ScanSource, Inc.'s (NASDAQ:SCSC) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- ScanSource's Annual General Meeting to take place on 10th of December

- Salary of US$901.0k is part of CEO Mike Baur's total remuneration

- The overall pay is comparable to the industry average

- Over the past three years, ScanSource's EPS grew by 7.2% and over the past three years, the total shareholder return was 52%

CEO Mike Baur has done a decent job of delivering relatively good performance at ScanSource, Inc. (NASDAQ:SCSC) recently. As shareholders go into the upcoming AGM on 10th of December, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for ScanSource

How Does Total Compensation For Mike Baur Compare With Other Companies In The Industry?

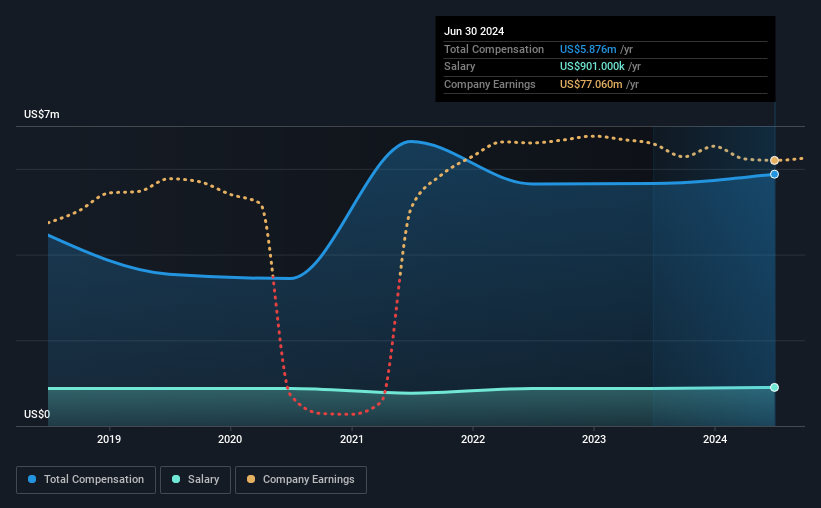

According to our data, ScanSource, Inc. has a market capitalization of US$1.3b, and paid its CEO total annual compensation worth US$5.9m over the year to June 2024. That's just a smallish increase of 3.9% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$901k.

For comparison, other companies in the American Electronic industry with market capitalizations ranging between US$1.0b and US$3.2b had a median total CEO compensation of US$5.8m. This suggests that ScanSource remunerates its CEO largely in line with the industry average. What's more, Mike Baur holds US$9.4m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$901k | US$875k | 15% |

| Other | US$5.0m | US$4.8m | 85% |

| Total Compensation | US$5.9m | US$5.7m | 100% |

On an industry level, roughly 28% of total compensation represents salary and 72% is other remuneration. ScanSource pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at ScanSource, Inc.'s Growth Numbers

Over the past three years, ScanSource, Inc. has seen its earnings per share (EPS) grow by 7.2% per year. Its revenue is down 15% over the previous year.

We would prefer it if there was revenue growth, but the modest improvement in EPS is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has ScanSource, Inc. Been A Good Investment?

We think that the total shareholder return of 52%, over three years, would leave most ScanSource, Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for ScanSource that investors should be aware of in a dynamic business environment.

Important note: ScanSource is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10