OXLC: The Good And Bad Side Effect Of Interest Rate Cuts

PM Images

Overview

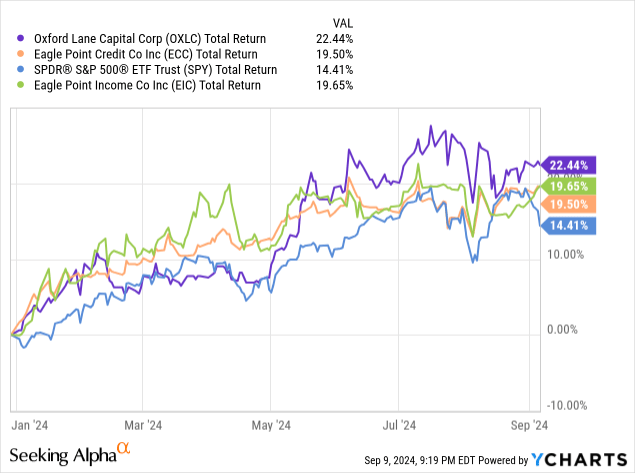

Oxford Lane Capital (NASDAQ:OXLC) remains one of the most popular CLO-oriented closed end funds that continues to reward shareholders with a high dividend yield. The current dividend yield sits slightly above 20% and this is highly appealing for income focused investors that are looking to juice up the cash flow generated from their portfolio of investments. I previously covered OXLC back in May and on a YTD basis the total return has outpaced the S&P 500. Even when comparing OXLC against peers such as Eagle Point Credit (ECC) and Eagle Point Income (EIC), OXLC continues to outperform because of the sustained high distribution.

When I previously covered OXLC, I discussed how the closed end fund continued to pull in elevated levels of net investment income due to the higher interest rate environment. The performance since then continues to be strong, proven by the last Q1 earnings report. However, I wanted to revisit OXLC to provide an updated outlook on what two likely outcomes of a changing interest rate environment may be. While future interest rate cuts can have some good side effects, it can also have some bad results that can cripple the growth of OXLC. Additionally, I wanted to revisit the current appeal around OXLC's valuation for both existing and new shareholders.

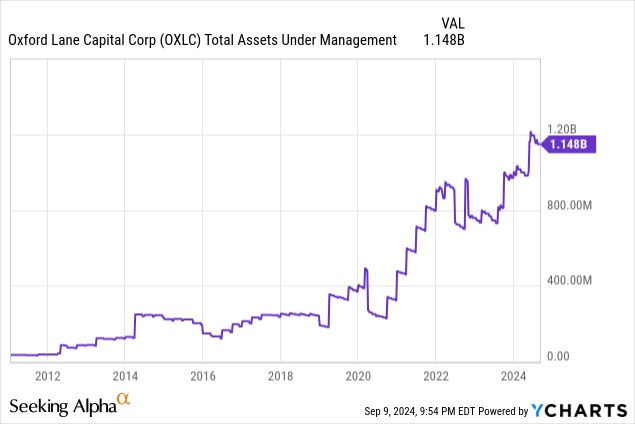

OXLC has a public inception dating back to 2011, which means we have over a decade of performance to reference. Assets under management currently total $1.15B and has rapidly increased after the pandemic in 2020. Coincidentally, total assets under management rapidly increased as interest rates were aggressively hiked throughout 2022 and 2023. This can be attributed to the combination of an influx of investor capital as well as OXLC's portfolio strategy that has allowed the fund to generate higher levels of income and reinvest back into their portfolio growth.

Portfolio Strategy

OXLC aims to provide total returns that are comprised of high current income that is generated from its portfolio of CLO debt and CLO equity. CLO stands for collateralized loan obligations that are different levels of debt, typically rated below investment grade, which are pooled together into one solid package. Since OXLC has a portfolio of debt that has poor credit ratings, the risk profile is a bit more elevated than other forms of debt. This is especially true when considering that OXLC's portfolio consists of 96% CLO equity, which sits at the bottom of the corporate capital structure. The remaining 4% is comprised of CLO debt, which sits near the top of the capital structure.

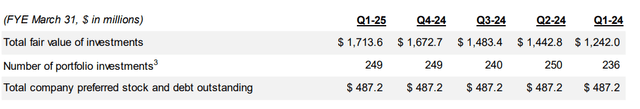

OXLC Q1 Presentation

Despite the higher risk profile of CLO equity, OXLC has managed to grow their total fair value at a rapid pace year over year. Q1 of 2024 saw total fair value sitting at $1.24B, and this has since growth to $1.71B as of the latest Q1 2025 earnings report. This growth includes an increased number of portfolio companies, now sitting at 249. The strong growth here can be attributed to management's focus on continuously investing into new opportunities that can increase the earnings potential. New investments for Q1 totaled $216.9M, a sizeable increase from last year's total of $111.9M.

