Breakout Alert! Ethereum (ETH) Price Prediction For November 28

Ethereum (ETH), the world’s second-largest cryptocurrency by market cap has breached a crucial level and currently is gaining significant attention from investors as well as traders. As of today on November 28, 2024, ETH’s breakout from a strong resistance level indicates that it is poised for a notable upside rally.

Ethereum Technical Analysis and Upcoming Level

According to Coinpedia’s technical analysis, ETH’s sentiment has strongly shifted toward the bullish side. In addition to breaching the horizontal support level of $3,550, the altcoin has also broken out of its five-day-long consolidation zone.

This zone breakout near the resistance level is considered successful, as notable accumulation has recently been observed in this zone.

Ethereum (ETH) Price Prediction

Based on recent price action, if ETH sustains above the $3,580 level, there is a strong possibility it could rally by 14% to reach the $4,000 mark in the coming days, with the potential to climb even higher if the bullish sentiment stays.

On the positive side, ETH is trading above the 200 Exponential Moving Average (EMA) on the daily time frame, indicating an uptrend. Additionally, its Relative Strength Index (RSI) suggests a potential upside rally in the coming days. Currently, ETH’s RSI on the daily time frame is below the 70 level, indicating there is still room for further growth.

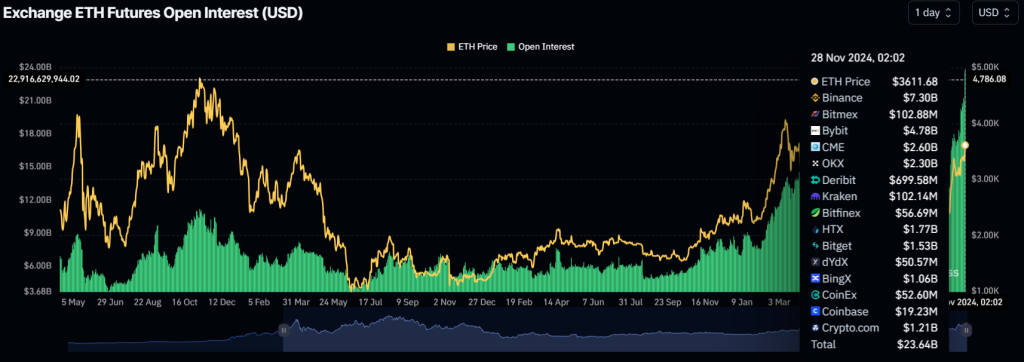

ETH’s Rising Open Interest

Besides technical analysis, on-chain metrics further support’ ETH's bullish outlook. Data from the on-chain analytics firm Coinglass reveals record trader participation in ETH. According to Coinglass, ETH’s Open Interest (OI) has surged by 15% in the past 24 hours, indicating a significant increase in new positions during this period.

With significant attention from traders, ETH’s Open Interest (OI) has reached a record high of $23.56 billion for the first time. During ETH’s previous all-time high, its OI was approximately $10 billion. This data highlights the growing interest and confidence traders have in the altcoin.

Current Price Momentum

At press time, ETH is trading near $3,612 and has experienced a price surge of over 10% in the past 24 hours. However, during the same period, its trading volume dropped by 9%, indicating lower participation from traders and investors compared to the previous day.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10