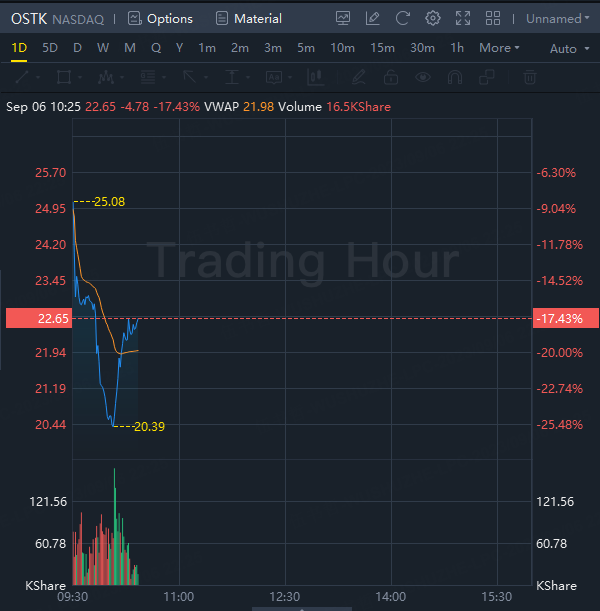

Overstock.com Tumbled Over 17% in Morning Trading After Providing Bed Bath & Beyond Update

Overstock.com (NASDAQ: OSTK) shares tumbled over 17% in morning trading following an update on the performance of Bed Bath & Beyond, for which it acquired intellectual property.

The update indicates that revenue for Bed Bath & Beyond has experienced a low-double-digit percentage decline year-over-year since July 1.

Here are some key highlights from the update:

Active customers in the last 12 months numbered over 4.8 million as of September 4;

There has been a mid-single-digit percentage net increase in customers since the U.S. launch;

Orders have seen mid-single-digit percentage growth year-over-year, including high-teens percentage growth since the US launch;

Revenue has suffered a mid-teens percentage decline year-over-year, including a low-double-digit percentage decline since the US launch;

Average order value has declined by a high-teens percentage year-over-year, including a low-20s percentage decline since the US launch;

Gross profit as a percentage of revenue is approximately 18%;

Sales & Marketing expenses as a percentage of revenue stand at around 15%.

“Our U.S. business launched successfully on August 1. Consumers are showing that they love the new Bed Bath & Beyond,” said Jonathan Johnson, CEO of the new Bed Bath & Beyond.

“Even in a challenging macro-economic environment, we acquired new customers and re-activated past customers. Our topline performance is improving steadily. We have experienced year-over-year order growth since the U.S. launch, led by orders from new customers.”

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10