Bitget’s BGB Tops Market Gains with 4% Rise, but There’s a Catch

- Bitget’s BGB token surged 4% in 24 hours but showing signs of bearish divergence.

- Negative Balance of Power and Chaikin Money Flow suggest current trend is getting weak.

- BGB’s price outlook hinges on buyer activity. If selling pressure continues, it could fall to $4.42.

Bitget’s native token, BGB, has noted a 4% price surge over the past 24 hours. This rally has made it the market’s top gainer among the top 100 cryptocurrencies by market capitalization during that period.

However, while this price uptrend might seem bullish, a look at BGB’s technical indicators reveals a potential looming decline. This analysis explains why.

Bitget Climbs, But the Rally May Not Last

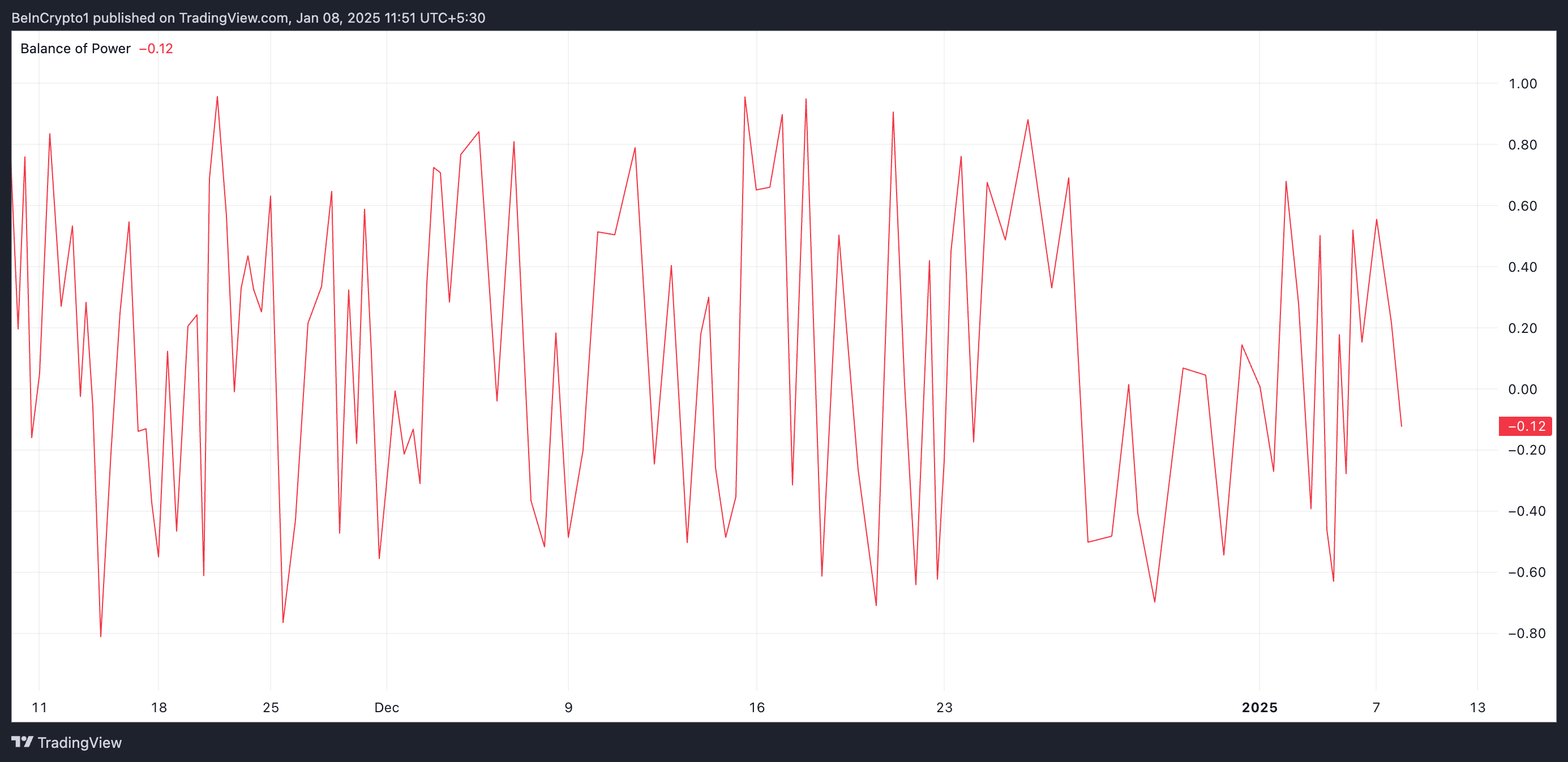

BGB’s Balance of Power (BoP), observed on a 12-hour chart, hints at a potential correction in the token’s price. As of this writing, the indicator is below zero at -0.12.

The BoP indicator measures the strength of buyers versus sellers in the market by analyzing price movements within a given period. As with BGB, a divergence is formed when the indicator’s value is negative during a price rally.

