PBDC: Active BDC ETF, Strong 9.5% Dividend Yield And Performance Track-Record

8vFanI

The Putnam BDC Income ETF (NYSEARCA:PBDC) is an actively-managed ETF focusing on BDCs. PBDC's strong 9.5% dividend yield and performance track-record make it a buy. The fund's share price has yet to recover from recent market losses, so investors have a solid entry point into the fund right now as well.

PBDC - Basics

- Investment Manager: Franklin Templeton

- Dividend Yield: 9.53%

- Management Fee: 0.75%

PBDC - Overview and Analysis

BDC Basics and Portfolio

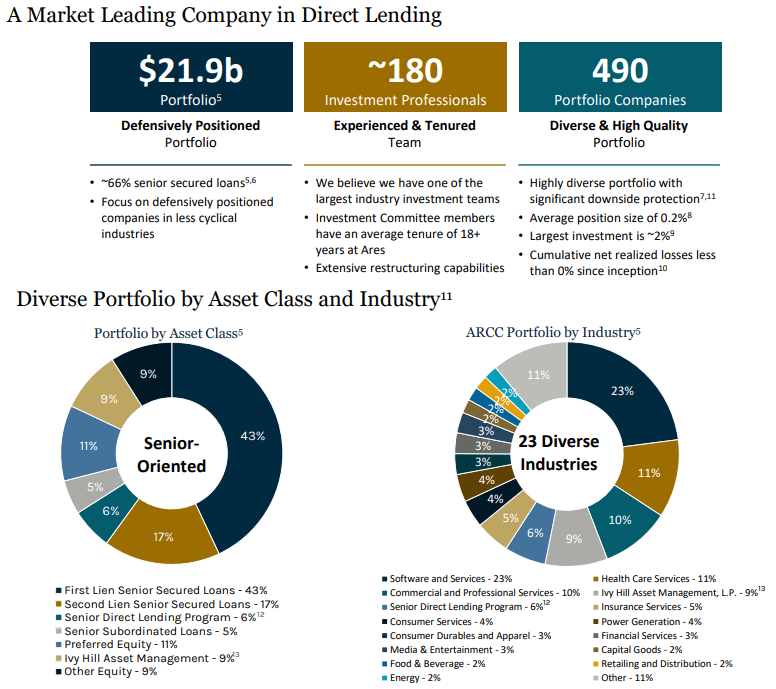

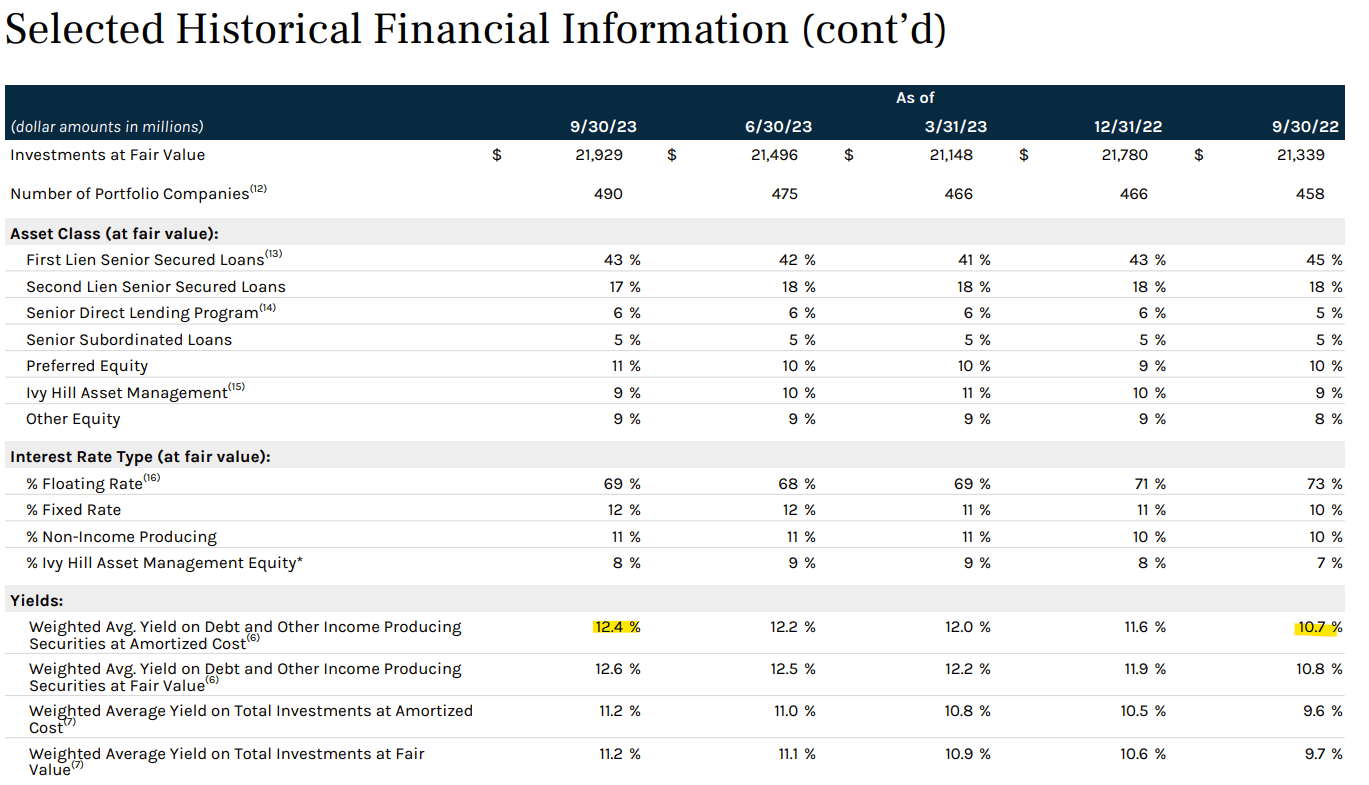

PBDC is an actively-managed ETF focusing on BDCs. BDCs are financial institutions that provide funds, generally senior loans, to small and medium-sized enterprises. BDCs are generally quite diversified, although less than the average mega-cap bank. As an example, Ares Capital (ARCC), the fund's largest holding, has the following portfolio.

ARES

