Investor Optimism Abounds Breville Group Limited (ASX:BRG) But Growth Is Lacking

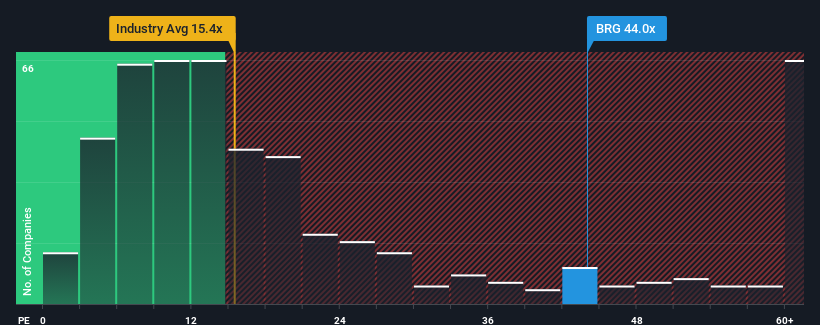

When close to half the companies in Australia have price-to-earnings ratios (or "P/E's") below 19x, you may consider Breville Group Limited (ASX:BRG) as a stock to avoid entirely with its 44x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

There hasn't been much to differentiate Breville Group's and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Breville Group

How Is Breville Group's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Breville Group's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 7.1%. The solid recent performance means it was also able to grow EPS by 25% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Looking ahead now, EPS is anticipated to climb by 12% each year during the coming three years according to the analysts following the company. With the market predicted to deliver 19% growth per year, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Breville Group is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Breville Group's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Breville Group with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Breville Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10