Bitcoin (BTC) Pulls Back from Festive Highs, Risks Falling Below $90,000

- BTC is nearing sub-$90,000 levels as momentum weakens, and profit-taking pushes its price downward.

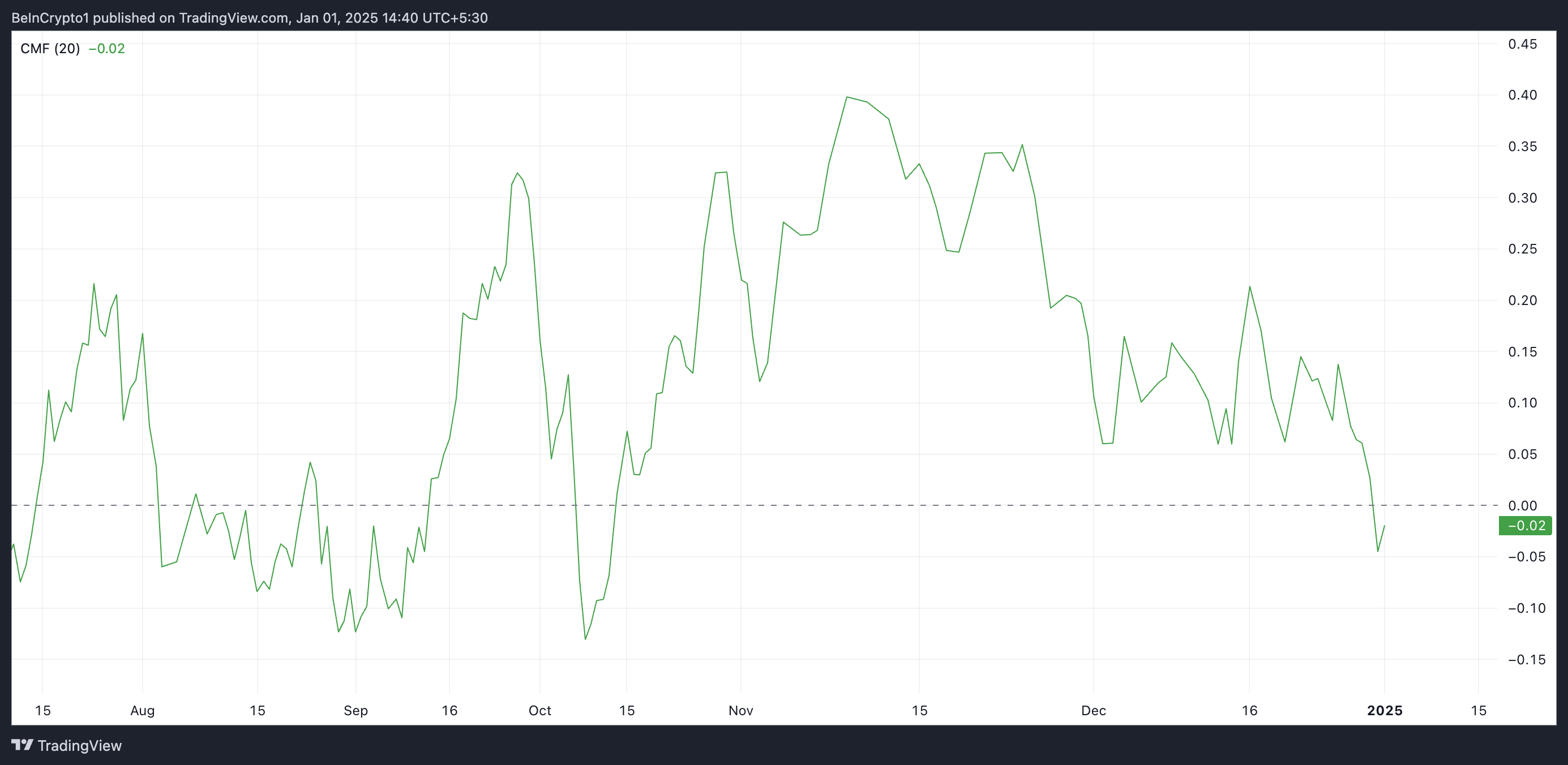

- Bitcoin trades below the Ichimoku Cloud’s Leading Span A, while negative CMF confirms declining buying pressure.

- Key support at $91,488 may fail, but a bullish resurgence could target resistance at $97,675 or its $108,230 all-time high.

Bitcoin, which saw a modest rally during the Christmas period, has recently witnessed a decline. The market participants appear to be booking profits, exerting downward pressure on the leading cryptocurrency’s price.

With weakening buying activity, BTC’s price may soon fall below the critical $90,000 mark. This analysis explores some of the reasons behind this projection.

Bitcoin Bears Apply More Pressure

BTC’s decline over the past few days has pushed its price below the Leading Span A (green line) of its Ichimoku Cloud indicator, where it currently trades. This indicator tracks the momentum of an asset’s market trends and identifies potential support/resistance levels.

When an asset’s price falls below the Leading Span A of its Ichimoku Cloud, it indicates weakening momentum and a potential bearish shift. The Leading Span A represents a near-term support level, so breaking below suggests diminishing strength in the asset’s uptrend.

Further, the coin’s negative Chaikin Money Flow (CMF) confirms the waning demand for BTC. As of this writing, the indicator lies below the zero line at -0.02.

Based on price and volume, the CMF indicator measures the strength of money flow into or out of an asset over a specific period. As with BTC, when its value falls below zero, it indicates that selling pressure dominates, suggesting more outflow of money than inflow. This is a bearish signal that implies weakening demand and potential downward price momentum.

BTC Price Prediction: Will $91,000 Support Hold?

Bitcoin’s next major support level, which lies at $91,488, may fail to hold if the demand weakens further. In that scenario, the coin’s price could fall below $90,000 for the first time since early November to trade at $86,697.

However, if BTC experiences a resurgence in buying activity, this could propel its price above the dynamic resistance of $97,675 offered by the Leading Span A of its Ichimoku Cloud. A successful breach of this level could drive BTC’s price toward revisiting its all-time high of $108,230.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10