As can be seen above, ARES's assets are incredibly well-diversified, with investments in dozens of industries, hundreds of investments. Concentration is low too, with an average position size of only 0.2%, and with the largest holding accounting for only 2% of its portfolio. ARES focuses on senior loans, as do most other BDCs, with sizable investments in other types of loans, and some equity.

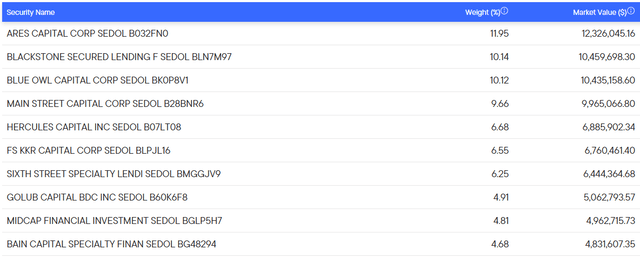

PBDC itself invests in 20 different BDCs. Largest of these are as follows:

PBDC

PBDC's portfolio has some diversification within its BDC niche, but overall diversification is low, and much lower than that of the S&P 500 and other broad-based equity indexes. This is because BDCs themselves are a small investment niche, targeting a tiny portion of the market, and because the fund's portfolio is concentrated, with its top ten holdings accounting for over 75% of the fund.

PBDC is actively-managed, so security selection and portfolio weights are at least partly an active investment decision. Active management increases risks somewhat but could generate excess returns and outperformance.

