CGIE: Exploring Overseas Investment Opportunities In Large-Cap Growth

boonstudio/iStock via Getty Images

I recently started covering a series of diverse ETFs from Capital Group, the 93-year-old investment powerhouse behind American Funds®. Following a very interesting bond/stock play called the Capital Group Core Balanced ETF (CGBL), which I just recommended as a Buy, I plan to cover several more of their 21 ETFs that have been launched since February 2022. My next pick is the Capital Group International Equity ETF (NYSEARCA:CGIE), which was launched a little under a year ago.

Coincidentally, CGIE comes right behind CGBL in terms of average total return as at the end of August, with 23% against CGBL's top-tier performance of 25.4%. So, I knew straight off that the fund has performed really well over the past year, but I wanted to dig in and see if it can perform as well over the next year and beyond. The reason is that market conditions were generally positive over the past year, but that could change in the next 12 to 18 months on the back of numerous macroeconomic catalysts.

Understanding the Global Dynamics Driving CGIE's Performance

As an internationally focused ETF, CGIE is taking a considerable bet on the performance of overseas companies, with nearly 95% of its $200+ million asset base invested. In itself, many investors would consider that a big risk, especially since domestic securities have been performing quite well over the past year, not to mention the dollar's long-standing dominance over almost every other global currency, particularly the euro.

I specifically cite the euro because CGIE invests two-thirds of its funds in European securities, so it's important to be aware of the currency (USD:EUR) dynamic at play. Over the past year, the dollar has been playing tag with the euro, but consistently losing ground, as illustrated by the chart below.

SA

Although there was a strong rally in Q1 2024 that took the USD to year-ago levels against the EUR, and continued attempts through Q2 to gain ground, the dollar is definitely losing its edge. Part of the reason is the ECB's decisive rate cuts, the second of which happened just yesterday. And with next week bringing in elevated anticipation that the U.S. Federal Reserve will follow suit with its rate reduction program, the dollar is clearly less attractive now than it was a year ago.

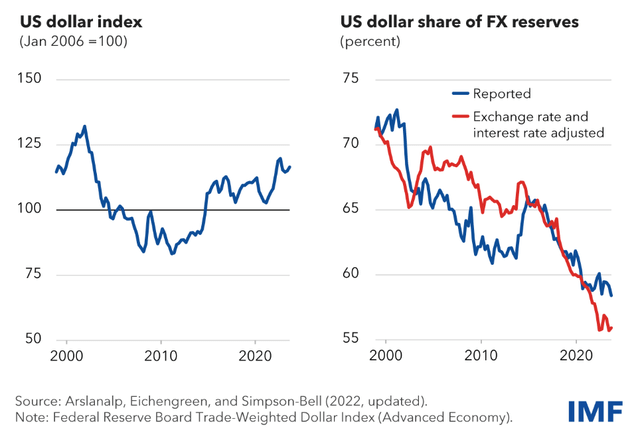

That's essentially one of the Fed's greatest challenges. Even though the dollar has been able to maintain its relative strength against most global currencies over the past decade and a half, it's been losing ground to other currencies in terms of share of foreign exchange reserves.

IMF

To be more precise, the emergence of non-traditional currencies like the Chinese renminbi, and the Canadian and Australian dollars have been eroding the USD's position.

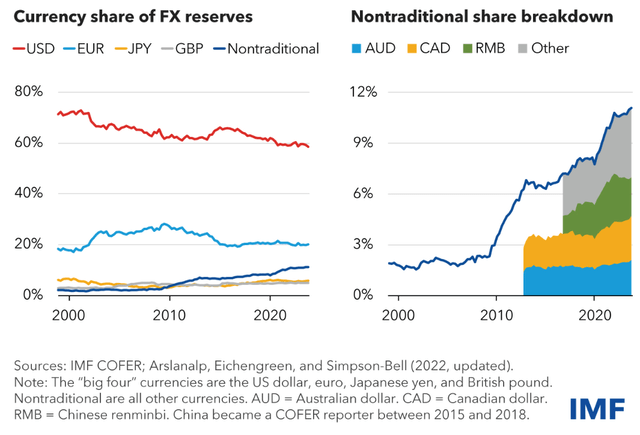

IMF

Incidentally, as the image above depicts, other major currencies like the yen, the pound, and even the euro don't seem to be responsible for this “stealth erosion,” as the IMF calls it. In the June report from which the above images were excerpted, the IMF says:

Strikingly, the reduced role of the US dollar over the last two decades has not been matched by increases in the shares of the other “big four” currencies—the euro, yen, and pound. Rather, it has been accompanied by a rise in the share of what we have called nontraditional reserve currencies, including the Australian dollar, Canadian dollar, Chinese renminbi, South Korean won, Singaporean dollar, and the Nordic currencies.

