What’s Ahead for FARTCOIN After Volume Crashes from $300 Million Peak

- Fartcoin's volume has fallen from over $300 million to $129.64 million, indicating dwindling interest in the meme coin.

- Sentiment around the token has also dropped to the negative region, which suggests potential challenges in recovering.

- FARTCOIN's price has slipped below the 23.6% Fib ratio, with analysis signifying an extended correction toward $0.58.

On December 20, Fartcoin (FARTCOIN) experienced a significant surge in trading activity, with its volume exceeding $300 million. This milestone coincided with a price rally that saw FARTCOIN reach $1.25, pushing its market capitalization above $1 billion.

However, things have changed as the meme coin has registered notable drops on several fronts. What’s next after this?

Interest in Fartcoin Drops, Sentiment Turns Bearish

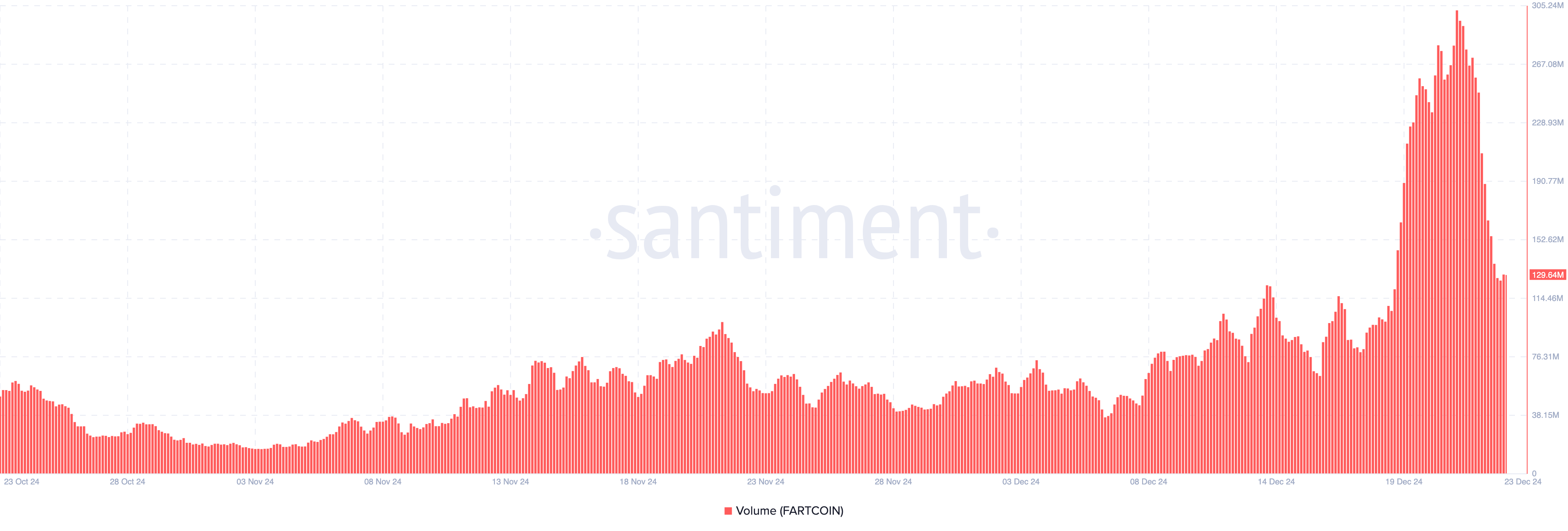

According to Santiment, Fartcoin’s trading volume has dropped to $129.64 million. Trading volume represents the total amount of a cryptocurrency traded within a specific time frame, and it also measures its level of liquidity around the asset in question.

Typically, higher trading volumes suggest increased interest and confidence, while lower volumes may indicate waning market activity. Therefore, the notable decline in FARTCOIN’s volume signifies declining interest in it.

From a price perspective, declining volume alongside falling prices indicates insufficient liquidity to support a significant price rebound. This trend often reflects reduced investor interest or weakened buying pressure.