Strong 9.5% Dividend Yield

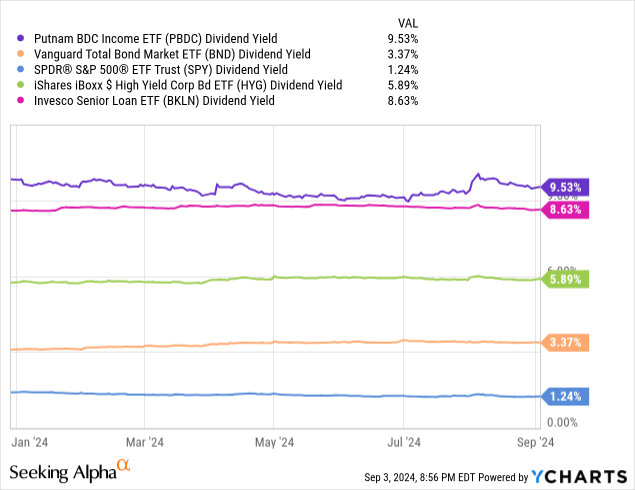

BDCs generate significant income from their portfolios. Said income must be distributed to shareholders due to regulatory reasons, so most BDCs sport strong yields. PBDC itself sports a 9.5% dividend yield, incredibly strong on an absolute basis, and higher than that of most asset classes, including bonds, equities, high-yield bonds and senior loans.

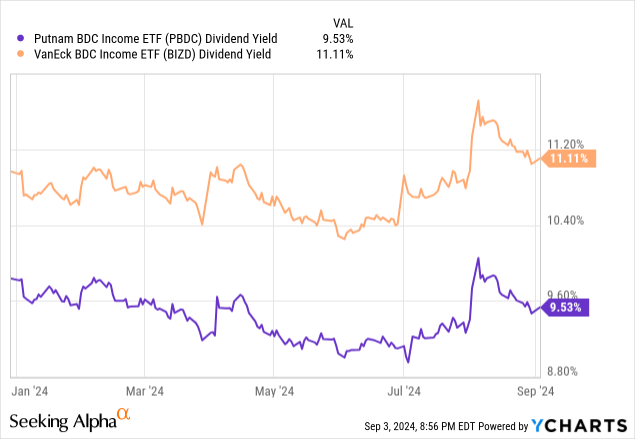

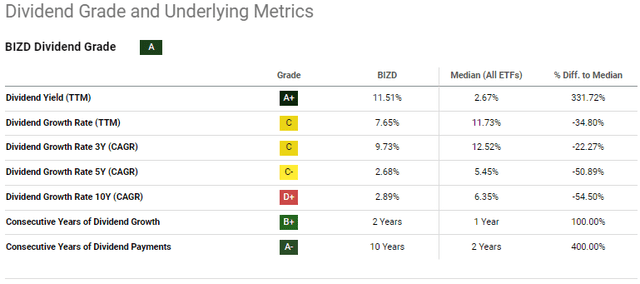

PBDC's dividend yield is a bit lower than that of its larger BDC peer, the VanEck Vectors BDC Income ETF (NYSEARCA:BIZD).

BDC income is dependent on two main factors: total assets and Federal Reserve rates.

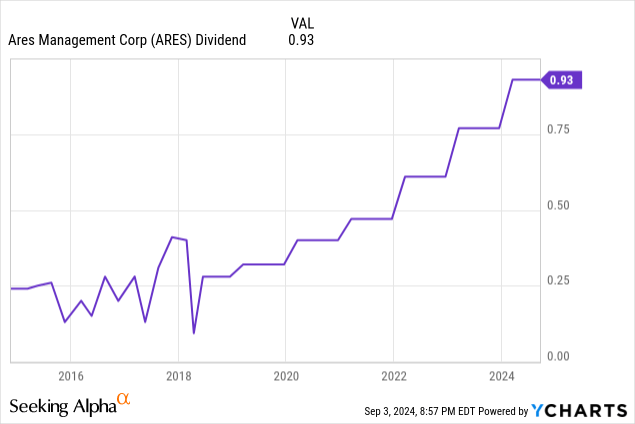

Assets are easy to explain: more assets means more income and fees. Most BDCs see organic portfolio growth long-term, so dividends grow long-term. Ares is one of the best examples of this, with dividends seeing significant growth since inception.

