SHY: Energy Should Bring Some Cooling

Wipada Wipawin

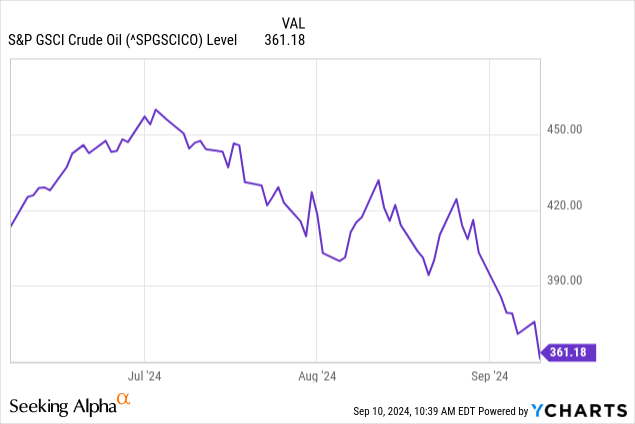

The iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY) is a low duration and zero credit risk fixed income ETF. In our last coverage, we echoed our preference for even shorter duration than the SHY with spot rates. However, we think that one key factor has changed since, and this will likely be the sluice gate lifted out of the way of monetary accommodation. August was the month where oil started to fall properly. We think it will already impact upcoming CPI figures on Wednesday. This could have an outsized impact on consumer inflation expectations, and we think will be the deciding factor for cuts. Any fixed income with duration makes some sense at this point, particularly medium duration, which will be impacted by revised expectations in the short term a little more.

SHY Breakdown

SHY is a pretty low expense ratio ETF at 0.15% from iShares. However, you can get lower expense ratios on other iShares fixed income products. Despite Treasuries being less exotic than corporate bonds, there are corporate fixed income ETFs that run cheaper for around 0.04%. For example, the more general (GOVT) only has an expense ratio of 0.05%, and that also sticks to just Treasuries. Other providers like Amundi offer lower expense ratios at 0.1% for ETFs that follow basically the same indices.

While you may want the lower duration of SHY which is below 2 years because a greater proportion of its present value of cash flows are in the exact years being targeted by the short-term rate speculations associated with Fed-watching, we do think the ETF is not the most efficient. And longer duration ETFs should respond similarly to the speculation we are seeing, as recently the whole yield curve has shifted down, not just the shorter duration profile.

A moderate duration profile, and indeed duration in general, may finally be the play after a long time of seeing inflation expectations remaining too high at 3% or above. We think the reason is oil.

Oil really started to fall in the last couple of weeks of August. It was generally lower in August than last year, but even more of the immediate declines happened in September, which won't be reflected in the upcoming CPI data on Wednesday.

The reasons are that there are incoming supply cut phaseouts, although now pushed back two months, are putting pressure on oil prices in the face of slightly weak industrial demand in the US, China and also in Europe. The US is still growing, but there is a deceleration, and China is proving more unable than hoped to come out of the doldrums economically.

The decline of oil, a consequence of slowing down industrial demand, and helped also by some signs of slowing hiring in the last jobs report, may be the demand side signals that help inflation appear tamed. We think that oil in particular has high transmission into consumer expectations, particularly in the US, where cars are must-haves. The breaking of higher expectations will be critical for giving credible space for the Fed to cut rates. The hawks on the FOMC will be looking at expectations.

Bottom Line

The CPI data for August may not reflect the full impact of lower oil, but incoming supply seems to indicate for now that oil will persist at these lower levels. In the September CPI data things will be stark, and before that, consumers may already start toning down expectations as gas becomes cheaper at the pump. Like shelter, petrol prices are going to have a big impact on the real feelings of consumers about their purchasing power and inflation.

Before a decline in oil, which is facilitated by supply factors, we were not seeing and are still not seeing enough demand side pressure alone to bring down inflation to a satisfactory degree. But supply conditions and the importance of oil may see its declines do the trick. We think ETFs like SHY, but even some longer duration ETFs like the (IEI) may start to make sense around now, even though cutting speculation had already started. It may not be commensurate to the new oil data, which, we believe, has underrated importance on the real inflation drivers such as inflation.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10