Thus, if FARTCOIN, currently trading at $0.68, continues to decline while its trading volume shrinks, it could indicate further bearish sentiment. As a result, the Solana-based meme coin’s value may slide lower unless there is a revival in volume to stabilize it.

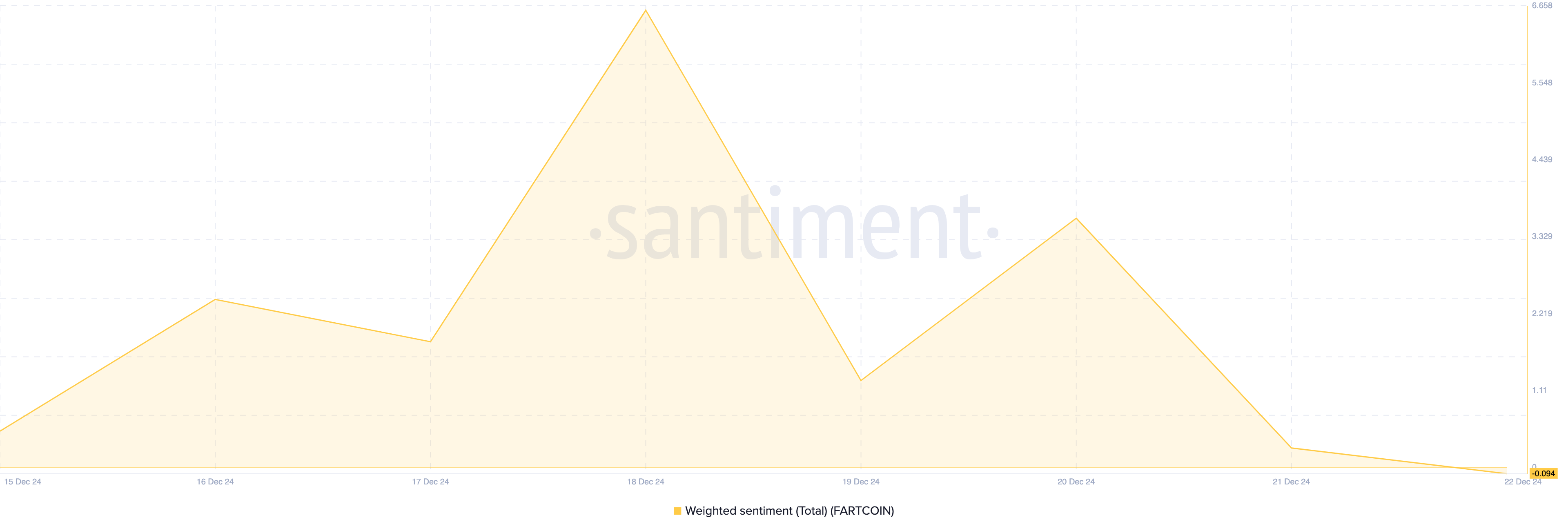

Besides that, sentiment around the token has changed. Some days ago, the Weighted Sentiment was around 6.58. Weighted Sentiment measures the comments the market has about a cryptocurrency online.

When it is positive, it means that there are more bullish remarks. However, a negative rating indicates a rise in bearish perception. As of this writing, the Weighted Sentiment is -0.094, indicating pessimism around the meme coin. Should that trend continue, then the cryptocurrency’s value might slide below $0.68.