With inception in mid-2022, PBDC is a bit too young for us to meaningfully analyze its long-term dividend growth potential. BIZD has seen its dividends grow at a 2.9% CAGR these past ten years, and that fund is quite similar to PBDC. Growth has been slow, but positive, a solid benefit for shareholders. Due remember that PBDC sports a 9.5% dividend yield. Growth might be low, at least using BIZD as a benchmark, but starting from a very strong base. In my opinion, PBDC should see similar dividend growth to BIZD long-term, so these figures are informative for the former.

Seeking Alpha

BDC income is also strongly dependent on Federal Reserve rates, as these companies focus on variable rate senior loans, whose coupons are benchmarked to Fed rates (really SOFR, but close enough). Ares has a (somewhat old) table showing how the yield on its investments increased as the Fed hiked rates, for instance:

Ares

Higher income meant higher dividends for Ares too, with dividends just about doubling since the Fed started to hike.

As Ares hikes its dividends, PBDC should see higher income, resulting in dividend growth for the ETF. Other BDCs saw higher income from past Fed hikes, leading to further dividend growth for these ETFs.

Let's go through the entire process above once more. Higher Federal Reserve rates means higher senior loan coupon rates, which means higher BDC income, leading to higher BDC dividends, ultimately resulting in dividend growth for BDC ETFs like PBDC.

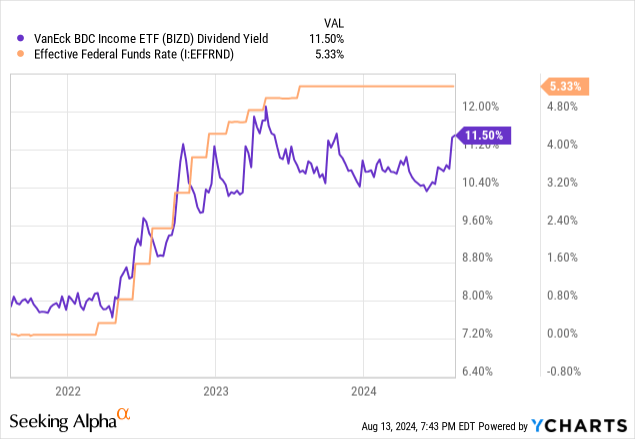

The complexity and length of the process muddles the link between Fed rates and BDC ETF dividend yields, but there is a real, important link here. As an example, BIZD's dividend yield has clearly risen alongside Fed rates these past few years, albeit with significant volatility.

Data by YCharts

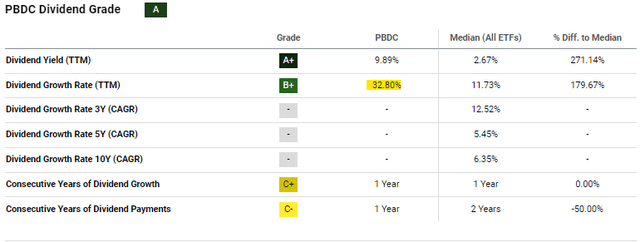

PBDC is too young a fund for me to meaningfully analyze its dividend yields these past few years, although dividends have grown these past twelve months.

Seeking Alpha

Overall, PBDC's strong 9.5% dividend yield is a significant benefit for shareholders, although coming Federal Reserve cuts are an important headwind. BDCs might be able to maintain their dividends if the Fed cuts by little, no one cuts a dividend unless they have to, but dividends should plummet if the Fed cuts deeply. In my opinion, investors should expect PBDC's dividend yield to settle in the 7.5% - 8.5% range in the coming years, as Fed cuts will likely be significant enough to materially impact BDC income / dividends. Organic growth can resume as interest rates stabilize or increase once again.

