Would Coolpoint Innonism Holding (HKG:8040) Be Better Off With Less Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Coolpoint Innonism Holding Limited (HKG:8040) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Coolpoint Innonism Holding

What Is Coolpoint Innonism Holding's Net Debt?

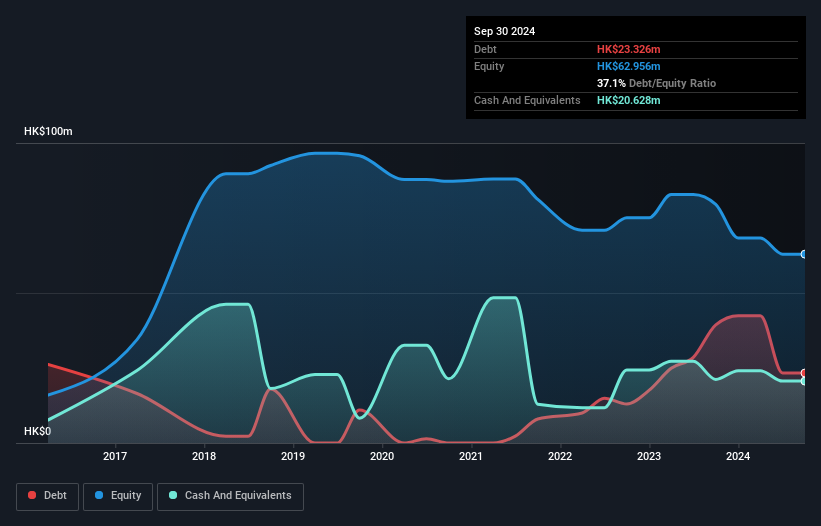

You can click the graphic below for the historical numbers, but it shows that Coolpoint Innonism Holding had HK$23.3m of debt in September 2024, down from HK$39.4m, one year before. However, it also had HK$20.6m in cash, and so its net debt is HK$2.70m.

How Healthy Is Coolpoint Innonism Holding's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Coolpoint Innonism Holding had liabilities of HK$64.7m due within 12 months and liabilities of HK$15.1m due beyond that. Offsetting this, it had HK$20.6m in cash and HK$111.7m in receivables that were due within 12 months. So it actually has HK$52.5m more liquid assets than total liabilities.

This surplus strongly suggests that Coolpoint Innonism Holding has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Coolpoint Innonism Holding will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Coolpoint Innonism Holding wasn't profitable at an EBIT level, but managed to grow its revenue by 18%, to HK$365m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Over the last twelve months Coolpoint Innonism Holding produced an earnings before interest and tax (EBIT) loss. Indeed, it lost HK$13m at the EBIT level. On a more positive note, the company does have liquid assets, so it has a bit of time to improve its operations before the debt becomes an acute problem. But we'd be more likely to spend time trying to understand the stock if the company made a profit. So it seems too risky for our taste. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Coolpoint Innonism Holding (of which 2 don't sit too well with us!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10