contribution Limits in 2021 and 2022

Making the most of health savings accounts means knowing the contribution limits.

2022 Rules for Health Savings Accounts (HSAs)

Making the most of your health savings account means understanding its rules.

HSA vs. PPO: Which should you choose?

Sometimes an HDHP combined with an HSA is clearly your best option, while for others a PPO plan is the better choice. Here are some general guidelines related to your health and financial situation to help you choose.

Choose an HDHP with an HSA if:

- You're generally healthy and don't need frequent medical care.

- You have enough money in savings to cover a high deductible in case of an emergency.

- You want to save money for your healthcare costs when you retire.

- You're willing to price-shop for medications and services to minimize your expenses.

Choose a PPO plan if:

- You have health problems, visit the doctor frequently, or take many medications.

- You are expecting a major medical expense such as surgery or the birth of a child.

- You're willing to pay higher premiums in exchange for the certainty of lower out-of-pocket costs related to specific medical needs.

If you opt for an HSA in conjunction with a high-deductible insurance plan, you'll also need to decide how to invest the funds in your account. Buying and holding the stocks of quality companies is a sure path to generating enough money to pay for your health expenses in retirement.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10