Modern Innovative Digital Technology Plus 2 Compelling Penny Stocks To Watch

Global markets have recently experienced volatility, with U.S. stocks ending mostly lower amid concerns over AI competition and mixed corporate earnings results. Despite these fluctuations, certain investment opportunities remain attractive, particularly in the realm of penny stocks. Although the term "penny stocks" might seem outdated, it still refers to smaller or newer companies that can offer significant growth potential at a lower price point. By identifying those with strong balance sheets and solid fundamentals, investors can uncover hidden gems that stand out as promising opportunities in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.64B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.69 | HK$43.08B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR417.12M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.10 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$143.12M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.94 | £448.27M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.75 | £178.85M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.40 | £83.91M | ★★★★☆☆ |

Click here to see the full list of 5,717 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Modern Innovative Digital Technology (SEHK:2322)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Modern Innovative Digital Technology Company Limited operates as an investment holding company involved in trading, money lending and factoring, finance leasing, and financial services in the People’s Republic of China and Hong Kong, with a market capitalization of approximately HK$2.88 billion.

Operations: The company's revenue is primarily derived from trading (HK$60.02 million), followed by money lending and factoring (HK$16.18 million), finance leasing (HK$10.57 million), and financial services (HK$5.82 million).

Market Cap: HK$2.88B

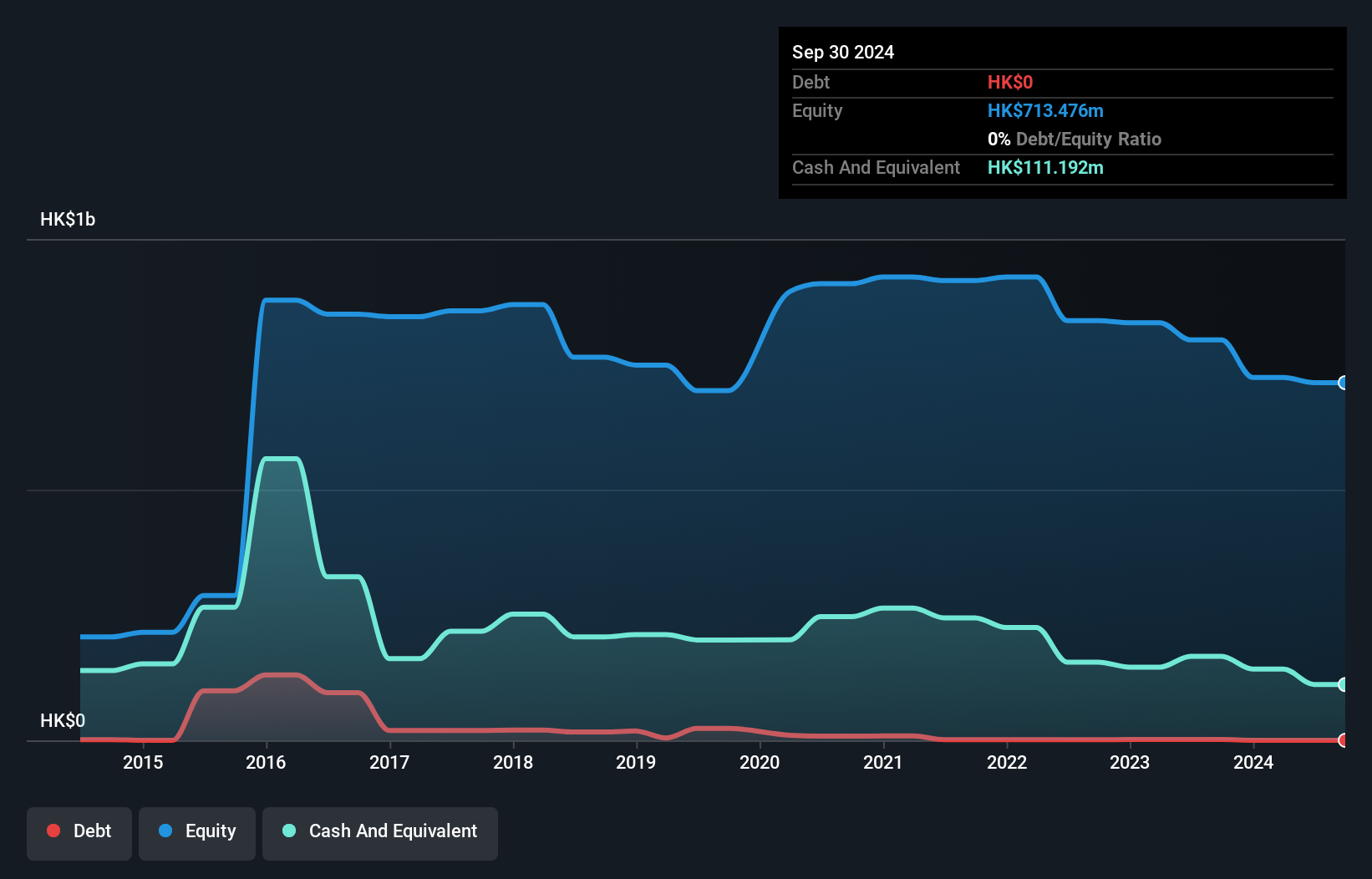

