DGRO: Strong Performance, But Is It Really A Dividend Fund?

PM Images

Thesis: DGRO's weak dividend focus is inadequate for income investors

At first glance, the iShares Core Dividend Growth ETF (NYSEARCA:DGRO) seems great, outperforming its closest competitors in terms of total returns across virtually all time frames. However, a deeper analysis reveals what I see as this fund’s fundamental issue: a low dividend yield, below that of direct peers.

Due to this low yield, I don’t see DGRO as a true dividend play but rather as a hybrid between a dividend fund and a broad equity market fund.

The challenge, in my view, is that this ETF falls short in both categories. I believe dividend-focused investors typically accept lower total returns in exchange for a reliable income stream. Conversely, investors prioritizing total returns usually disregard dividends, making DGRO’s 2.28% yield unattractive to them.

For these reasons, I believe investors seeking dividend-focused options would be better served by holding the Schwab U.S. Dividend Equity ETF (SCHD) or the Vanguard High Dividend Yield Index Fund ETF (VYM). On the other hand, those focused on total returns might prefer a fund like the Vanguard S&P 500 ETF (VOO).

For investors who already have the DGRO ETF in their portfolio, I see no reason to sell and potentially incur a taxable event, so I recommend a HOLD. However, for those searching for a dividend fund to add to their portfolio, I advise against choosing DGRO. Its low dividend yield does not align well with the objectives of dividend-focused investing, and there are more suitable alternatives available.

DGRO: ETF profile and direct competition

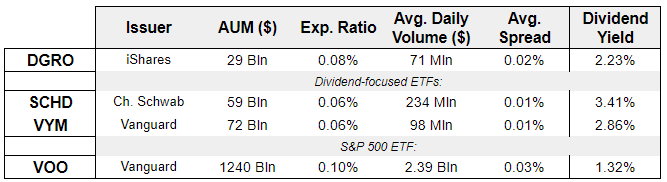

DGRO, SCHD, VYM, VOO - key metrics comparison (Author's elaboration of Seeking Alpha data)

The table above summarizes the key metrics for DGRO, SCHD, and VYM. DGRO’s expense ratio is slightly higher than its competitors, but I find it still reasonable and not a sufficient reason to recommend avoiding the fund.

The three ETFs are also quite similar in terms of size and liquidity, with only minor differences. Although SCHD and VYM are more liquid and have higher assets under management, I do not view these factors as significant enough to influence an investment decision, particularly for long-term investors who plan to hold these funds over an extended period.

Currently, SCHD represents roughly 15% of my portfolio, and it’s an ETF that I’ve observed was once highly favored by investors on Seeking Alpha. However, I think it might have lost some of its appeal since it began underperforming the S&P 500.

Despite this, and having covered SCHD in the past, I continue to see it as a unique and superior ETF due to its narrow focus on high-quality dividends, which sets it apart in the dividend investing space.

I consider VYM a valid alternative to SCHD, especially for investors who may find SCHD’s concentration too high, given that it holds only about 100 stocks, with its top 10 companies accounting for over 40% of the fund.

As for the DGRO ETF, the main issue I have with this fund - and reason why I do not recommend it - has to do with its low dividend yield. In a context of high interest rates like the one at the moment, and considering the VOO ETF yields 1.32%, I do not consider DGRO’s current dividend yield sufficient, at less than 1% more than VOO’s. I will cover in more detail this issue in the next sections of this article, outlining why I do not really see DGRO as a dividend play.

DGRO beats competition in total returns, but there is no free lunch

At first glance, investing in DGRO is a no-brainer. This fund has overperformed both the VYM ETF and the SCHD ETF for the past five years. This is despite its expense ratio, at 0.08%, is slightly higher than the 0.06% expense ratio its two competitors are charging.