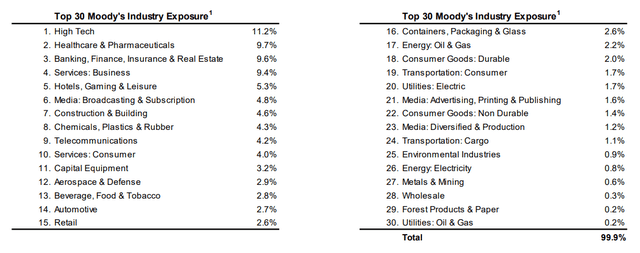

Another portfolio strategy implemented here is the focus on maintaining diverse exposure across industries. This helps limit the amount of concentration risk and reduces overall sensitivity to bear markets. We can see that the largest industry exposure is to high-tech, making up 11.2% of net assets. This is closely followed by exposure to Healthcare & Pharmaceuticals and Banking, Finance, Insurance & Real Estate, accounting for 9.7% and 9.6% respectively.

OXLC Q1 Presentation

Risk Profile - Interest Rate Cuts

Interest rates can arguably be the biggest risk to OXLC since its underlying portfolio consists of below investment grade debt. Borrowers with poor credit ratings usually have weaker balance sheets and earnings potential, which leave these businesses more vulnerable to market down turns and underperformance. A weaker balance sheet simply means that these borrowers don't have the cash cushion to navigate headwinds and are more susceptible to defaults when times get bad. Sometimes these borrowers are loaded with debt that has been issued on a floating rate basis. This means that as interest rates increase, the cost of this debt maintenance rises.

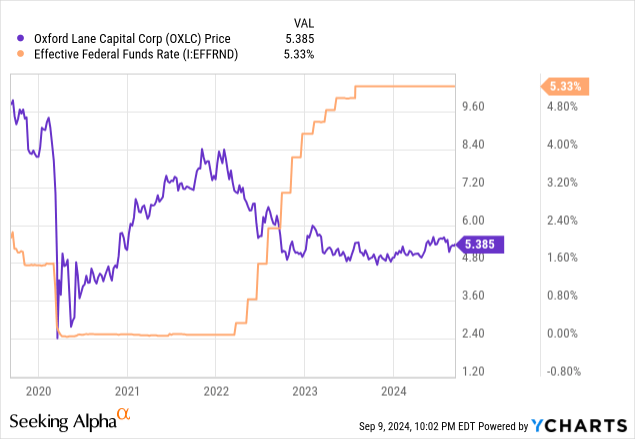

Naturally, this has resulted in OXLC also showing some sensitivity to changes in the federal funds rate. However, OXLC is on the lending side of the cash register and has been able to generate higher levels of income from the underlying portfolio of loans. While OXLC can pull in higher income, the risk comes from the increased probability of defaults within their portfolio and lower valuations as companies take less risk and opt to address cost efficiencies rather than focus on growth initiatives.

Following this concept, we can see that OXLC has shared an inverse relationship with the federal funds rate. When rates were cut to near zero levels following the 2020 pandemic, the price of OXLC rapidly moved to the upside, as this increased the volume of borrowers in the market that OXLC was able to use as a catalyst for portfolio growth. Conversely, when interest rates were rapidly hiked throughout 2022 and 2023, the price retracted to the downside for almost two years straight before eventually stabilizing in 2024.

I anticipate interest rate cuts to happen soon, driven by a few different indicators. First, the unemployment rate has steadily increased over the last twelve months and now sits at 4.2%. As more households are out of work, this will cause a shift in consumer spending to be a bit more conservative. Additionally, US Presidential elections are still upcoming and this may create a market environment of higher volatility and uncertainty. Historically, the Fed has more frequently made changes to the federal funds rate during election years. Now that interest rates are anticipated to be cut by the end of 2024, I wanted to share my thoughts on what the good and bad outcomes are likely to be.

The Bad

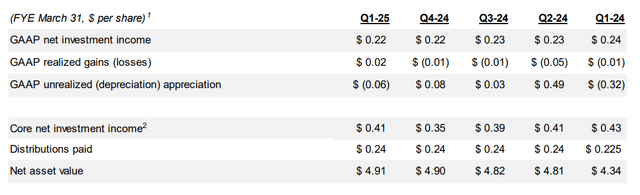

Since the debt portion of OXLC's portfolio operates on a floating rate basis, they have been able to pull in higher levels of net investment income. As interest rates get higher, so does the required debt maintenance that borrowers have to pay. As a result, OXLC benefits from a higher interest rate environment and can grow their earnings more rapidly. For instance, core net investment income for Q1 in 2025 amounted to $0.41 per share while the interest rate sits at the decade high.

OXLC 1 Presentation

To display the relationship here, I went back to the Q1 results in 2020, when interest rates were reactively cut to near zero levels. At the time, core net investment income landed at a modest $0.23 per share. This is almost half the level of core NII per share that OXLC now generates while interest rates are high.

Therefore, a lower interest rate is likely to directly impact the rate of net investment income, and I expect there to be a short-term dip as rates are cut. Lower earnings translates to weaker distribution coverage and a slowdown or elimination of supplemental distributions for shareholders. There may even be a chance that the current distribution is no longer support, and a reduction is needed.

Therefore, I wouldn't be surprised if we saw the price of OXLC retract a bit in reaction to the first earnings report following these rate cuts. Therefore, if you are looking for an attractive price to initiate a position for the first time, you may want to hold off until interest rates are cut. However, rate cuts aren't all bad and there are some positives that can come out of it, which may actually be positive for long-term holders.

