Cardano Outflows Hit 2-Month High Amid Prolonged Downtrend

- Cardano’s price fell to $0.84, with high outflows and declining user activity deepening the bearish market sentiment.

- The Price DAA Divergence and Chaikin Money Flow indicators point to weak momentum, with investor skepticism on the rise.

- Reclaiming $0.85 as support could target $1.00, but ongoing outflows and bearish sentiment risk further declines to $0.77.

Cardano’s (ADA) price has been on a steady decline, recently falling to a multi-week low of $0.84. This ongoing downtrend reflects broader market challenges, with investors displaying diminished optimism.

ADA’s inability to hold critical support levels has further contributed to its weakened position heading into 2025.

Cardano Investors Are Skeptical

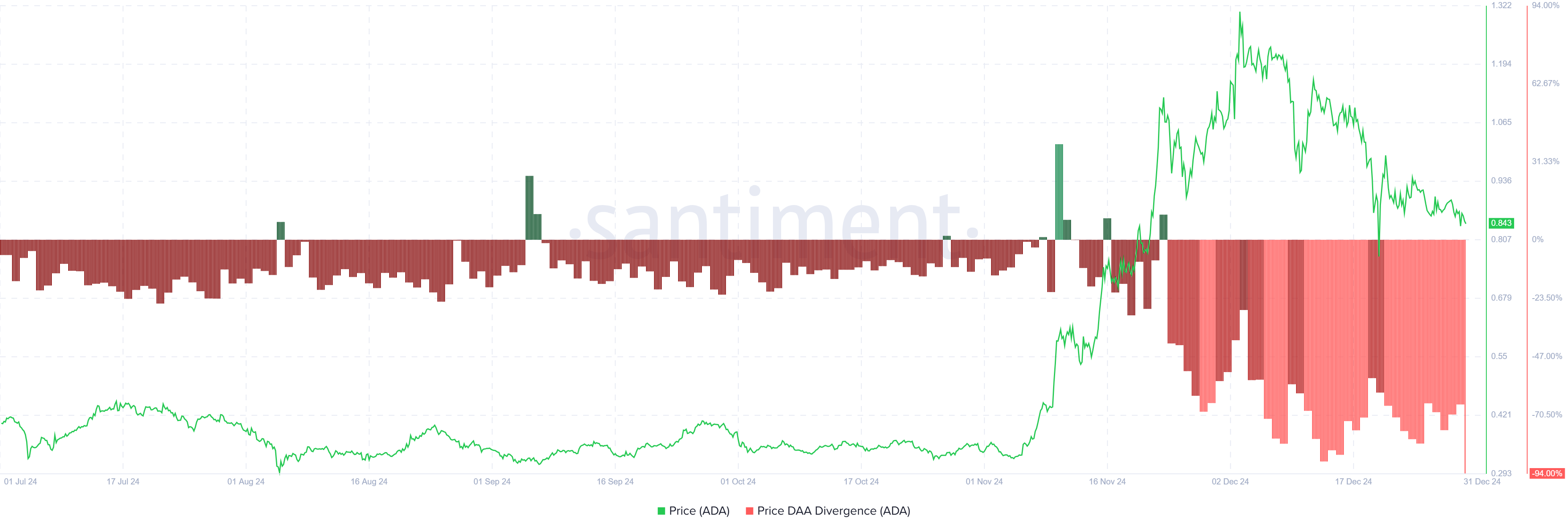

The Price DAA Divergence indicator is currently flashing a sell signal, highlighting Cardano’s deteriorating market sentiment. This signal emerges from the combination of declining prices and reduced network participation. Such patterns suggest investors are losing confidence, with uncertainty surrounding ADA’s potential for recovery.

Adding to the bearish outlook, ADA’s participation metrics reveal a shrinking active user base. This declining interest reflects broader hesitation among investors. The reduced activity aligns with the downtrend, suggesting that market participants are increasingly backing away from the asset as recovery appears uncertain.

