These Analysts Cut Their Forecasts On Qualys After Q4 Results

Qualys, Inc. (NASDAQ:QLYS) reported upbeat earnings for its fourth quarter on Thursday.

The company posted quarterly earnings of $1.60 per share which beat the analyst consensus estimate of $1.35 per share. The company reported quarterly sales of $159.191 million which beat the analyst consensus estimate of $156.192 million.

“Customers are starting to leverage the breadth and depth of the Qualys Enterprise TruRisk Platform as they look to rearchitect and transform their security stacks,” said Sumedh Thakar, Qualys’ president and CEO. “Our results this quarter demonstrate the rapid pace of innovation at Qualys and reflect the growing success of newer product initiatives, including Cybersecurity Asset Management, Patch Management, and TotalCloud. With our natively integrated platform and frictionless approach to quantifying, prioritizing, articulating, and remediating cyber risk, we believe we’ll continue to perform well against our competitors, extend our leadership, and provide a runway for long-term sustainable growth.”

Qualus said it sees FY25 adjusted earnings of $5.50 to $5.90 per share, and revenue of $645 million to $657 million.

Qualys shares fell 3.4% to trade at $136.00 on Friday.

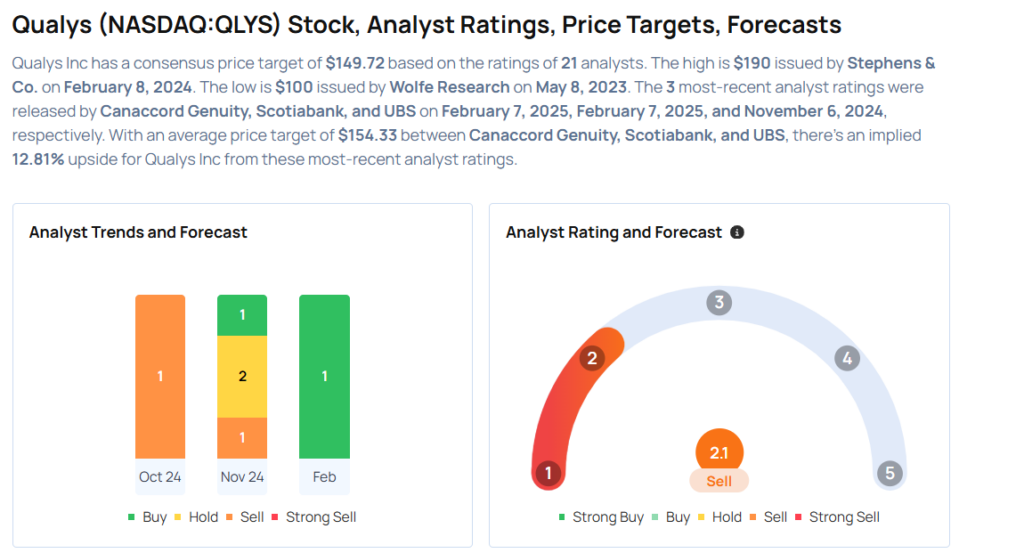

These analysts made changes to their price targets on Qualys following earnings announcement.

- Scotiabank analyst Patrick Colville maintained Qualys with a Sector Perform and lowered the price target from $150 to $140.

- Canaccord Genuity analyst Michael Walkley maintained the stock with a Buy and cut the price target from $170 to $163.

Considering buying QLYS stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From McDonald’s Stock Ahead Of Q4 Earnings

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10