Modern Innovative Digital Technology Company Limited, with a market cap of HK$2.88 billion, primarily generates revenue from trading (HK$60.02 million) and has recently been unprofitable, reporting a net loss of HK$30.68 million for the half year ended September 2024. Despite having no debt and short-term assets exceeding liabilities significantly, its negative return on equity (-17.19%) and declining earnings highlight financial challenges. The company withdrew a follow-on equity offering of HKD 560 million in January 2025 after filing it in December 2024, indicating potential capital raising difficulties amid management changes with new board appointments last December.

- Unlock comprehensive insights into our analysis of Modern Innovative Digital Technology stock in this financial health report.

- Gain insights into Modern Innovative Digital Technology's past trends and performance with our report on the company's historical track record.

Lee's Pharmaceutical Holdings (SEHK:950)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lee's Pharmaceutical Holdings Limited is an investment holding company that develops, manufactures, markets, and sells pharmaceutical products primarily in the People's Republic of China, with a market cap of HK$724.27 million.

Operations: The company's revenue is derived from Licensed-In Products, generating HK$483.06 million, and Proprietary and Generic Products, contributing HK$716.01 million.

Market Cap: HK$724.27M

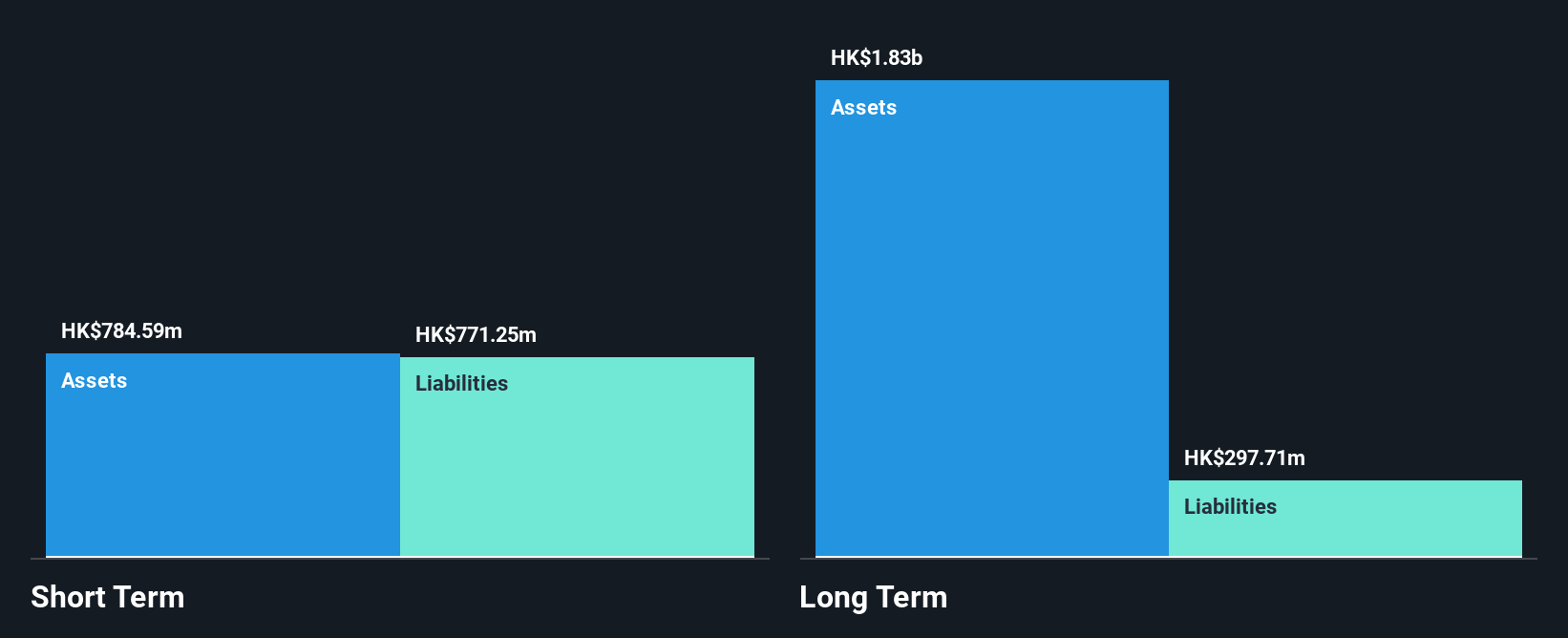

Lee's Pharmaceutical Holdings, with a market cap of HK$724.27 million, shows financial resilience in the pharmaceutical sector. The company generates substantial revenue from Licensed-In Products (HK$483.06 million) and Proprietary and Generic Products (HK$716.01 million). Its short-term assets (HK$696.8M) cover both short-term liabilities (HK$632.6M) and long-term liabilities (HK$288.8M), reflecting solid liquidity management. Despite a low Return on Equity of 3.3%, earnings growth has been robust at 61.9% over the past year, surpassing industry averages, while debt is well-managed with interest payments covered by EBIT at 6.5 times coverage ratio and operating cash flow covering debt effectively at 56%.