Credit Risk

BDCs focus on riskier loans and issuers, generally small and medium-sized companies. Specific figures are hard to come by but expect most BDCs to focus on non-investment grade issuers / those without credit ratings. Credit risk is generally quite high. BDCs are generally leveraged, sometimes excessively so, boosting risks further.

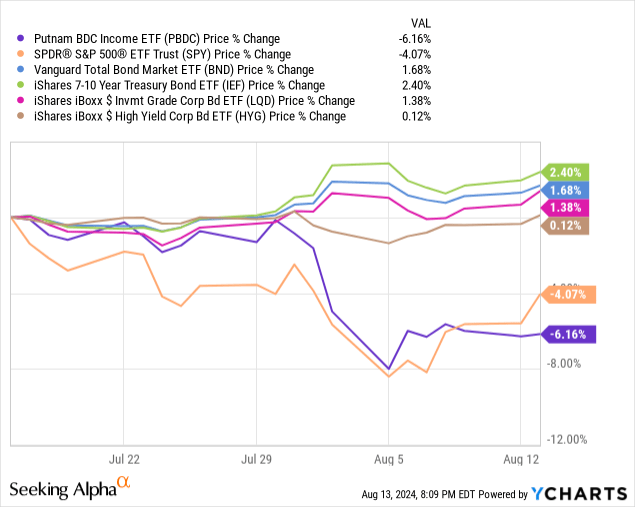

Due to the above, expect significant, above-average losses for PBDC during downturns and recessions, especially compared to higher-quality bonds. As an example, PBDC's share price declined by around 8.0% in late July, as bearish economic news and the (partial) unwinding of the Yen carry trade led to sharp, albeit short-lived, market losses. High-yield bonds suffered marginal losses, while most bonds were up.

Data by YCharts

PBDC's high credit risk is the fund's most significant risk and drawback. For more conservative income investors, it might be a deal-breaker.

Valuation Analysis

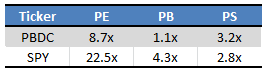

PBDC trades with a heavily discounted valuation to the S&P 500:

Morningstar - Table by Author

As there are significant differences between BDCs and stocks I wouldn't put too much emphasis on the figures above, but they do have some value. PBDC is a bit cheap, a clear benefit for shareholders.

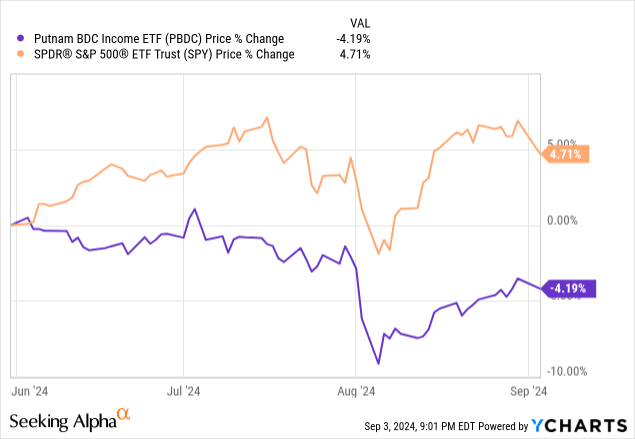

Share prices themselves seem compelling, with PBDC having yet to recover from recent market losses, unlike the S&P 500.

In my opinion, recent events could not have plausibly caused a real, significant deterioration of BDCs. Soft economic data and the partial unwinding of the Yen carry trade could not have plausibly impacted BDCs that much, especially in comparison to S&P 500 companies. As such, I think PBDC's share price should recover in the coming weeks, as investors re-assess the situation. As the S&P 500 is the more well-known, covered index, it does make some sense that it reacts faster to the news than BDCs.

Overall, PBDC's valuation is compelling, and its current share price a good entry point for prospective investors. It's a strong fund, and right now is a great time to buy.

Conclusion

PBDC is an actively-managed ETF investing in BDCs. PBDC's strong 9.5% dividend yield and performance track-record make the fund a buy.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10