MDYG: U.S. Mid-Cap Growth Stocks Are Cyclically Attractive

- SPDR S&P 400 Mid Cap Growth ETF is an inexpensive ETF focused on mid-cap growth stocks, with $2.68 billion in assets.

- MDYG's portfolio is mostly in economically sensitive sectors, with a forward return on equity of up to 22%, and expected earnings growth of over 12% (three- to five-year basis).

- A valuation suggests MDYG is within the fair value range, but with a healthy IRR potential of over 9%, backed by favorable cyclical positioning and fund diversification.

EschCollection

Introduction

SPDR S&P 400 Mid Cap Growth ETF (NYSEARCA:MDYG) is an exchange-traded fund focused on investing in mid-cap growth stocks. The fund is designed to track the S&P MidCap 400 Growth Index, and carries a gross expense ratio of 0.15%, making it quite cheap/affordable for a strategy with this specificity, while assets under management were $2.68 billion as of August 22, 2024, according to SSGA (the fund manager for MDYG).

I have not covered MDYG before, but I have been looking at funds recently that map to strategies that include mid-cap stocks and/or growth stocks, since we are in the kind of economic and market environment that might begin to favour these funds. It is difficult to outperform the S&P 500 or Nasdaq 100 (or ETFs that track these benchmarks), but with growth and inflation moderating, and monetary policy potentially set to begin easing, growth stocks and mid-cap stocks could potentially outperform. Growth stocks tend to perform well when monetary policy eases, as discount rates fall, while mid-caps can often offer higher equity risk premiums owing to higher perceived risk as compared to large- and mega-cap stocks.

MDYG Portfolio

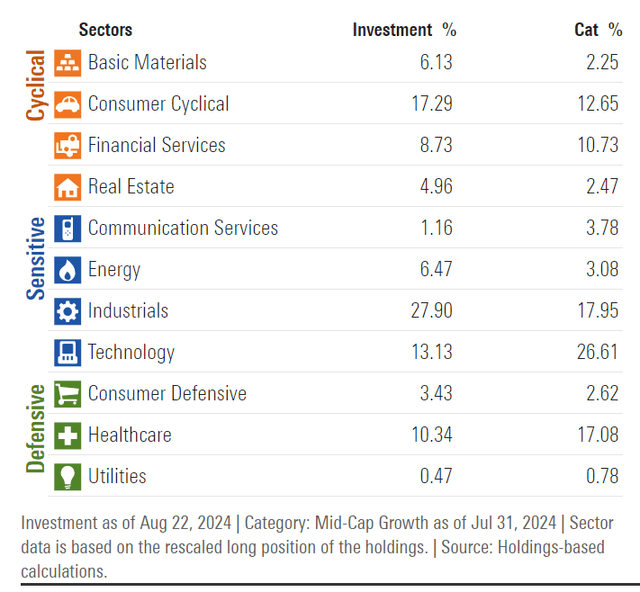

The MDYG fund is spread mostly across economically sensitive and cyclical sectors, most specifically Industrials (at 27.90%) and Consumer Cyclical (at 17.29%). Other key sectors include Technology (13.13%), Healthcare (a more "defensive" sector, at 10.34%), and Financial Services (at 8.73%; a sector that admittedly does not tend to perform well as interest rates fall).

Morningstar.com

Interest rates are still fairly high though (at least relative to the past ten years, on average), in the United States, and it is U.S. yields that matter since MDYG is almost 100% exposed to the United States (with some smaller exposures to Canada and the United Kingdom, by public listing).

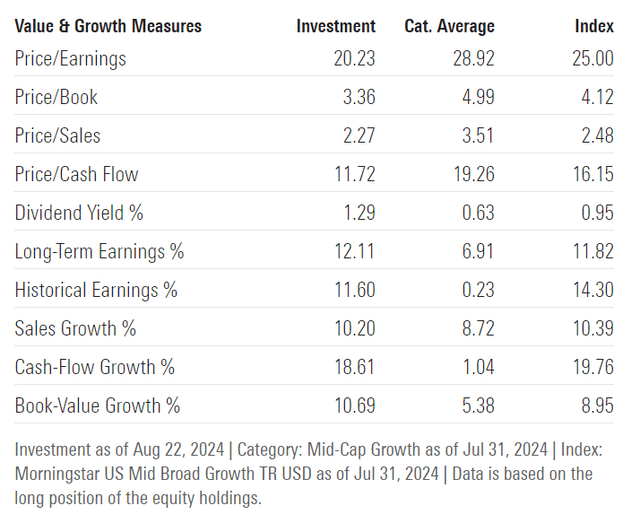

Morningstar expect the fund's portfolio, at present, to generate three- to five-year earnings growth of about 12.11% on average. The forward price/earnings ratio of 20.23x compares to a price/book ratio of 3.36x, implying a forward return on equity of 16.61%, which is moderately high.

