Fortune Brands (FBIN): Buy, Sell, or Hold Post Q3 Earnings?

Fortune Brands’s 18.7% return over the past six months has outpaced the S&P 500 by 6.3%, and its stock price has climbed to $78.20 per share. This run-up might have investors contemplating their next move.

Is now the time to buy Fortune Brands, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We’re happy investors have made money, but we don't have much confidence in Fortune Brands. Here are three reasons why FBIN doesn't excite us and a stock we'd rather own.

Why Do We Think Fortune Brands Will Underperform?

Targeting a wide customer base of residential and commercial customers, Fortune Brands (NYSE:FBIN) makes plumbing, security, and outdoor living products.

1. Core Business Falling Behind as Demand Declines

In addition to reported revenue, organic revenue is a useful data point for analyzing Home Construction Materials companies. This metric gives visibility into Fortune Brands’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Fortune Brands’s organic revenue averaged 4.8% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Fortune Brands might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

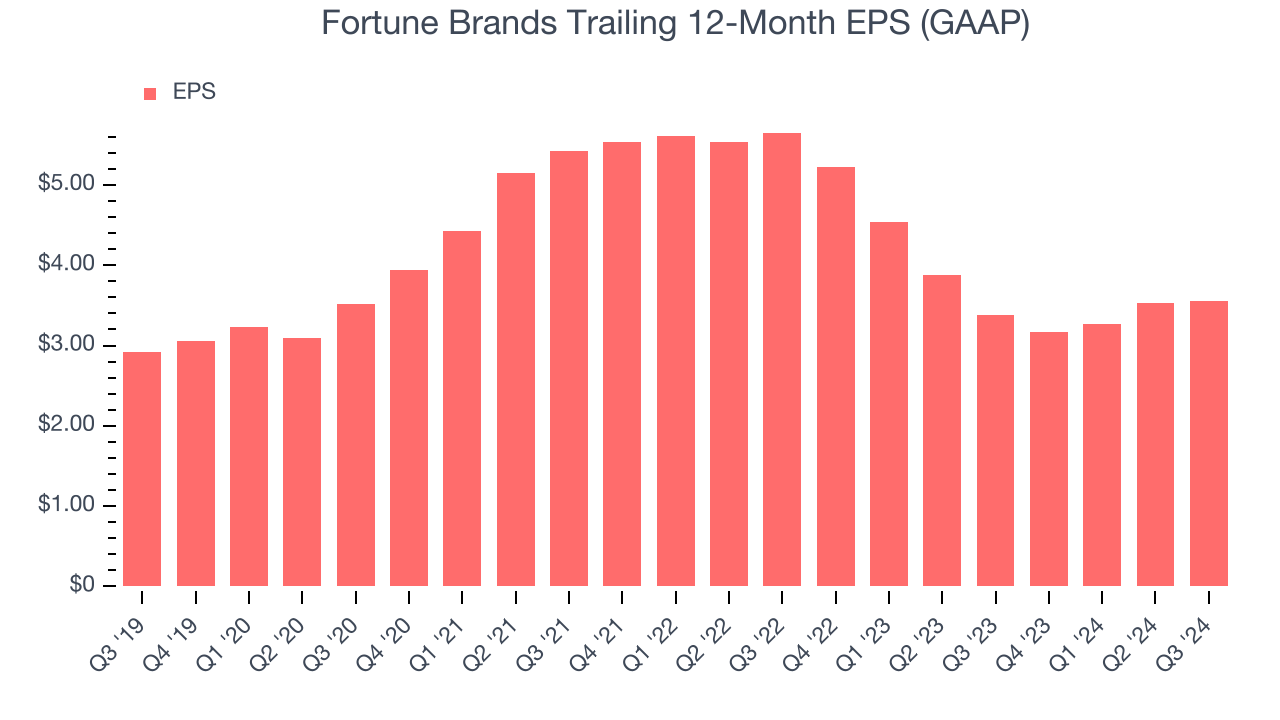

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Fortune Brands’s unimpressive 4% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Fortune Brands’s margin dropped by 10.7 percentage points over the last five years. If its declines continue, it could signal higher capital intensity. Fortune Brands’s free cash flow margin for the trailing 12 months was 8.6%.

Final Judgment

Fortune Brands doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 16.6× forward price-to-earnings (or $78.20 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere. Let us point you toward Chipotle, which surprisingly still has a long runway for growth.

Stocks We Would Buy Instead of Fortune Brands

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10