BND: Bonds Are Rising Again, But They Face 2 Key Risks

NoDerog/E+ via Getty Images

The medium and long-term bond markets have reacted well to economic data indicating a slowdown. I've covered the popular bond ETF (NASDAQ:BND) for years, with a bearish outlook from 2020 onward, as I believed excessive government stimulus efforts would raise inflation and interest rates. My outlook has been more neutral for most of this year. I covered BND last June in "BND: Falling Employment Stability Temporarily Lifts Bond Market Outlook." Since then, BND has risen by 4.3% with a total return of 5.3%, one of its best performance periods since before its 2022 crash.

As expected, the tone of the bond market has shifted dramatically away from inflation concerns to questions regarding employment and the economy. Importantly, BND has a weighted average effective maturity of 8.4 years, so immediate Federal Reserve decisions have minimal bearing on its price. Just over two-thirds of its holdings are US government debt; the rest is investment-grade corporate debt, giving it only minor exposure to economic credit risk.

Fundamentally, BND is primarily an inverse bet against inflation expectations, which drives long-term interest rates. Though the Federal Reserve's rate decisions have no direct price impact on most of BND's holdings, QE and QT may influence real interest rates or bond rates after expected inflation. Thus, to determine BND's trend, we must gauge the trend for both inflation expectations and real interest rates and give minor consideration to corporate credit risk.

Inflation Expectations are Collapsing - For Now

BND's average duration is 6.0, meaning a 1% rise or fall in its yield-to-maturity should lower or raise its price by around 6%. Its current yield-to-maturity is 4.6%, effectively its dividend yield, though not all interest is paid out in dividends depending on its cash management. Its expense ratio is negligible at three bps.

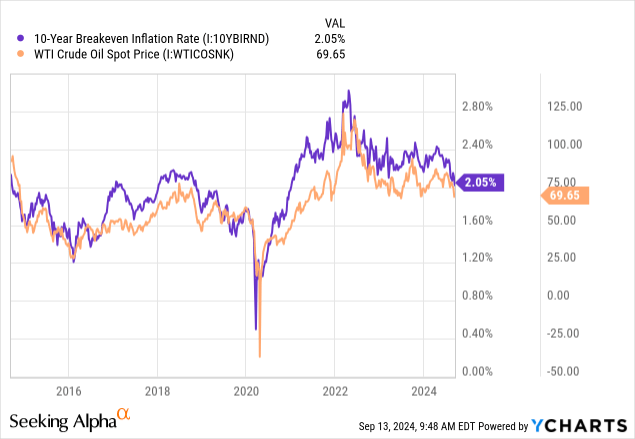

The most important driver of its yield is inflation expectations. Not the immediate inflation rate, but what is expected to average over the next decade (specifically, the next eight years). The Federal Reserve closely tracks inflation expectations, implied by the market's relative yield on Treasury bonds vs. inflation-indexed Treasury bonds. When that figure is below 2%, particularly for longer measures such as the 10-year, it warrants cuts to short-term rates. However, the inflation expectation rate is closely correlated to crude oil because that is the primary driver of inflation outside the Federal Reserve's control. See below:

The expected average inflation rate over the next ten years has collapsed from nearly 2.5% earlier this year to almost 2% today, warranting rate cuts. The recent collapsed in the inflation outlook has coincided with a decline in the price of oil. Oil is crucial because it drives transportation costs, a significant driver of all goods prices. The Federal Reserve can boost and restrict economic demand through interest rate decisions but cannot increase or cut oil production. Thus, when oil rises, the Fed risks raising rates too fast, trying to stop inflation that can only be aided by higher energy supplies. Indeed, I'd argue that improving global oil production (and SPR depletion) has lowered inflation recently, not higher interest rates, though both play a role.