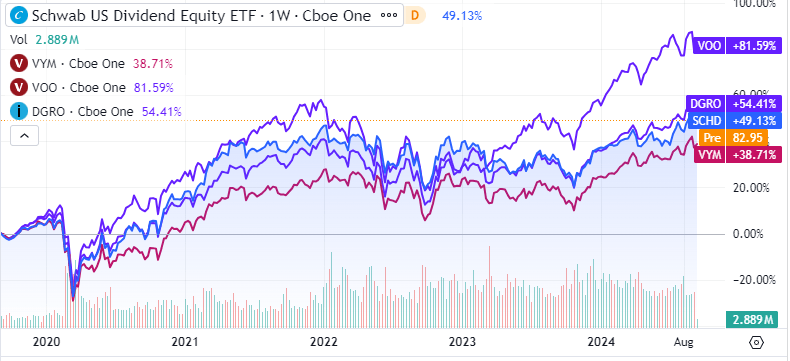

SCHD, VYM, VOO, DGRO - past 5 years performance (Seeking Alpha)

However, while overperforming direct competitors, the DGRO ETF has fundamentally underperformed the S&P 500, represented by the Vanguard S&P 500 ETF in the chart above. In the past 5 years, the VOO ETF has returned roughly 30% more than DGRO. To note, the chart above does not consider dividend reinvested, which would narrow the gap between DGRO and SCHD and VYM, and slightly widen the gap with VOO.

The reason behind this difference in performance is to be found in DGRO’s investment strategy and underlying holdings. DGRO’s info sheet mentions the below in relation to the fund’s investment strategy and objective:

[Why DGRO? To] access companies that have a history of sustained dividend growth and that are broadly diversified across industries

