SPX6900 (SPX) Rockets 25%, Beating Top Coins in Daily Growth

- SPX hit a new all-time high of $1.25, climbing 25% in 24 hours before pulling back 4%, maintaining a bullish outlook.

- Open interest spikes 90% to $30.46 million, signaling strong market participation and confidence in SPX's upward momentum.

- Positive indicators like CMF and Long/Short ratio support a bullish trend, but profit-taking could push prices to $0.99.

SPX’s price has climbed by 25% over the past 24 hours, significantly outperforming major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and other assets in the top 100. This rally propelled SPX to a new all-time high of $1.25 during Friday’s early Asian session.

While it has since noted a 4% pullback, the bullish bias toward the token remains significant, hinting at further price growth.

SPX6900 Enjoys Increased Trading Activity

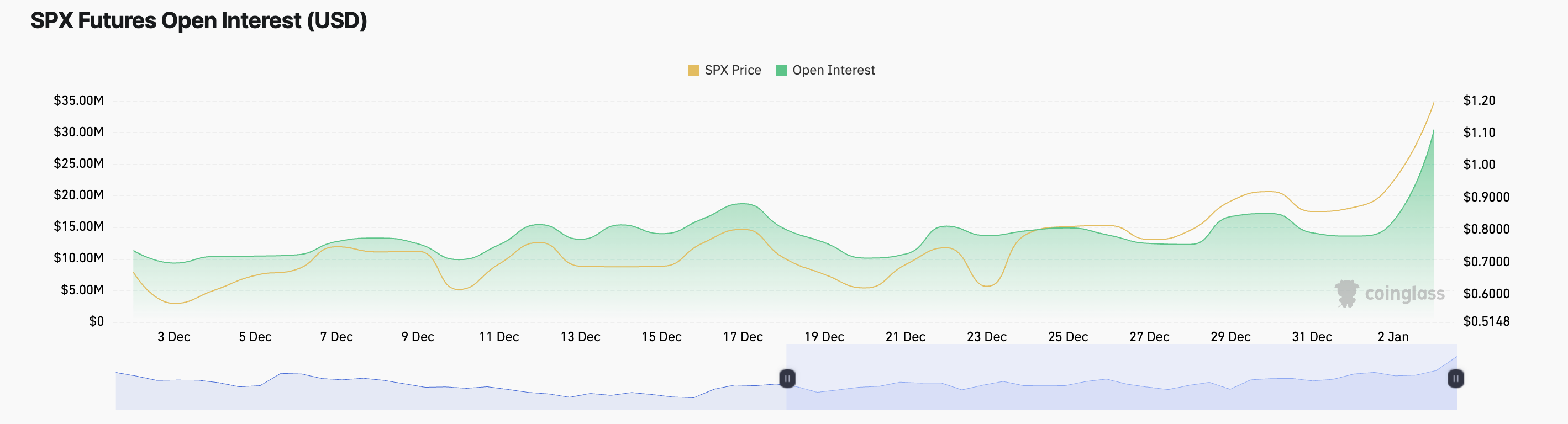

The surge in activity around SPX is reflected in its rising open interest, which now sits at an all-time high of $30.46 million. According to Coinglass, this has increased by 90% over the past 24 hours.

Open interest measures the total number of outstanding derivative contracts, such as futures or options, that have not been settled or closed. When open interest rises during a price rally, new money is entering the market, indicating stronger participation and confidence in the upward trend. It signals that the rally has momentum and is less likely to be a short-term move.

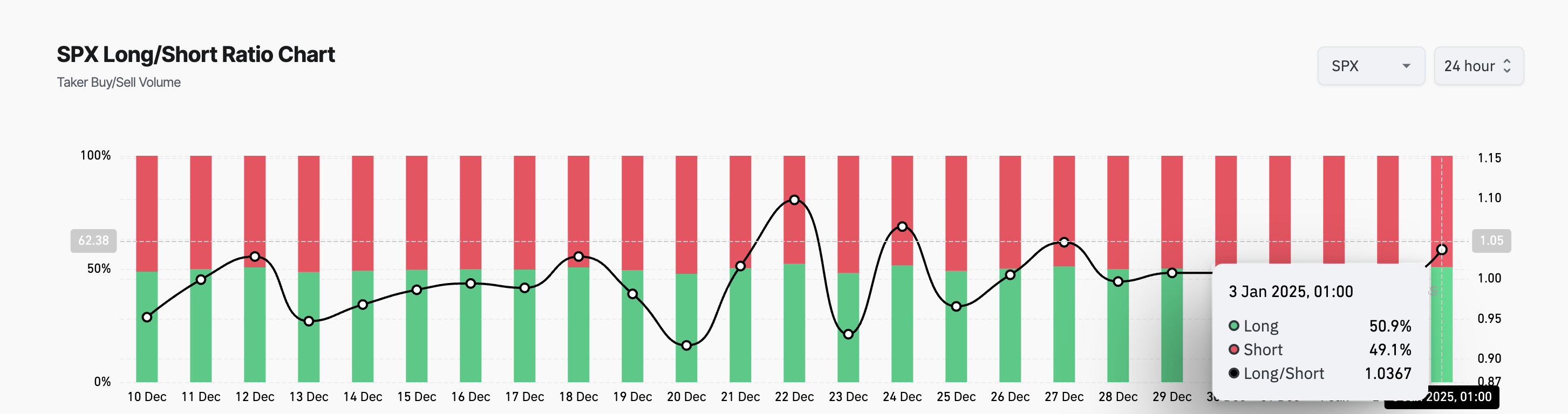

Additionally, SPX’s Long/Short ratio confirms the bullish bias toward the altcoin. As of this writing, this is 1.03.

An asset’s Long/Short ratio measures the proportion of its long (buy) positions to short (sell) positions in a market, reflecting trader sentiment. As with SPX, when the ratio is above 1, it shows more traders are taking long positions, often signaling bullish sentiment.

SPX Price Prediction: Profit-Taking Poses Risks to Bullish Outlook

On the daily chart, SPX’s Chaikin Money Flow (CMF) highlights the growing demand for the altcoin. At press time, this indicator, which measures the flow of money into and out of an asset, is in an upward trend at 0.08.

When an asset’s CMF is positive, it indicates that buying pressure is stronger than selling pressure, suggesting bullish market sentiment. If this bullish sentiment persists, SPX could reclaim its all-time high of $1.25 and rally past it.

However, if token holders begin to sell for profits, this could invalidate this bullish projection. In that scenario, SPX’s price may dip to $0.99.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10