ACIO: This One Makes Sense For The Put Option Alone

Lighthouse Films

I’ve written a lot about covered call ETFs, but not ones that also use a longer-term put option to hedge against broad cycle declines. These collared approaches have a unique payoff structure with high yield typically, while hopefully limiting large drawdowns over time. One fund that does this is the Aptus Collared Investment Opportunity ETF (BATS:ACIO). This fund uses an actively managed approach to generate current income and increase capital. The fund puts money into a mix of 70-80 large-cap stocks, giving investors a stake in some of the biggest companies out there.

But it doesn't end there. ACIO looks to boost income by selling covered calls on these individual stocks, a move that can lead to better returns when markets are flat or up. But the most interesting part of ACIO is how it handles risk. The fund also tries to lower the chance of big losses by owning long put options on a wide market index. This "collar" approach aims to guard against major market drops, which can appeal to investors who want to protect their money when things are shaky.

A Look At The Holdings

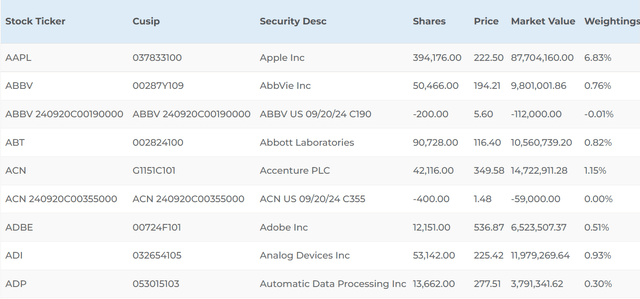

For the life of me, I don’t understand why holdings are alphabetized as opposed to in order of largest holding to smallest. Regardless, a look at the holdings indicates the core positions are all the familiar ones that effectively drive the S&P 500, with weightings that aren’t far off in terms of overall contribution to the portfolio.

aptusetfs.com

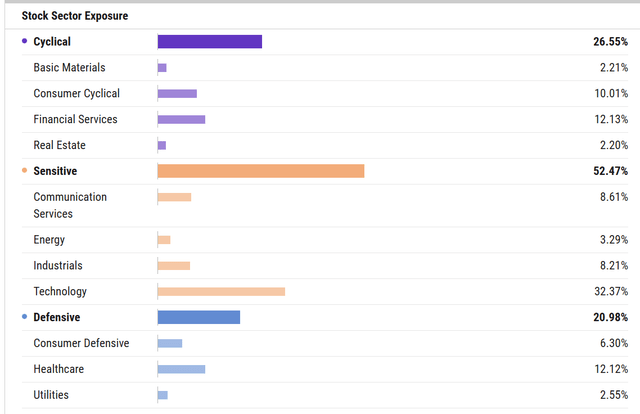

Sector and Global Allocation

ACIO's sector makeup tilts toward a large-cap focus. It spreads its investments across other areas like healthcare, finance, and consumer goods.

ycharts.com

Peer Comparison

When you compare ACIO to other ETFs in the large-cap growth area, you'll notice some big differences. Unlike passive index funds that just follow a benchmark, ACIO's active management gives it room to move and control risks. The covered call strategy makes it stand out from many growth-focused ETFs by bringing in extra income. Also, the protective put part is something special that many of its rivals don't have, giving it a safety net that can help when the market takes a dive.

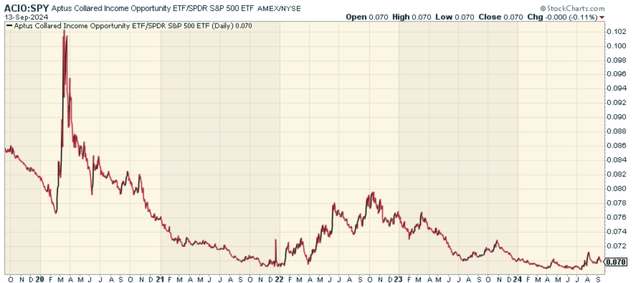

When we look at the price ratio of ACIO to the S&P 500 ETF (SPY), we find that the fund has largely performed in line since late 2021. Notice the COVID crash spike in the ratio as the long put paid off.

stockcharts.com

Pros and Cons

On the positive side, the covered call approach adds a way to make money that can be appealing when yields are low or markets are just chugging along. This extra cash flow can help smooth out your returns and give you a bit of a buffer against market ups and downs. However, the real standout feature of ACIO is how it uses protective puts. This way of guarding against losses can help when markets take a big dive, cutting down on losses and giving more cautious investors some peace of mind. At its core, ACIO tries to give you the best of both worlds – a chance to gain when markets go up, along with a cushion against big drops.

Still, every investment approach has its downsides. ACIO's method might be hard for some investors to grasp because it's complex. The fund uses options strategies that can be tricky, and how well they work can change based on what's happening in the market. When stocks are booming, the covered call strategy could hold back big gains, as the fund might have to sell stocks that have gone up in value at the call strike price. Also, buying protective puts can slow down performance when the market isn't moving much or is going up.

The active management approach, while potentially helpful, also has a risk linked to the manager. How well the fund does will depend on how good the portfolio managers are at picking stocks, timing options trades, and handling changing market conditions. This dependence on active choices can result in times when the fund does worse than the broader market indices if the managers' plans don't match up with current market trends.

Conclusion

The Aptus Collared Investment Opportunity ETF is a pretty interesting fund, in my view. It combines exposure to large-cap stocks, generates income through covered calls, and protects against large sudden downside with protective puts. This mix provides unique value in today's tricky market environment. I think this is worth considering at this point. Tail risks are growing in my view, but the question of when is unclear. Might as well be prepared for whenever the accident takes place, right?

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10