PPG Industries Analysts Cut Their Forecasts Following Weak Q4 Earnings

PPG Industries, Inc. (NYSE:PPG) reported worse-than-expected fourth-quarter adjusted EPS results and issued FY25 adjusted EPS guidance below estimates, after the closing bell on Thursday.

PPG reported quarterly earnings of $1.61 per share which missed the analyst consensus estimate of $1.65 per share.

Tim Knavish, PPG chairman and chief executive officer, commented on the year and quarter said, "Throughout 2024, we demonstrated resilience in a challenging macro environment by growing our adjusted EPS by 6%, improving aggregate segment margins and generating $1.4 billion in operating cash flow which we returned to shareholders. During the quarter, we repurchased approximately $250 million of stock, and about $750 million for the full year, which represented approximately 3% of our outstanding shares. Combined with our dividend, we have returned $1.4 billion to our shareholders throughout the year."

PPG said it sees adjusted EPS for FY25 will be in the range of $7.75-$8.05, versus market estimates of $8.68.

PPG shares fell 2.9% to trade at $112.07 on Monday.

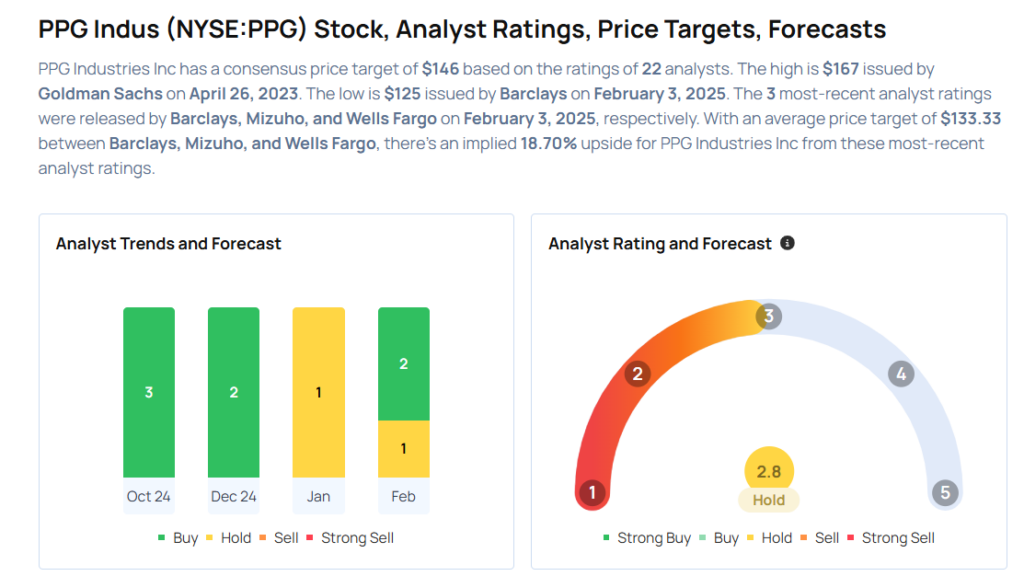

These analysts made changes to their price targets on PPG following earnings announcement.

- Wells Fargo analyst Michael Sison maintained PPG with an Overweight rating and lowered the price target from $150 to $135.

- Mizuho analyst John Roberts maintained the stock with an Outperform and lowered the price target from $150 to $140.

- Barclays analyst Michael Leithead maintained PPG with an Equal-Weight and cut the price target from $144 to $125.

Considering buying PPG stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Energy Stocks Delivering High-Dividend Yields

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10