HBAR Rides the Bull: An 11% Surge Points to More Gains Ahead

- HBAR surged 11% in 24 hours, backed by rising demand and bullish technical indicators signaling the potential for further gains.

- Super Trend support at $0.23 signals bullish momentum; breaking $0.39 could mark a new three-year high.

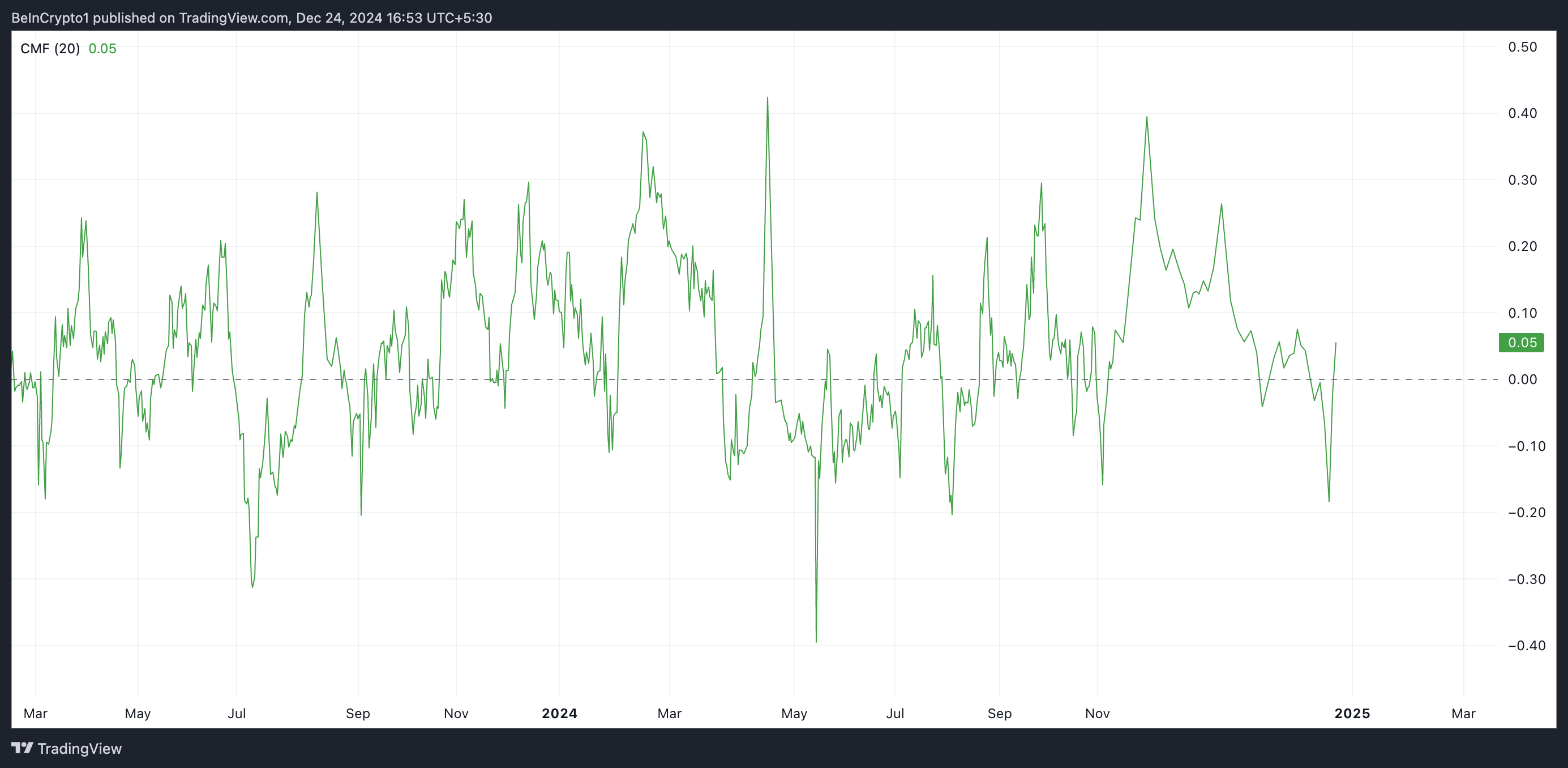

- Rising Chaikin Money Flow (CMF) suggests strong buying pressure, supporting the likelihood of sustained upward price movement.

HBAR, the native token powering the Hedera Hashgraph distributed ledger, has seen an 11% price surge in the past 24 hours. This price rally comes amidst a noticeable rise in demand for the token in the past few days.

Technical analysis suggests that HBAR may be poised for further gains. This analysis highlights price levels that token holders need to pay attention to.

Hedera Token Holders Intensify Accumulation

Readings from HBAR’s daily chart show that despite its recent pullback, its price has remained above the Super Trend indicator, which continues to offer dynamic support at $0.23.

The Super Trend indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the trend: green for an uptrend and red for a downtrend.

If an asset’s price is above the Super Trend line, it signals bullish momentum in the market. In this scenario, this line offers dynamic support, and as long as the price remains above it, the bullish trend is likely to continue.

Furthermore, HBAR’s rising Chaikin Money Flow (CMF) hints at the likelihood of a sustained rally. At press time, this is at 0.05.

This indicator measures money flows into and out of an asset’s market. As with HBAR, when its value is positive during a price rally, it indicates strong buying pressure as more volume is flowing into the asset than out. This suggests that the price rally is supported by actual accumulation, increasing the likelihood of a sustained uptrend.

HBAR Price Prediction: Bulls Eye $0.39 While Bears Target $0.24

According to its Fibonacci Retracement tool, HBAR’s price will revisit its three-year high of $0.39 and rally past it if accumulation persists. That price level must be flipped into a support floor for this to happen.

On the other hand, if selloffs resurge, HBAR’s price will shed some of its recent gains and trend toward $0.24. A break below this level will cause a further decline to the Super Trend’s dynamic support of $0.23. If this level fails to hold, the HBAR token price may plunge to $0.16.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10