This divergence suggests that sellers are exerting significant influence, potentially weakening the rally’s momentum or indicating a lack of strong buyer conviction. This indicates that the upward price movement may not be sustainable or could reverse if selling pressure increases.

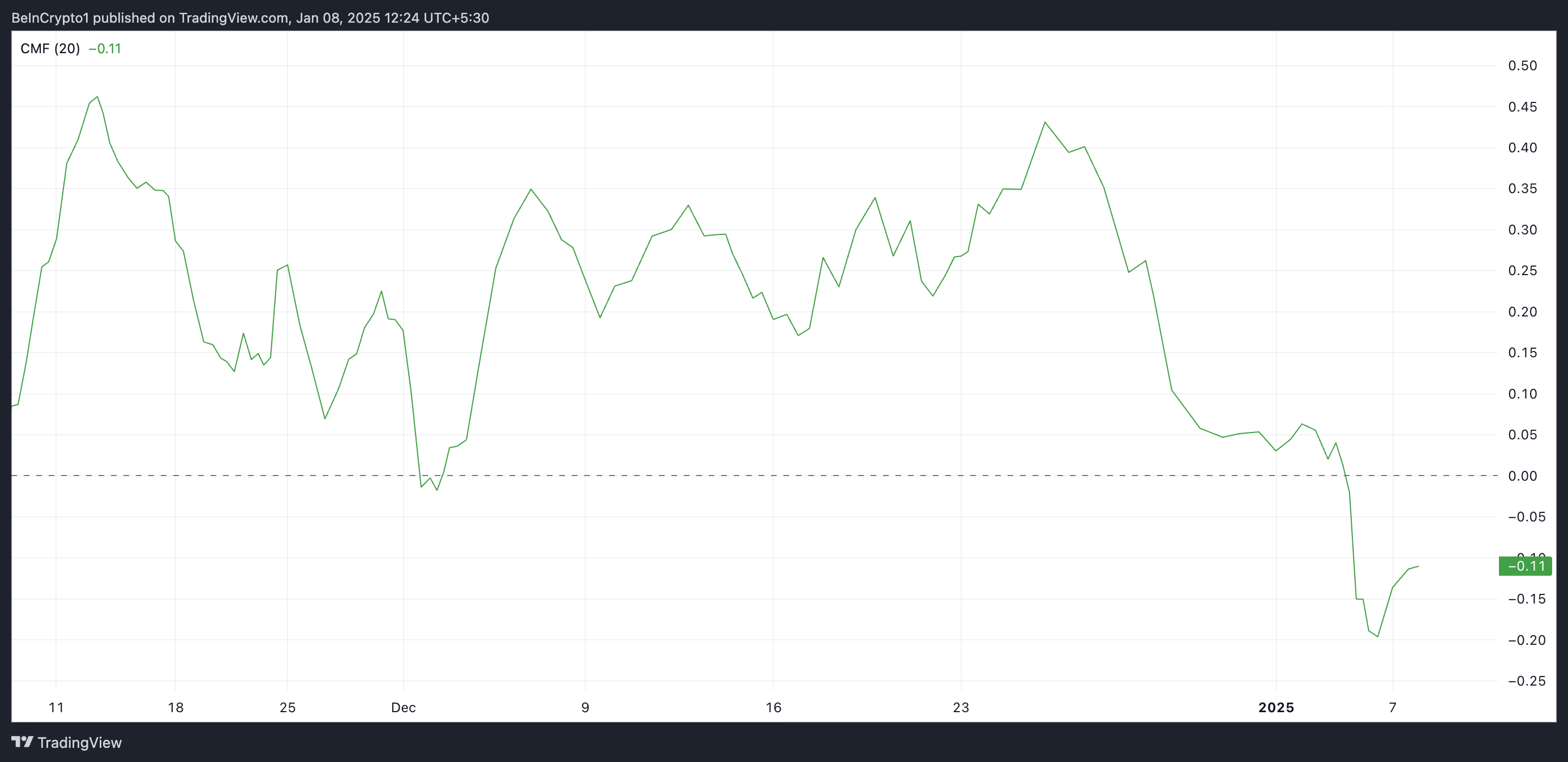

Further, BGB’s Chaikin Money Flow (CMF), which measures the flow of money into and out of the market, is below the zero line, confirming this bearish outlook. At press time, this is at -0.11.

When an asset’s CMF is negative, it indicates that selling pressure dominates, with more trading volume associated with price declines than price gains. This signals a bearish sentiment, suggesting weakness in the Bitget token price rally and an imminent reversal in the uptrend.

BGB Price Prediction: The Case for a New All-Time High

At press time, BGB trades at $6.44. If bearish pressure intensifies, it will shed its current gains and further its decline.

According to its Fibonacci Retracement tool, its next major support lies at $4.42, which may be tested as selling pressure strengthens.

On the other hand, a resurgence in buying activity could propel the Bitget token price toward its all-time high of $8.50 and above.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10