XRP Open Interest Shrinked by $1 Billion in 24 Hours: Here’s Why

- XRP Open Interest plunged $1 billion in 24 hours, reflecting growing trader skepticism about a price breakout.

- Price DAA Divergence signals bearish sentiment, with declining participation and consolidation under $2.73 resistance.

- XRP risks dropping below $2.00 support but could aim for $3.31 ATH if broader market conditions turn bullish.

XRP has been consolidating under key resistance for over a month, frustrating investors as the altcoin struggles to gain upward momentum.

This prolonged stagnation has impacted trader confidence, with many opting to step back amid a lack of significant price growth.

XRP Traders Are Uncertain

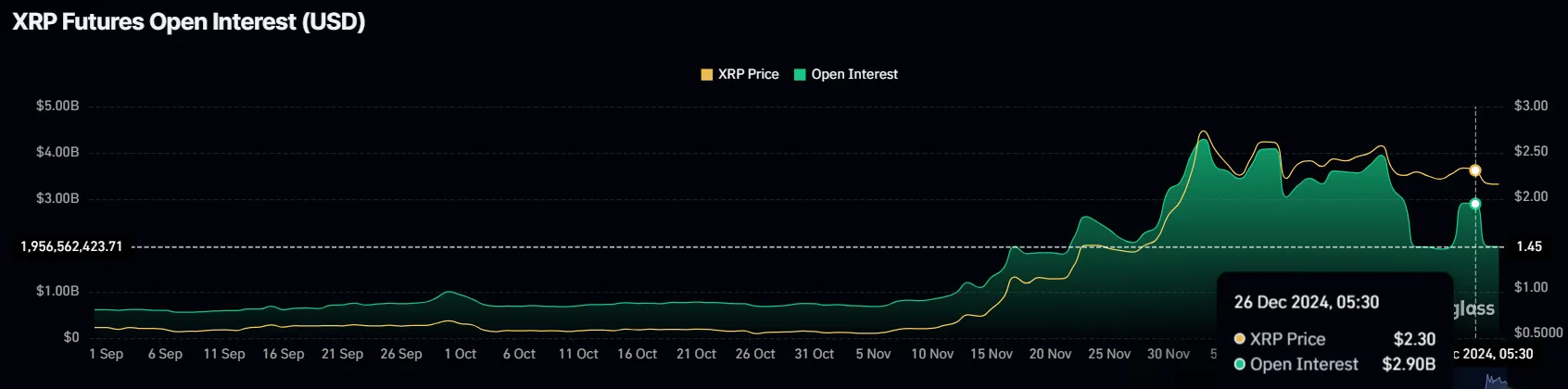

Open Interest (OI) in XRP Futures dropped by $1 billion in the past 24 hours, signaling a loss of trader conviction. Just a day earlier, OI had surged to $2.9 billion, fueled by expectations of a price rally. However, when these hopes failed to materialize, traders began pulling their money out.

This sudden withdrawal indicates a growing bearish sentiment among XRP enthusiasts. The decline in OI highlights the increasing skepticism surrounding XRP’s ability to break through its current resistance levels, potentially dampening market activity further in the short term.

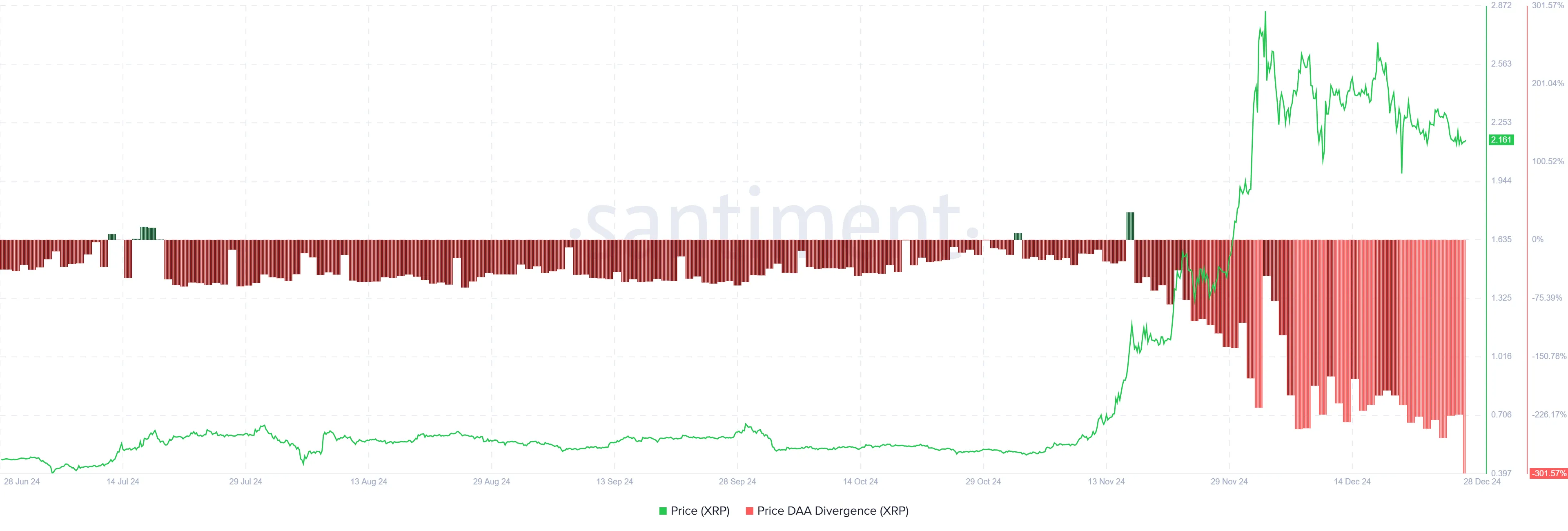

XRP’s macro momentum is also showing signs of weakness. The Price DAA Divergence is currently flashing a sell signal, reflecting declining participation and stagnant price movement. This bearish indicator suggests that traders may begin to secure profits, which could lead to further price declines.

If selling pressure intensifies, XRP could face additional challenges. The combination of reduced participation and hesitant investors may stall the altcoin’s recovery, keeping it locked in a consolidation phase until stronger market cues emerge.

XRP Price Prediction: Escaping The Consolidation

XRP’s price has fallen by 20% over the past month but has managed to hold above the $2.00 support level. Despite this, the altcoin remains consolidated under the critical resistance of $2.73, unable to break through and initiate a rally.

If the bearish factors persist, XRP could continue consolidating with a risk of losing its $2.00 support. Such a scenario would further undermine investor confidence and place additional downward pressure on the price, extending the current stagnation.

Conversely, if broader market conditions turn bullish, XRP could breach the $2.73 resistance and aim for its all-time high of $3.31. Achieving this level would invalidate the bearish thesis and signal a renewed uptrend, attracting more investors back to the market.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10