- Get an in-depth perspective on Lee's Pharmaceutical Holdings' performance by reading our balance sheet health report here.

- Gain insights into Lee's Pharmaceutical Holdings' historical outcomes by reviewing our past performance report.

Roctec Global (SET:ROCTEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Roctec Global Public Company Limited, with a market cap of THB8.28 billion, operates in the advertising sector across Thailand, Hong Kong, and Vietnam through its subsidiaries.

Operations: The company generates revenue from advertising, amounting to THB437 million, and system installation services, totaling THB2.46 billion.

Market Cap: THB8.28B

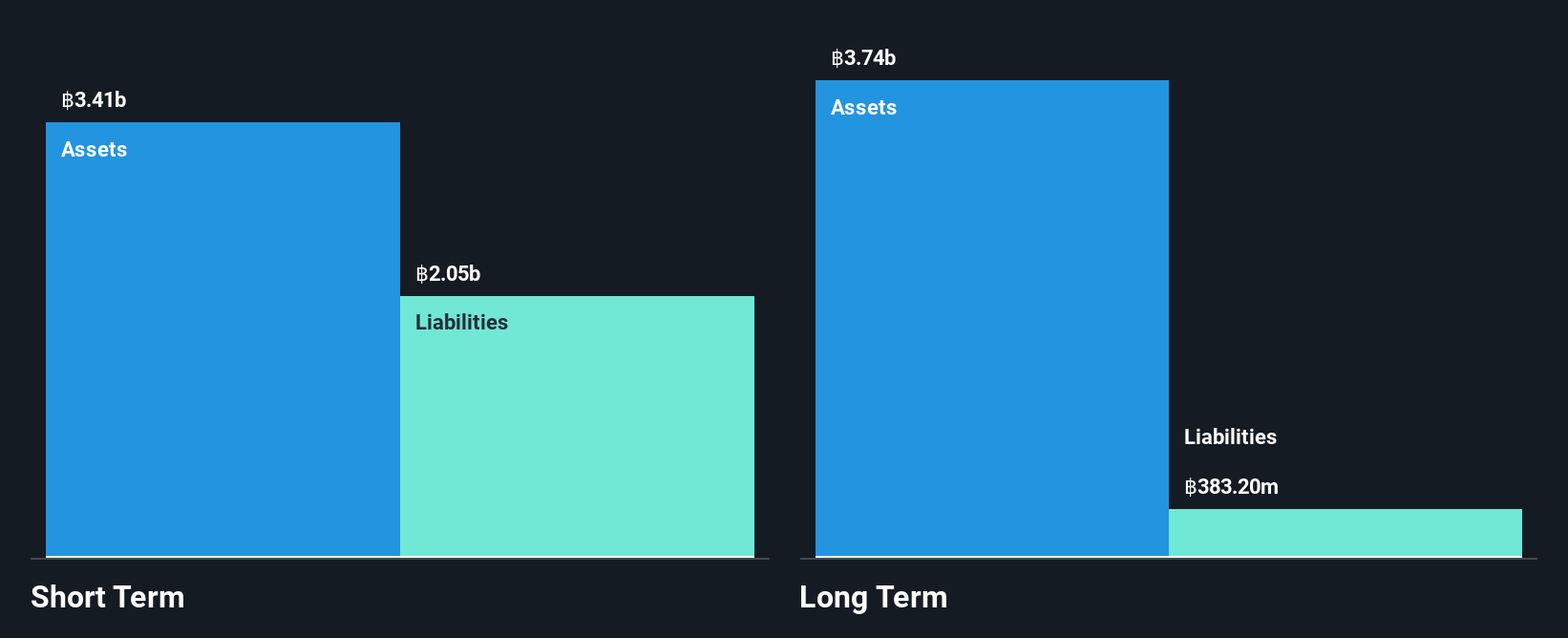

Roctec Global, with a market cap of THB8.28 billion, operates debt-free and demonstrates strong financial management, as its short-term assets of THB2.9 billion exceed both short-term liabilities (THB1.9 billion) and long-term liabilities (THB393 million). The company has shown impressive earnings growth of 77% over the past year, outpacing the media industry's growth rate. Despite experiencing high share price volatility recently, Roctec's profit margins have improved from 6% to 10%. Trading at a discount to estimated fair value and with no shareholder dilution in the past year, it offers potential appeal for investors seeking undervalued opportunities in the advertising sector across Thailand, Hong Kong, and Vietnam.

- Navigate through the intricacies of Roctec Global with our comprehensive balance sheet health report here.

- Assess Roctec Global's previous results with our detailed historical performance reports.

Seize The Opportunity

- Take a closer look at our Penny Stocks list of 5,717 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10