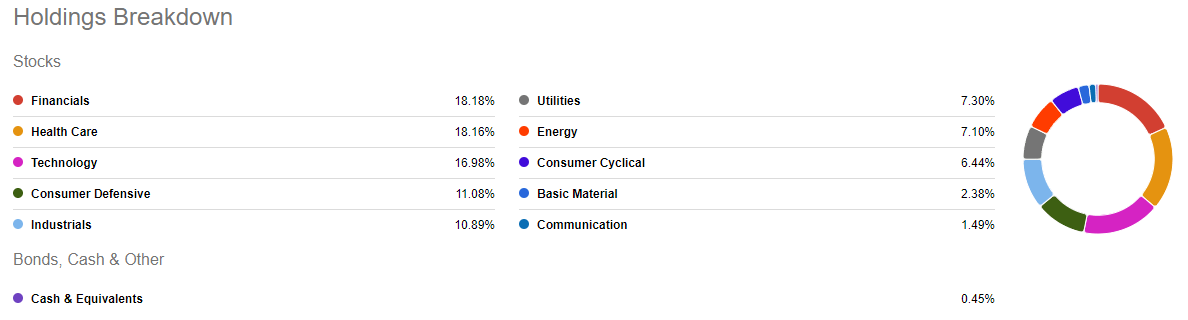

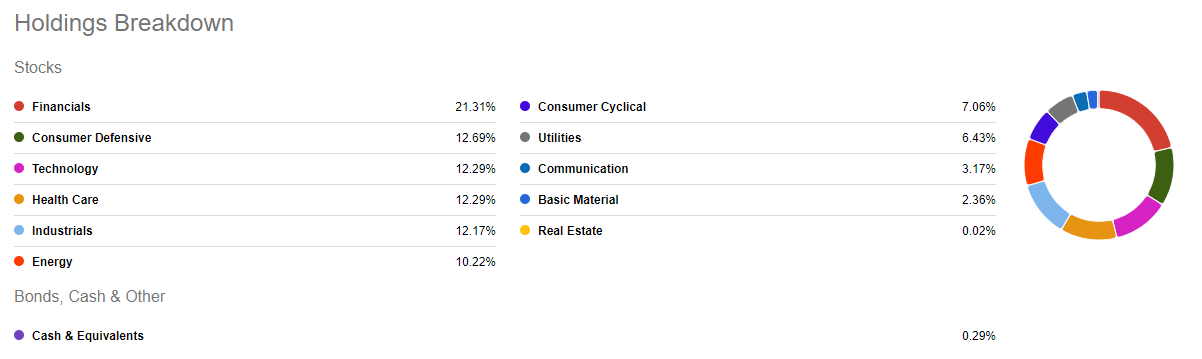

The phrase 'broadly diversified' is, in my view, exactly what drives DGRO’s overperformance and low dividend yield. When comparing DGRO’s holdings with those of VYM, one key difference stands out: DGRO has a significantly higher exposure to the Technology and Healthcare sectors, at 18% and 17% respectively. In contrast, VYM, which I still consider very diversified, allocates only about 12% to each of these sectors. This difference in sector allocation is a crucial factor that contributes to DGRO’s low dividend yield relative to VYM.

DGRO, top holdings breakdown by sector (Seeking Alpha)

VYM, top holdings breakdown by sector (Seeking Alpha)

What this data shows, in my view, is that there’s no free lunch. On the one hand, DGRO is overperforming dividend peers. But it is managing to do so simply because it has a less strict focus on dividends, and therefore its dividend yield is below its direct peers. On the other hand, DGRO still has a somewhat respectable 2%+ yield, but that comes at the expense of a significant underperformance against a more broad index such as the S&P 500.

What is DGRO’s role in a portfolio?

When evaluating an ETF, I always begin by asking myself who the issuer is targeting with this fund. iShares, DGRO’s issuer, suggests to:

Use [DGRO] at the core of your portfolio to seek income

The fundamental issue I have with this statement is that the DGRO ETF is not truly a dividend-focused ETF, due to its low dividend yield. Therefore, I do not consider it a good way to 'seek income'. And, if we were to consider DGRO as a broader U.S. equity market fund, it falls short of delivering against the S&P 500 benchmark.

In this context, I struggle to find a clear role for DGRO in any portfolio.

Investors who are looking for a high dividend yield, in my view, should be fine to accept lower total returns, as this is the 'price' to pay for having a more reliable and constant stream of income in the form of dividends. These investors would be better served by choosing SCHD, my personal favorite for dividend investing, or VYM, if they prefer a more diversified approach that still maintains a decent focus on dividends.

Conversely, I see no reason to recommend DGRO to investors focused on total returns, as DGRO has historically underperformed the S&P 500. Additionally, DGRO’s 2.23% yield may be seen as a drawback for these investors, especially when considering tax implications. They would be better off with VOO, or an even broader U.S. market equity fund like the Vanguard Total Stock Market Index Fund (VTI).

Risks to my thesis

I think the main counter-argument to my thesis is that DGRO might appeal to investors who want to ‘dip their toes’ into dividend investing without fully committing to a high-yield strategy. While I see this as a very narrow investment narrative and not suitable for seasoned investors, I acknowledge it’s an element worth considering.

Another point to mention is that DGRO has outperformed VYM and SCHD in the past. I expect this outperformance in terms of total returns to continue in the foreseeable future, largely due to DGRO’s higher exposure to the Technology and Healthcare sectors and its broader market diversification.

Although I don’t view this latter element as a drawback, but rather a feature of the fund, it’s important to note. Investors should be aware that DGRO may underperform its peers in terms of dividend yield, and they should be comfortable with this trade-off if they decide to invest in SCHD or VYM to seek income.

Conclusion

The DGRO ETF stands out for its overperformance relative to direct dividend-focused peers. However, it also significantly underperforms the broader market, represented by the S&P 500. While its overperformance relative to peers might initially seem like an advantage, I view it as a fundamental weakness in DGRO’s investing strategy.

With its low dividend yield, DGRO is in my opinion inadequate for investors seeking income. Simultaneously, it does not adequately serve investors prioritizing total returns, either. The latter would be better off with a broader market index fund.

For investors who already hold DGRO, I recommend a HOLD. However, those looking for dividend income should consider alternatives like SCHD or VYM, which offer more focused dividend strategies.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10