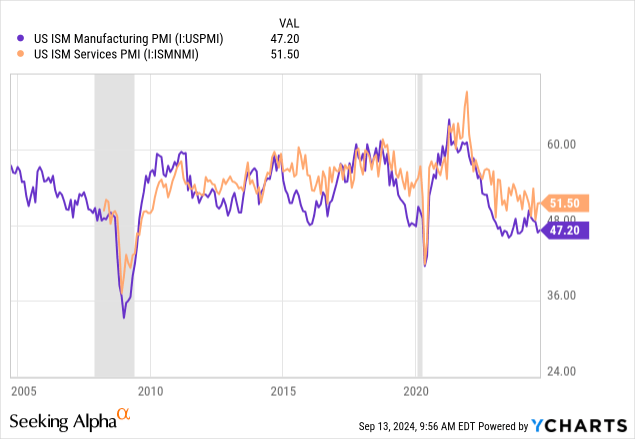

Of course, both inflation expectations and oil will decline if the economy is expected to slow. While there are no 100% guaranteed measures of a recession, we're seeing a remarkable confluence of bearish signals. PMI data measures an index of survey data from businesses regarding hiring, orders, etc. When it is below 50, that indicates a declining business activity trend. The manufacturing PMI has been below 50 for over a year, as it's more impacted by inflation. The services PMI (technology, banking, etc.) is right at the cusp of 50 today, indicating both may be contracting soon. See below:

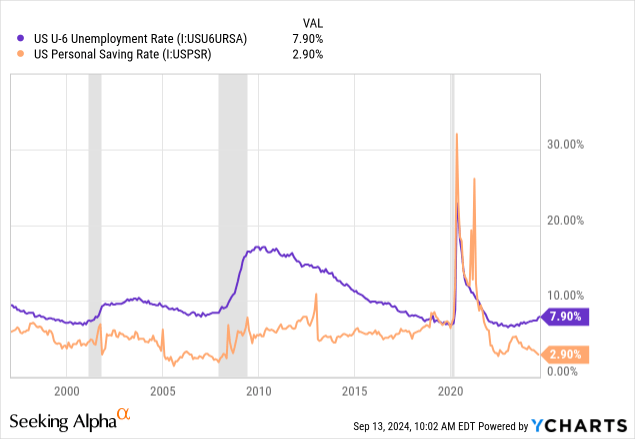

Although the unemployment rate fell slightly last month, the July figure was likely somewhat elevated due to hurricane impacts. The more telling U-6 unemployment rate, which accounts for underemployment or marginal employment, continued to rise. I think this metric is more critical because job growth in highly underpaying jobs is not a positive sign, and almost all job growth since 2022 has been part-time. Personal savings levels are also collapsing. See below:

Technically, a fall in savings is a positive immediate economic signal because it implies higher consumer spending. However, generally, savings below 5% are not sustainable because they suggest that some people are likely going into debt or at risk of losing savings. Given the average is 2.9%, many likely have negative personal savings rates. In my view, it is a clear sign that the average American household is struggling to make ends meet, with an apparent deterioration from pre-pandemic levels and no recovery despite a recovery in stocks and corporate profits.

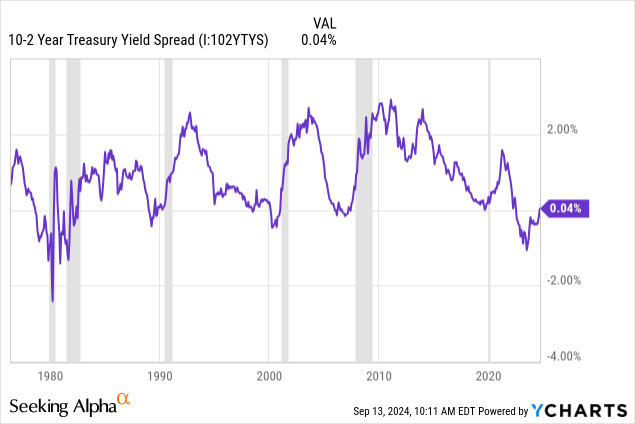

Lower savings and lower full-time employment imply a future decline in consumer spending. That is mirrored by business survey metrics declining regarding their growth, as seen in the PMI data. Lastly, the yield curve gives us a strong indication of a downturn. Historically, when the 10-2 spread is inverted, it predicts a recession. However, the recession usually occurs in the steepening phase, coinciding with rate cuts. See below:

With the yield curve now slightly positive after being very negative for an extended period, we have yet another solid historical indicator of an economic slowdown. Curve steepening is not bearish for BND if it comes from a decline in short-term rates stemming from interest rate cut expectations. However, BND would be slightly bearish if the curve continues to steepen while the Fed stops rate cuts because its holdings have medium-to-long-term maturities.

