The China IPO market has collapsed

ronniechua

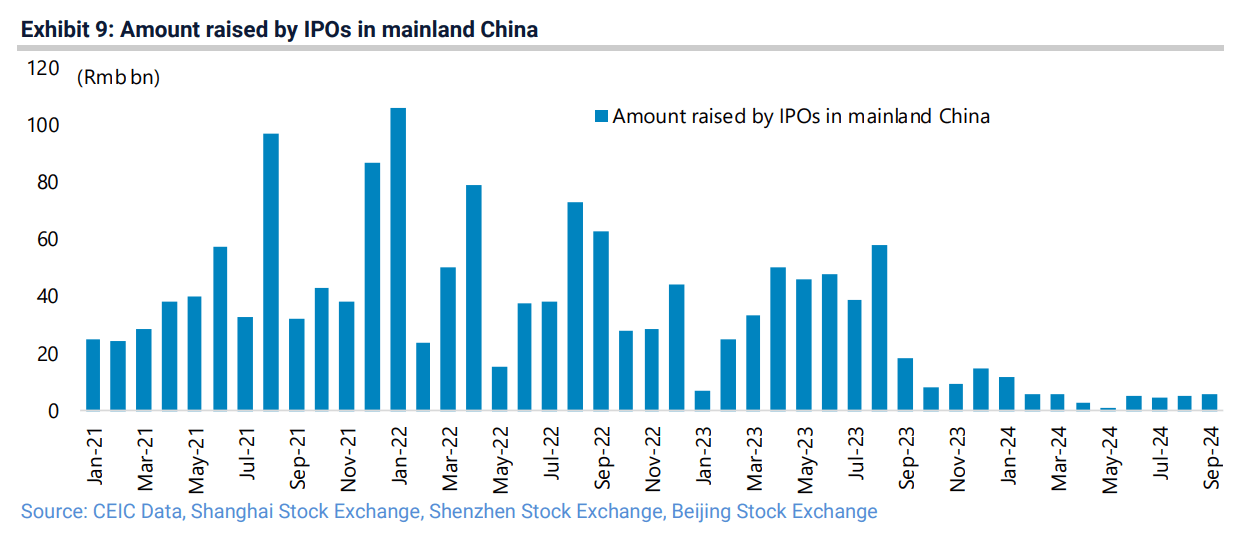

IPOs raised in mainland China have collapsed by 85% year-over-year to CNY 48B in the first nine months of the year.

Christopher Wood, global head of Equity Strategy at Jefferies, said in a note that the ongoing collapse in IPO activity in China is causing "a dramatic change in the supply and demand dynamics for Chinese equities."

IPO activity in China plummeted due to the prolonged regulatory scrutiny for the country’s economic policy.

Funds raised via the Shanghai Stock Exchange (SHCOMP) and the Shenzhen Stock Exchange fell to $4B from January through June, down from $29.8B in the same period in 2023, according to S&P Global Market Intelligence data.

Results for the 2024 first half were less than the second half of last year, which raised $15.89B – the lowest half-year result since the first six months of 2020, when $20B were raised, S&P Global Market Intelligence data showed.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10