The Good

Despite the possibility of lower earnings as a result of rate cuts, there are a few positive things that can come from cuts. The first good thing to come from rate cuts would be the improvement of OXLC's underlying portfolio strength. Since their portfolio primarily consists of below investment rated loans, a lower rate would give the underlying borrowers a bit more operating cushion. This would reduce the debt burden for borrowers on a floating rate basis and give them a bit of breathing room. This would directly translate to lower default rates within the portfolio.

Additionally, this could improve the rate of prepayments from the underlying borrowers. As interest rates decrease, borrowers can refinance existing debt to more attractive levels. This could lead to an increased level of prepayments that can improve OXLC's overall liquidity and strength to capitalize on new opportunities. Most importantly, lower rates can lead to an influx of borrowers in the market that can lead to more opportunities for OXLC to capitalize on new portfolio companies.

OXLC Q1 Presentation

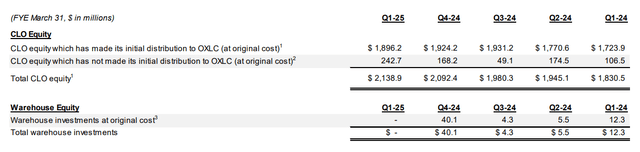

This can be measured by the rate at which CLO warehousing changes. Warehousing describes the process of pending loans that are waiting to be securitized into CLOs and the recent history supports the idea that this is not the most ideal time for borrowers. There were absolutely no warehouse investments as of the latest Q1 report, which helps paint the picture of unfavorable times for taking on new debt. A year ago, this total also sat relatively low at only $12.3M. As rates start to get cut, we may see a rise in warehousing, and this can contribute to the growth of OXLC's net investment over time and offset any short-term impacts.

Valuation & Dividend

In terms of valuation, OXLC still trades at an attractive level. When I last covered OXLC it traded at a premium to NAV of 10.8%. The price is a bit more attractive as it currently trades at a premium to NAV of 9.2%. This sits on par with OXLC's three-year average premium to NAV of 9%. Looking back over the last decade, we can see that this premium level is typical, especially following 2020. The premium is supported by solid NAV growth over time, with the current NAV sitting at $4.91 per share. This is a sizeable growth from last year's total NAV of $4.34 per share.

CEF Data

Wall St. seems to be optimistic about OXLC's outlook, as the current price target sits at $6 per share. This represents a double-digit upside of 11.5% from the current price level. However, there is no doubt that the true value here is derived from the consistent income that can be produced with a vehicle like OXLC. If you are looking for capital appreciation over time, I would look elsewhere. OXLC is best utilized as an income investment and highly beneficial to investors that may depend on the supplemental income generated from their portfolio to fund lifestyle expenses.

In my opinion, this premium is justified when you consider that OXLC has been able to grow their portfolio and provide shareholders with a large margin of safety on the distribution coverage. As of the latest declared monthly dividend of $0.09 per share, the current dividend yield sits slightly above 20%. As mentioned, core NII per share landed at $0.41 for the quarter. If we take the monthly payout and covert it to a quarterly number by multiplying it by three, we get a total quarterly distribution amount of $0.27 per share. This means that earnings cover the distribution by a massive rate of 151.8%, which should provide plenty of reassurance for long-term investors that want a steady stream of income. Therefore, I do not anticipate any future distribution cuts here.

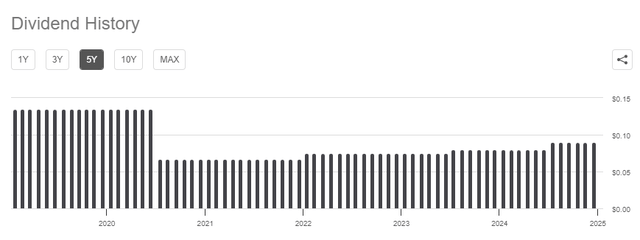

Seeking Alpha

To be fair, this dividend coverage follows a prior cut during 2020. The distribution was cut as a result of lower earnings, but at this rate, OXLC's steady raises can get us back to pre-pandemic levels if the portfolio continues to generate a sufficient amount of net investment income. It should be noted that the high distributions received here are categorized as ordinary dividends, which have less favorable tax consequences. Ordinary dividends come with more of a tax burden than the qualified dividends you would receive from a traditional dividend paying stock. Therefore, an investment in OXLC may be best utilized in a tax advantaged account based on your situation.

Takeaway

In conclusion, I maintain my buy rating on OXLC as I believe that interest rate cuts will still provide some positives through an increased volume of borrowers. OXLC can utilize these ideal conditions by capitalizing on opportunities to grow their portfolio and create additional sources of long-term earnings growth. Additionally, the distribution coverage remains very large at over 151%. Therefore, I have no worries about future interest rate cuts, regardless of how much interest rates are cut. The price still trades at an attractive valuation, within its typical premium to NAV range. While interest rate cuts may have short-term impacts on net investment income, I believe that the good outweighs the bad.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10