I say that's one of the Fed's greatest challenges because investors are razor-focused on the effect of interest rate cuts in the domestic market. Many are missing the fact that the global implications of lower interest rates could have an equally adverse impact on the economy, potentially adding momentum to other, internal recessionary forces.

So, Why CGIE?

Against that macroeconomic background, it would make sense to invest in European securities because the cost of borrowing is now getting much cheaper for corporates. With main refi rates now at 3.65%, we should be able to see a lot more capex being deployed by large companies.

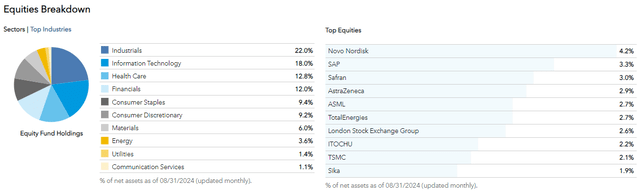

And that ties in directly to my CGIE investment case because 97% of its holdings are focused on large-cap, growth-focused companies. More importantly, its sectoral allocations are likely to drive performance in the quarters ahead. If you look at how the fund is allocated across sectors, it's obvious that the fund is growth-focused, with two-thirds being allocated to what I like to think of as the cornerstone sectors of any economy: tech, financials, healthcare, and industrials.

CGIE Website

Just a brief look at a couple of companies in these sectors tells a compelling story of growth.

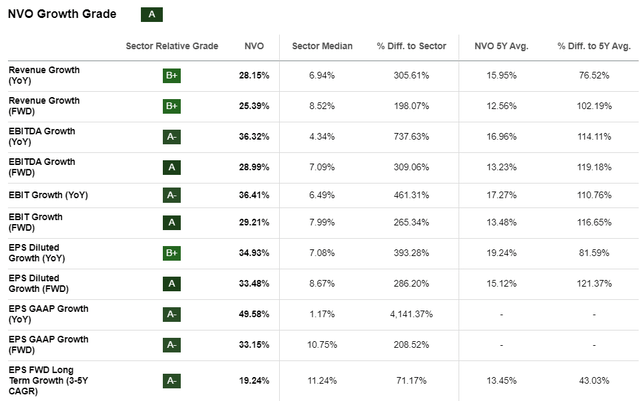

Novo Nordisk A/S (NVO)

SA

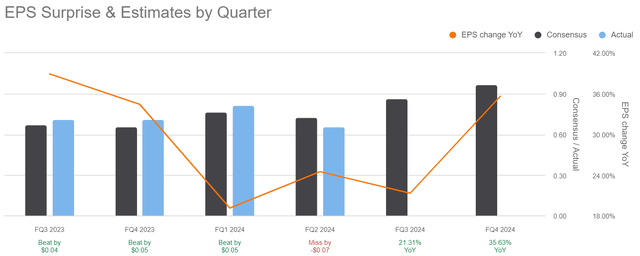

Although this European pharma giant's stock has been moving sideways in Q3, that belies the tremendous growth it's shown all the way down its P&L. Much of that pessimism seems to have arisen because of muted earnings and revenue growth in the last reported quarter, but a more balanced look tells me that sell-side analysts modeled a little too much growth too soon.

The tide of GLP-1 drugs that are coming to the market over the next five years could dampen NVO's growth on this front. However, as reported by Seeking Alpha Morningstar expects GLP-1 pioneers (or first movers) NVO and Eli Lilly (LLY) to maintain more than a third of the total projected market of $200 billion market by the start of the next decade.

The stock has been under pressure due to the revenue and earnings misses in Q2 2024. However, there appears to be more than a little optimism creeping in toward the final quarter, when the Street expects an EPS print of 35% on a YoY basis.

SA

Regardless of what happens down the road, the growth element here looks very attractive over the next two years, with analysts expecting a 27% revenue growth rate in FY 2024, with an EPS surge of 25%. As such, it's an important growth stock in CGIE's portfolio, and with a 4.2% weighting, it leads the field.

