Slammed 26% Fluence Corporation Limited (ASX:FLC) Screens Well Here But There Might Be A Catch

Fluence Corporation Limited (ASX:FLC) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

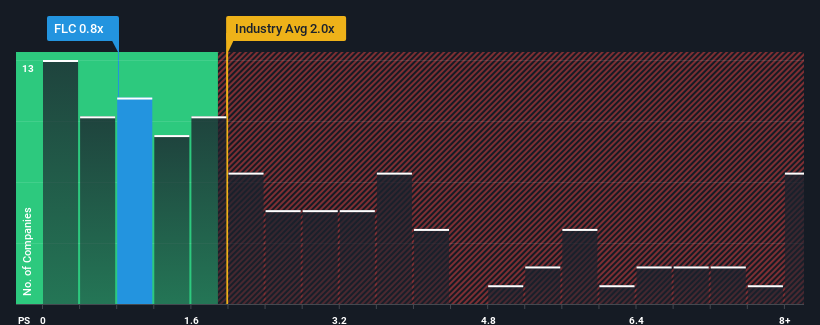

Following the heavy fall in price, Fluence may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Water Utilities industry in Australia have P/S ratios greater than 2x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Fluence

How Has Fluence Performed Recently?

Fluence hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Fluence's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Fluence would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's top line. As a result, revenue from three years ago have also fallen 22% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 42% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 12%, which is noticeably less attractive.

In light of this, it's peculiar that Fluence's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Fluence's P/S Mean For Investors?

Fluence's recently weak share price has pulled its P/S back below other Water Utilities companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Fluence currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Fluence is showing 4 warning signs in our investment analysis, and 1 of those is significant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10