These data indicate that the US economy is slowing and, in my view, points to a "hard landing." However, whether that is a "very hard landing" or just a bumpy hill remains unclear. Still, we're seeing inflation, and expectations decline because households and businesses are likely to cut spending due to lower incomes and possibly low savings.

This trend is bullish for BND because it usually rises when the inflation outlook declines. However, we must consider the price of oil as it greatly impacts inflation but is not significantly impacted by interest rates. For now, oil is in a correction as global demand outlooks sour. That said, we've often seen OPEC look to cut production when prices fall below $70. US oil companies have dramatically lowered their rig counts in response to lower prices, indicating lower production activity. The US SPR is also low on oil but will buy it if it's below $79, lowering glut risks.

Of course, with the current geopolitical tensions regarding Iran, Russia, and other essential oil exporters, there is a high risk of a geopolitical supply shock. In my view, investors in BND should consider its oil price risk because inflation will not fall in a recession for long if oil rises dramatically.

An End to QT May Boost BND

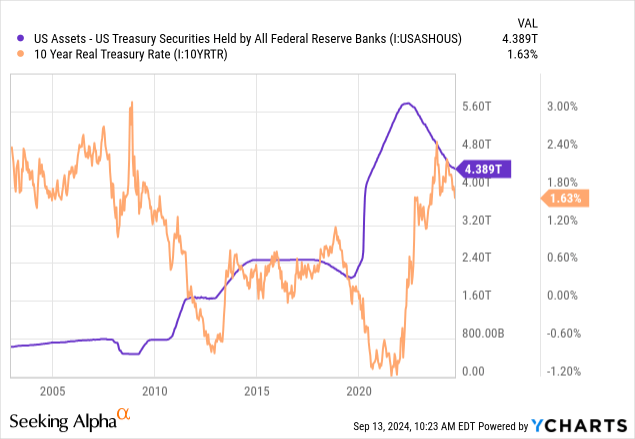

Although inflation expectations have the most significant impact on BND, real interest rates matter too. BND's actual value comes from real interest rates, which deliver a return after the expected inflation rate. I believe this is primarily determined by the Federal Reserve's QE or QT pattern. Since its purchasing power is so immense, the Fed tends to push the Treasury market's yield when it makes large sales or purchases. Today, the Fed is selling Treasuries, likely pushing real interest rates up. See below:

Real rates hit an extreme low in 2020 when the Federal Reserve engaged in a vast buying program. However, that resulted in the opposite trend since it reversed that program in 2022, allowing its balance sheet to mature.

Through this mechanism (QE and QT), the Federal Reserve appears to impact long-term interest rates. The Fed quietly slowed its QT program in May, creating less upward pressure on real interest rates. I expect we may see a further deceleration in QT over the coming months, which, I believe, has a more significant impact than rate cuts, particularly for the long-term bonds in BND.

In the event of a recession, I believe it is very likely the Federal Reserve will return to its QE program, particularly if inflation expectations continue to decline. Again, if oil prices rise and cause a supply shock to inflation (see 2021), the Federal Reserve may be reluctant to look to QE in concern of exacerbating inflation pressures. However, that is unlikely as long as oil and other economic commodities are falling.

Corporate Credit Risk is Underpriced

Overall, I believe BND will rise as long as oil does not. BND may not rise if the economy has a "soft landing" without increased unemployment. Most of the data I analyze seems to point to a hard landing. A recession is good for BND unless corporate credit risk rises too fast. Around a third of the fund is in corporate bonds, half of which are at the bottom of investment grade with BBB ratings. The risk of those bonds having default is very low, but BND may face losses if they're downgraded to BB or lower in a recession, which is often the case.

