Plexus Corp. (NASDAQ:PLXS) reported worse-than-expected first-quarter sales results and issued second-quarter revenue guidance below estimates, after the closing bell on Wednesday.

Plexus reported quarterly earnings of $1.73 per share which beat the analyst consensus estimate of $1.59 per share. The company reported quarterly sales of $976.000 million which missed the analyst consensus estimate of $982.220 million.

Plexus said it sees second-quarter adjusted earnings of $1.46 to $1.61 per share, versus market estimates of $1.59 per share. The company projects revenue of $960 million to $1.00 billion, versus expectations of $1.015 billion.

Todd Kelsey, President and Chief Executive Officer, commented, “Our team’s agility and responsiveness enabled strong operating performance in the fiscal first quarter, resulting in robust financial results to begin fiscal 2025. We delivered fiscal first quarter revenue of $976 million, in-line with expectations, and non-GAAP operating margin of 6.0%, near the high end of our guidance and consistent with our long-term goal. This contributed to non-GAAP EPS of $1.73, which exceeded guidance. Furthermore, free cash flow generation surpassed expectations, benefiting from the ongoing efforts of our fiscal 2024 initiatives to drive sustained improvement in working capital efficiency.”

Plexus shares fell 10.1% to close at $153.30 on Thursday.

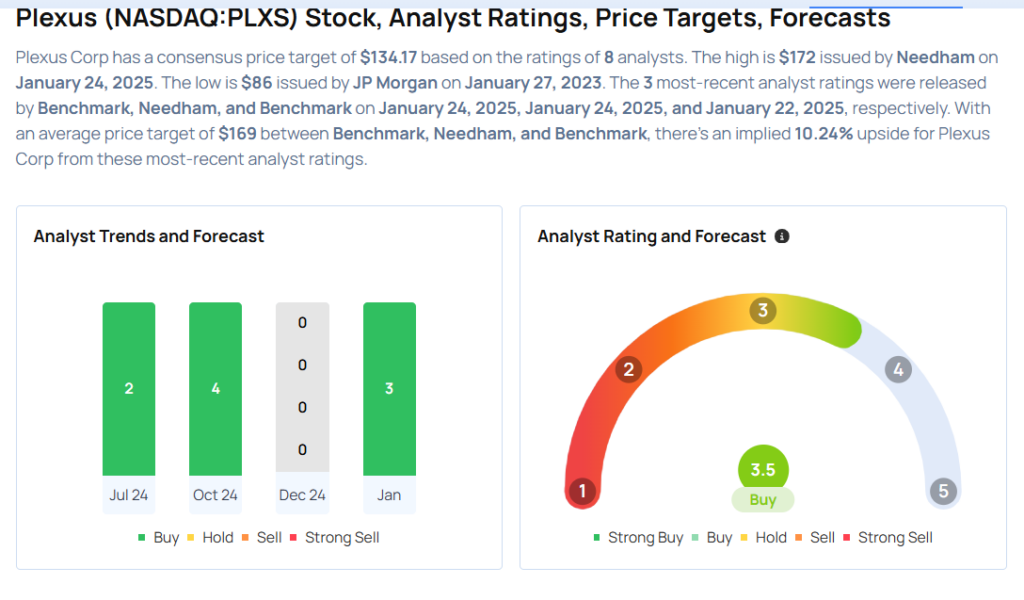

These analysts made changes to their price targets on Plexus following earnings announcement.

- Needham analyst James Ricchiuti maintained Plexus with a Buy and raised the price target from $162 to $172.

- Benchmark analyst David Williams maintained the stock with a Buy and lifted the price target from $165 to $170.

Considering buying PLXS stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says This Tech Stock Is Speculative But He Likes It