Mitre Mining Insiders Are Down AU$38k But Regain Some Losses

Some of the losses seen by insiders who purchased AU$160.7k worth of Mitre Mining Corporation Limited (ASX:MMC) shares over the past year were recovered after the stock increased by 10.0% over the past week. However, total losses seen by insiders are still AU$38k since the time of purchase.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we would consider it foolish to ignore insider transactions altogether.

View our latest analysis for Mitre Mining

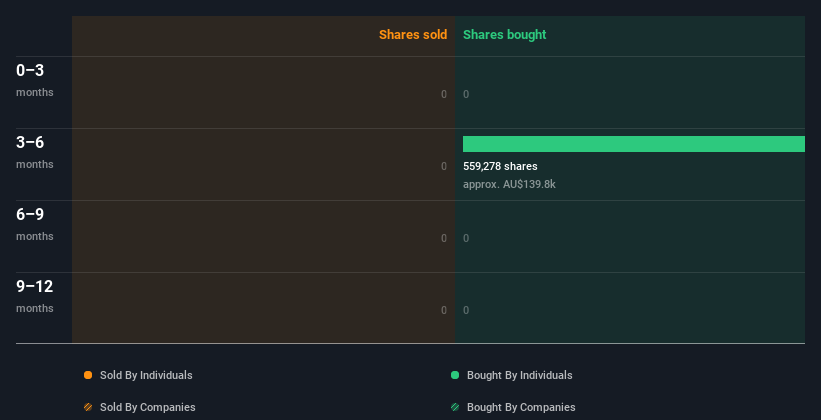

Mitre Mining Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by insider Stephen Parsons for AU$161k worth of shares, at about AU$0.31 per share. So it's clear an insider wanted to buy, even at a higher price than the current share price (being AU$0.22). Their view may have changed since then, but at least it shows they felt optimistic at the time. To us, it's very important to consider the price insiders pay for shares. It is encouraging to see an insider paid above the current price for shares, as it suggests they saw value, even at higher levels. The only individual insider to buy over the last year was Stephen Parsons.

You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Mitre Mining is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership Of Mitre Mining

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. It appears that Mitre Mining insiders own 31% of the company, worth about AU$3.9m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Do The Mitre Mining Insider Transactions Indicate?

It doesn't really mean much that no insider has traded Mitre Mining shares in the last quarter. However, our analysis of transactions over the last year is heartening. Insiders own shares in Mitre Mining and we see no evidence to suggest they are worried about the future. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For example, Mitre Mining has 4 warning signs (and 3 which are a bit concerning) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're helping make it simple.

Find out whether Mitre Mining is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10