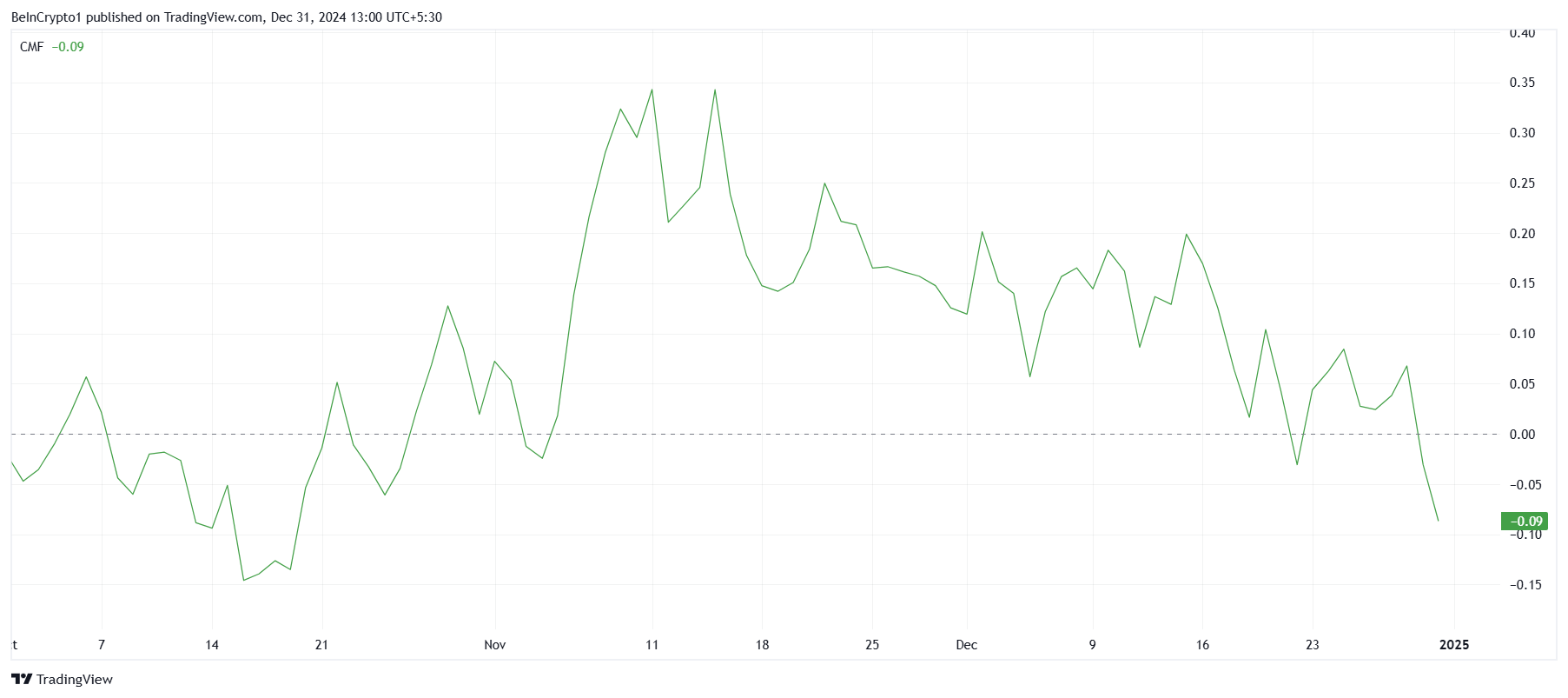

Cardano’s macro momentum shows further weakness, with the Chaikin Money Flow (CMF) indicator hitting a two-and-a-half-month low. This trend signals that outflows are currently dominating ADA’s market activity, reflecting a lack of fresh capital entering the ecosystem. The prolonged negative CMF highlights the challenges ADA faces in attracting investor confidence.

The lack of clear price direction is compelling ADA holders to exit their positions with selling pressure mounting, and the asset risks further decline. Unless macroeconomic or network-specific factors shift significantly, this trend is likely to persist, exacerbating ADA’s struggles as outflows continue to dominate.

ADA Price Prediction: Aiming At Recovery

Cardano’s current price of $0.84 has slipped below the crucial support level of $0.85. While ADA had managed to sustain itself above this mark in recent days, the last 24 hours have seen renewed pressure, resulting in further losses. This decline places ADA in a precarious position.

If ADA fails to reclaim the $0.85 support level, it risks falling to $0.77. Such a drop could be compounded by the ongoing high outflows, which weaken the asset’s price stability. This scenario would likely heighten bearish sentiment and further discourage investor participation.

Conversely, reclaiming $0.85 as support could provide ADA with a chance to recover. Successfully flipping this level could enable ADA to target $1.00 as a support floor once again. However, such a recovery depends heavily on improving sentiment and reducing capital outflows.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10