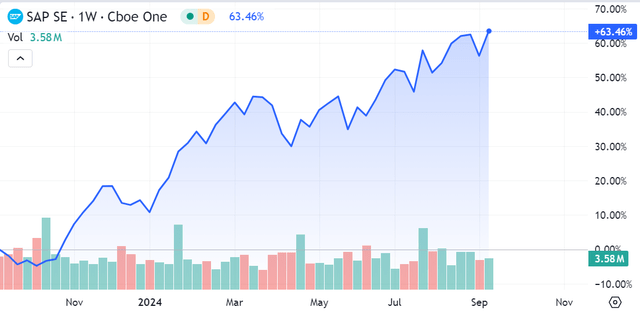

SAP SE (SAP)

Fielding the tech side is SAP, the $256-billion German behemoth that is ubiquitous across multiple industries, empowering companies with its advanced suite of enterprise applications intended to boost productivity, manage risk, handle supply chain logistics, provide analytical insights, and much more. SAP is a mainstay in the enterprise world, and the growth element is clearly visible from the sheer momentum of the stock, as it gained over 60% in the last year.

SA

Looking at forward growth prospects, the Street is clearly optimistic on SAP over the next couple of years, with growth rates projected in the low double digits for the years through FY 2026. Yet another tale of success in CGIE's “storied portfolio.”

Final Thoughts

These are just two of the fast-growing securities that the ETF holds, and these cornerstone securities are simply a small sample of the fund's extensive investments in growth-oriented industries. It's time for growth again in Europe, and all the signs point to that inevitable conclusion, which is why I believe this fund will do really well over the short to medium term.

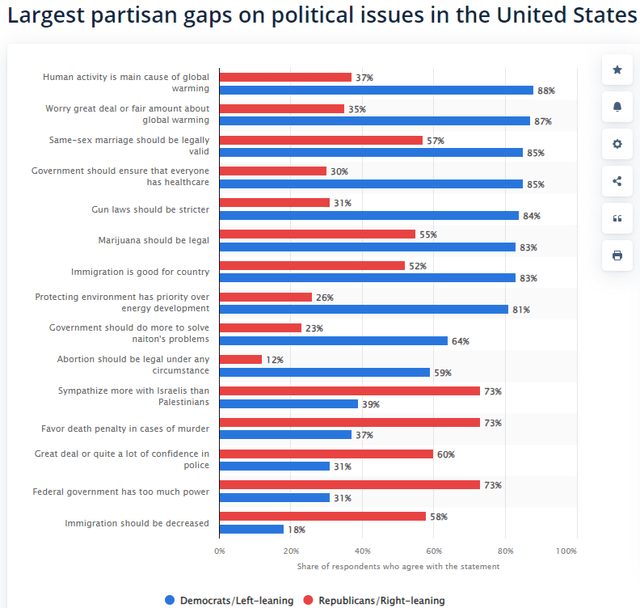

Heading back to the domestic market in the U.S., the nation is on the verge of significant financial and political volatility over the coming months, in my opinion.

On the one side is the Fed's attempt to bring inflation under control and start reversing the QT cycle. This hopefully will avoid a hard landing where inflation might flare up again and undo the central bank's efforts of the last two and a half years. This is further exacerbated by Europe now getting back on the growth track and threatening the dollar's dominance, not to mention those non-traditional currencies that have been taking their share of FX reserves at central banks around the world.

On the other side is the political polarity that we've been seeing over the past several years. There are various divisive topics driving that uncertainty, as depicted in this eye-opening graphic from Statista.

Statista

All of this is indicative of the volatility to come, and political considerations are merely a small part of the volatility equation. All things put together, it's almost a certainty that the markets will not be “business as usual” over the next year to a year and a half — at the very least.

Honestly, though, I'd never recommend betting outright against the U.S. economy as a whole. This sentiment is best voiced by Gregory Daco, EY-Parthenon Chief Economist, Strategy and Transactions, Ernst & Young LLP, in a report from a couple of weeks ago:

Despite elevated financial market volatility and softer economic data, worries about an imminent US recession are overstated. Labor market conditions have visibly softened, but economic momentum remains positive. The US economy is still moving forward at a modest to moderate pace.

Frankly, I don't know the difference between modest and moderate, but I do know that the U.S. economy is as tough as they come. It can and has weathered worse situations than the one we find ourselves in right now. Nevertheless, from an investment perspective, it's always better to spread your risks rather than concentrate them on a single market.

In such a scenario, it makes sense to explore overseas investment opportunities in addition to your core domestic holdings. As such, I'm recommending a Buy for Capital Group International Equity ETF, primarily for its capital appreciation prospects over the short to medium term that, I believe, will be driven by a stronger EU economy. It should also help act as a hedge of sorts against your U.S.-domiciled holdings, which I recommend retaining as long as the U.S. economy keeps showing signs of strength.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10