Morningstar.com

Mega-cap stocks and funds typically offer higher returns on equity than 16-17% at present, but 17% is still competitive. MDYG should also be valued based on prevailing price relative to value, which we will come onto next. However, I will look at the fund's benchmark index's statistics, cited earlier, for more reliable and less biased statistics. (Morningstar is known to adjust its ratios for losses in portfolios, etc., and use operating earnings instead of net earnings, which is a less conservative approach.)

Valuation

The most recent factsheet for MDYG's benchmark is dated as of July 31, 2024, and reports trailing and forward price/earnings ratios of 24.17x and 19x, respectively, with a price/book ratio of 4.21x. The indicative dividend yield is reported at 0.98%. Together, these suggest forward one-year earnings growth of 27.21%, with a forward return on equity of 22.16% (interestingly even better than Morningstar's figure, but I will continue using S&P's figures, as they tend to be more reliable in my experience). To build a valuation, we will be using Morningstar's average earnings growth expectation and a moderated return on equity, going forward, to understand the consensus base case.

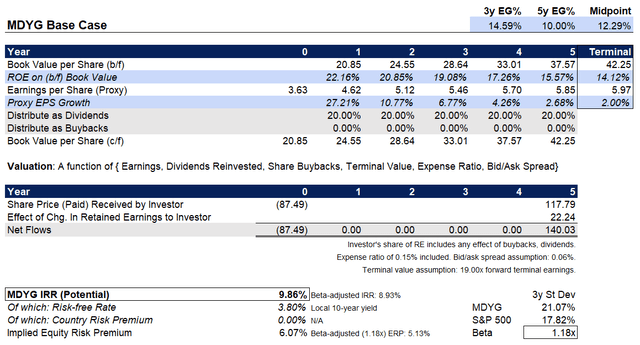

With the return on equity moderating in my calculations fairly quickly downward to 14% in year six, but nevertheless following a very similar average earnings growth expectation to consensus (around 12% as a midpoint between three and five years), and taking into account the fund's expense ratio (and bid/ask spread: currently only 0.06%), the implied headline IRR is 9.86%.

Author's Calculations

This would suggest to me that MDYG is within the realm of fair value, given that the equity risk premium is 6.07%, or 5.13% once adjusted for historical three-year beta of 1.18x. As a result, MDYG does not look like a characteristically "Strong Buy", from a valuation standpoint, as developed-market equities "should" usually offer an ERP of 3.2-5.5%. However, as noted previously, from a cyclical standpoint, MDYG's characteristics are quite attractive (being focused on growth and mid-caps, together).

The fund rebalances quarterly in accord with its goal of aligning with its benchmark index, which is reconstituted quarterly. Nevertheless, the fund had 252 holdings as of August 22, 2024, and the largest holding represented only 1.35% of the fund, making MDYG well diversified and less liable to significant rebalancings. This does therefore contribute to the strength of our thesis, since MDYG is less likely to rebalance in such a way as to remove the high headline IRR potential in the medium- to long-term (which is a greater risk with more concentrated ETFs).

Further, the cyclical positioning for MDYG is strong, and so while MDYG is likely trading within the realm of fair value, the underlying equity risk premium is still full and healthy on a beta-adjusted basis.

As a result, I would take a bullish ("Buy") view on MDYG at present. The only cautionary note would be that while the valuation looks favorable for investors at present, should inflation begin to tick up again this could hurt the fund, as the portfolio is less likely than mega-caps to prove robust to cost increases (owing to typically lesser pricing power in smaller companies vs. large- and mega-cap companies). Additionally, should a weaker, growth-moderating environment lead to recession (which is not presently on the cards), this could drive MDYG lower than the broader market given its elevated historical beta.

Nevertheless, I do maintain that the base case for MDYG looks constructive, and in a pro-risk environment, the ERP should easily drop. This would create a higher, "front-loaded" IRR if held for under the five- to six-year projection period I presented above.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10