Solana Open Interest Nears $5 Billion, but Price ATH Remains Elusive

- Solana nears $245 resistance, with Futures Open Interest at $4.7 billion signaling strong trader confidence despite overbought RSI.

- Technical challenges emerge, as RSI suggests overbought conditions, risking a pullback to $221 if SOL fails to breach resistance.

- Flipping $245 into support could drive Solana to a new all-time high above $260, reinforcing its bullish trajectory.

Solana’s price rally has brought it close to forming a new all-time high, stirring optimism among traders and investors. The altcoin’s upward momentum reflects heightened market activity, but challenges remain as Solana struggles to breach critical resistance levels.

Despite these hurdles, SOL enthusiasts remain bullish about the asset’s long-term potential.

Solana Is Struggling

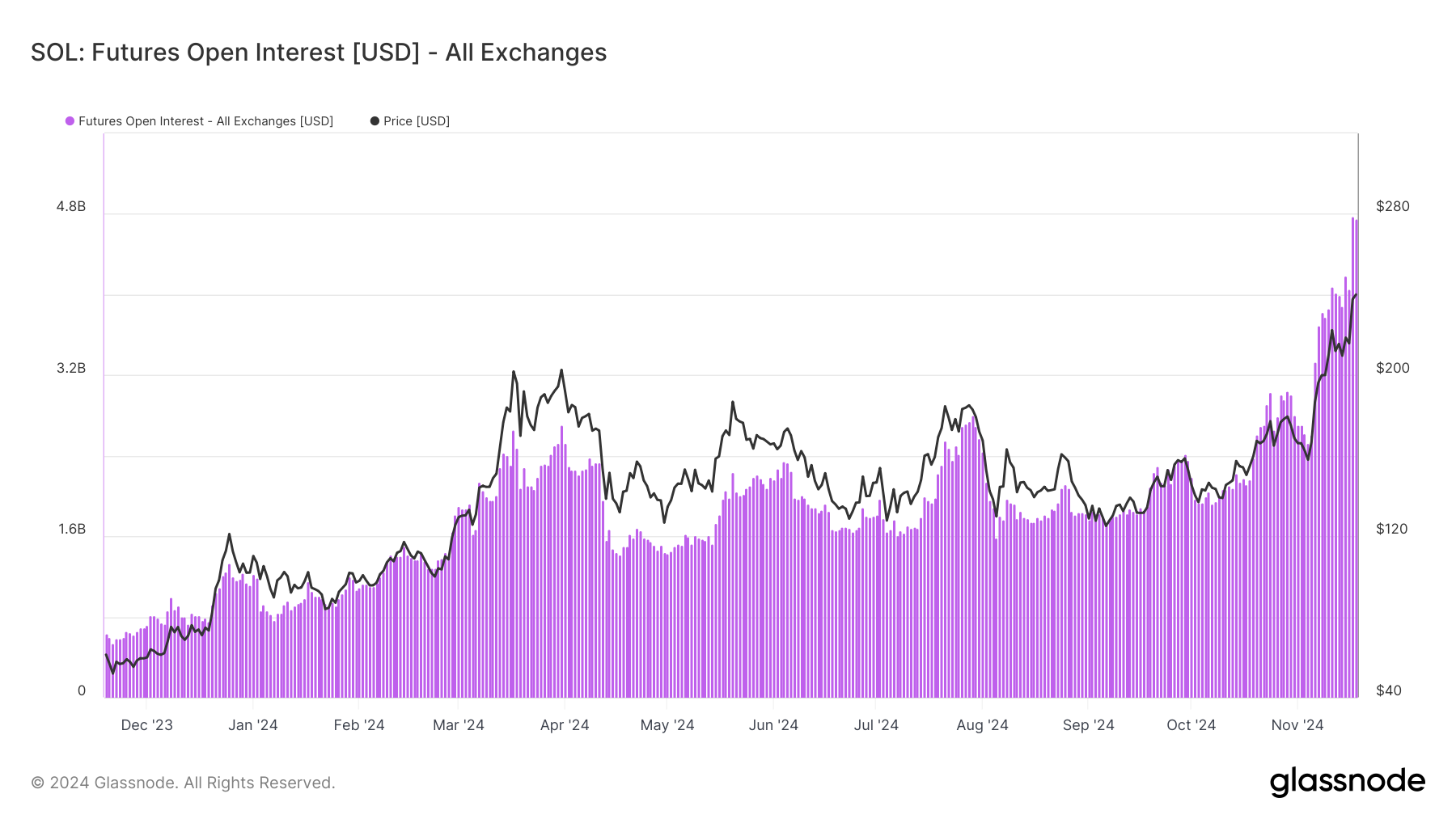

Solana traders exhibit strong optimism, with the asset’s Futures Open Interest (OI) reaching a record $4.7 billion. This surge highlights increasing confidence among traders as they pour significant capital into SOL amid its ongoing rally. With OI nearing $5 billion, Solana is experiencing a notable rise in market participation, reflecting heightened anticipation for further gains.

However, this growing OI highlights a divergence between expectations and current price movement. While traders are heavily investing, Solana’s price has yet to break past critical resistance levels. This contrast between open interest and price action raises questions about whether the bullish momentum can sustain itself or lead to a correction.

From a technical perspective, Solana’s Relative Strength Index (RSI) indicates overbought conditions, sitting well above the neutral range. Historically, such RSI levels have triggered price corrections, suggesting SOL may face short-term headwinds. A dip in price could materialize as traders adjust positions and secure profits, pulling the asset away from its all-time high ambitions.

Despite this, Solana’s macro momentum remains strong, driven by broader market cues and increased adoption. These factors contribute to the asset’s resilience, but the overbought conditions warrant caution. Investors will need to monitor whether Solana can maintain its upward trajectory or succumb to market pressures.

SOL Price Prediction: Continuing the Rise

Solana’s price is trading just below the $245 resistance level, which serves as the final barrier to a new ATH beyond $260. Breaching this critical level would confirm the continuation of SOL’s rally, allowing the asset to set new milestones.

However, mixed signals from market sentiment and technical indicators suggest potential difficulties in overcoming $245. A failure to break through could send Solana down to $221 or lower, testing investor confidence.

But if the broader market cues remain positive and $245 is flipped into support, Solana would have a chance at forming a new ATH beyond $260, invalidating the bearish thesis

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10