FARTCOIN Price Prediction: Lower Lows

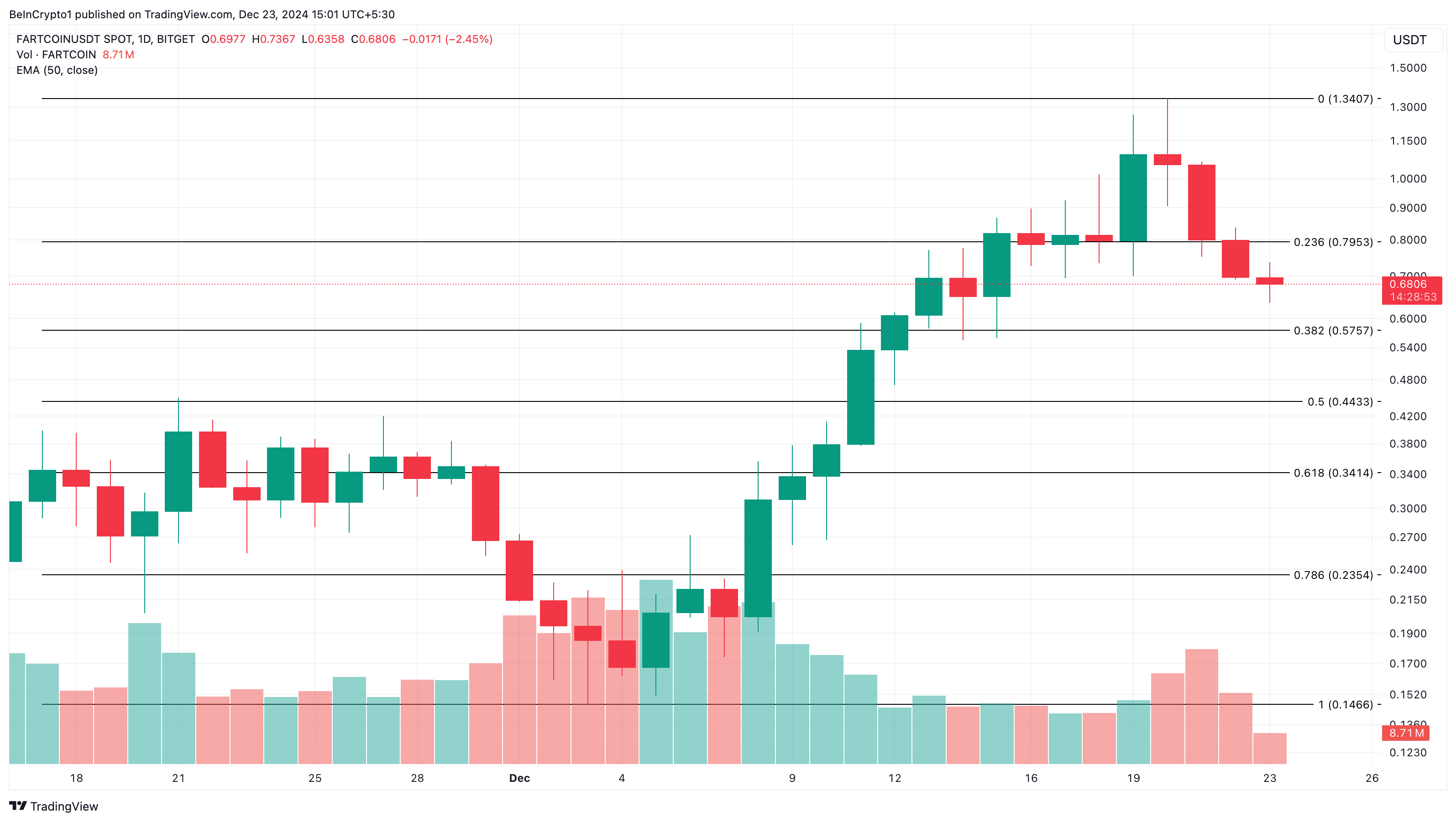

Using the Fibonacci retracement indicator, BeInCrypto observed that FARTCOIN’s price has dropped below the 23.6% support zone. The decline below this area suggests that the cryptocurrency’s price is likely to keep falling.

As mentioned above, with volume dropping, the token might not experience a quick rebound soon. Instead, FARTCOIN might decrease to the 38.2% Fibonacci sequence area. Declining toward this region would mean that the price could trade at $0.58.

A highly bearish market condition might see it decrease to $0.34, where the 61.8% golden ratio lies. However, if the broader market begins to buy FARTCOIN in large volumes again, another decline could be evaded. In that scenario, the price might jump to $1.34.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10