Onyxcoin (XCN) Targets Three-Year Peak as It Leads Market Gains

- XCN jumps 22%, fueled by its resolution with HTX and Justin Sun, making it the top market gainer.

- RSI at 64.78 signals strong buying pressure, indicating further upside potential unless overbought conditions emerge.

- XCN targets $0.049, but profit-taking could push it down to $0.021 if momentum weakens.

Onyxcoin (XCN) has surged 22% in the past 24 hours, making it the top-performing asset in the crypto market. The rally began last week and gained momentum following an announcement that the project had resolved its issue with Huobi and Tron founder Justin Sun.

XCN is now eyeing its three-year high of $0.04, with technical indicators signaling strong upside potential.

Onyxcoin Sees New Gains

Besides the broader market rally, XCN’s price surge is largely fueled by the recent announcement that the Onyx DAO has successfully resolved a longstanding issue with HTX Global and Justin Sun. Trading at $0.03 at press time, XCN’s price has since climbed by 76% as demand strengthens.

Its Relative Strength Index (RSI), assessed on a one-day chart, confirms this growing demand. At press time, the key momentum indicator is in an upward trend at 64.78.

This indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Conversely, values below 30 suggest that the asset is oversold and may witness a rebound.

At 64.78, XCN’s RSI suggests that the asset is in a strong bullish phase, with increasing buying pressure. As the RSI continues to rise, XCN’s demand is growing, and the upward momentum may continue unless it approaches overbought levels.

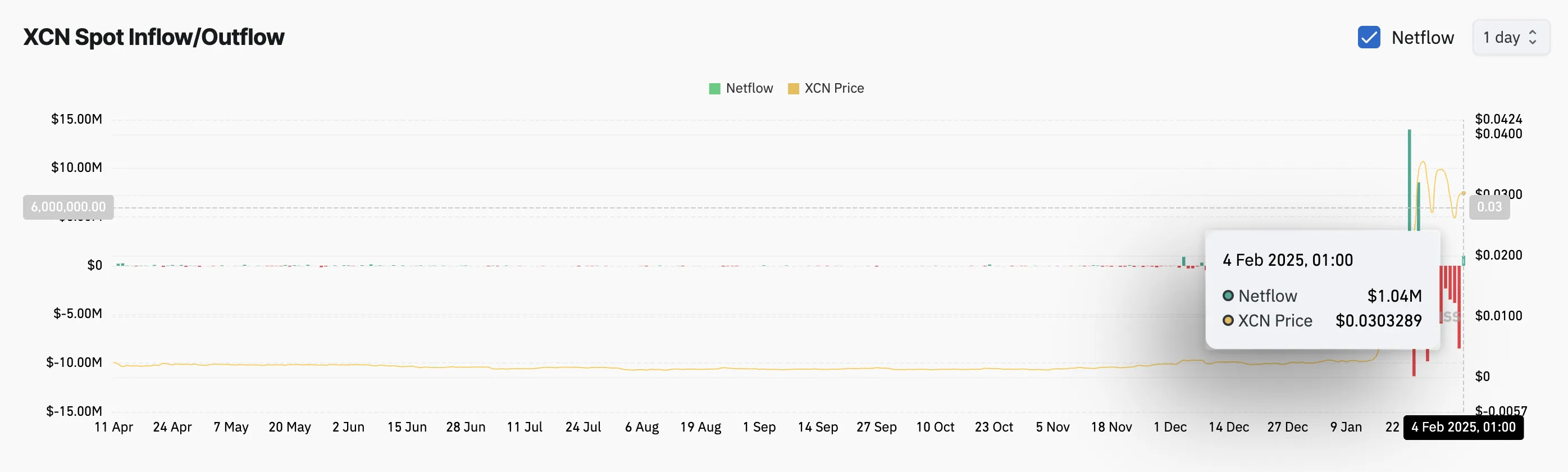

Notably, XCN has recorded spot inflows for the first time since January 27. According to Coinglass, this currently stands at $1.04 million, reflecting the buying activity in the market.

When an asset records spot inflows, more traders buy it directly on exchanges rather than through derivatives, signaling strong demand. This increased buying pressure typically drives prices higher as more investors accumulate the asset.

XCN Price Prediction: Aiming for $0.04 or Facing Reversal?

The daily chart shows XCN trades just below the resistance at $0.038. If buying momentum strengthens, it could break above this price level.

A successful breach of the resistance could propel XCN to $0.049, a three-year high that it recently revisited on January 26.

However, if market participants resume profit-taking, this bullish thesis will be invalidated. In that scenario, XCN’s value could drop to $0.021.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10