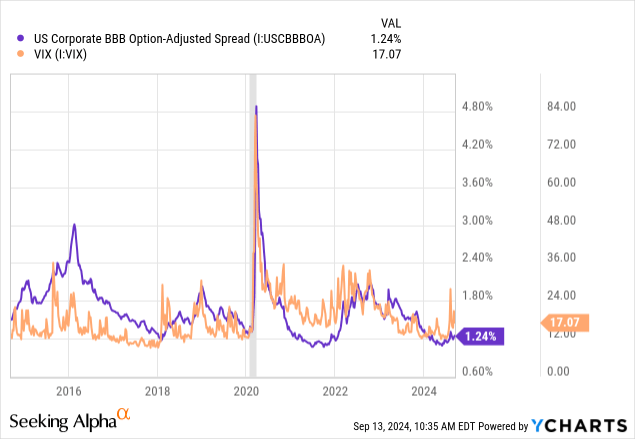

The effective spread on BBB corporate bonds (and A-AAA) is below average today. Usually, that figure correlates to the VIX index on stocks, which is elevated. Corporate bond spreads have ticked up recently, but have a way to rise before normalizing. See below:

Corporate credit spreads may rise by 1-5% in a recession. Around a third of BND is exposed to this risk, so I estimate a 1% rise in corporate credit spreads should have a -2% price impact on BND, given its duration. However, a recessionary 3%+ spread increase may push BND around 6% lower or more.

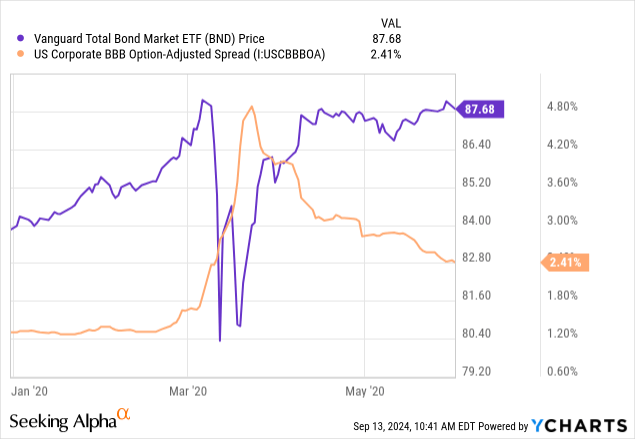

Although BND's performance in 2020 was decent due to the above trends (lower inflation expectations and real rates), it did fall with stocks as credit risk spreads rose. See below:

BND might not have recovered so quickly if the Federal Reserve had not started buying downgraded corporate debt in its QE program.

Arguably, corporate credit spreads are so low today despite elevated market risk because investors expect the Federal Reserve to bail out corporate bonds again if need be. Although I feel that creates a significant "moral hazard," another corporate bond-buying program may occur, given they were quick to do so in 2020.

The Bottom Line

In the short run, I believe BND's outlook is positive. I expect the ETF to continue rising due to lower inflation expectations and a potential end to Treasury bond sales that push real interest rates lower. I think its upside in a recession is around 6-12%, based primarily on a potential 1-2% decline in real interest rates on long-term Treasury bonds.

That said, I am still officially neutral on BND because numerous black-swan events can easily upset its rally. One, I expect any escalation in the Middle East, or Russia conflicts to push oil prices back up, likely offsetting demand concerns impacting oil and, therefore, inflation. To me, that is a considerable risk that the market is not accounting for because an oil supply shock would likely also limit the Federal Reserve's ability to use QE or rate cuts to stimulate the economy.

The second significant risk to BND is a rebound in corporate credit risk, which usually occurs during stock market crashes. It is unclear if the Fed will buy corporate bonds as it did in 2020 and effectively bail out the market. That said, with a massive 2025-2026 corporate debt maturity wall, I would not buy corporate debt today, even the lower-risk debt owned by BND.

Those two risks aside, I do not believe BND is an excellent long-term investment. Yes, it may rally in the short term as the economy slows. However, if you're buying BND, you're lending to the most cash-flow-negative institution in the world - the US government. The Treasury is now spending over $1T per year in interest, causing an acceleration in the deficit. Ultimately, the Treasury needs higher inflation to keep its debt from spiraling. While inflation may be falling in the short run, I believe long-term Treasury bonds will likely have a negative post-tax and inflation return over the coming decade, likely as inflation rises to a new high after the current slowdown ends.

In short, I expect a repeat of the 2020-2022 situation, but perhaps with more volatility and a larger magnitude.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10