Quantum-Si (NasdaqGM:QSI) Sees 31% Price Surge As Scientific Advisory Board Announced

Quantum-Si (NasdaqGM:QSI) recently achieved a 31% price increase over the last quarter, possibly reflecting several strategic initiatives announced during this period. Key events included the announcement of Quantum-Si's upcoming presentation at the Advances in Genome Biology and Technology meeting, which is set to spotlight their Next-Generation Protein Sequencing (NGPS) technology. Furthermore, the establishment of a Scientific Advisory Board featuring prominent experts like Dr. Gloria M. Sheynkman is expected to bolster the company's scientific direction. The launch of new products, such as the Platinum Pro benchtop sequencer, aligns with a market that, although currently mixed, had seen substantial growth over the past year. While broader indices like the S&P 500 experienced short-term declines, Quantum-Si's advancements could resonate positively with investors looking for innovation in the protein sequencing domain. The company's international expansion efforts and follow-on equity offering underscored its growth-oriented strategy amid fluctuating market conditions.

Click here and access our complete analysis report to understand the dynamics of Quantum-Si.

Over the last year, Quantum-Si's total return, including share price and dividends, saw a 14.37% decline. During the same period, the company outperformed the US Life Sciences industry, which experienced a 15.6% decline, though it underperformed the US Market's 16.7% gain. Several factors may have influenced this performance. In December, the company introduced the Platinum Library Prep Kit, V2, reducing hands-on time and enhancing protein sequencing capabilities. This followed their integration with Liberate Bio in September, highlighting potential applications in gene therapy.

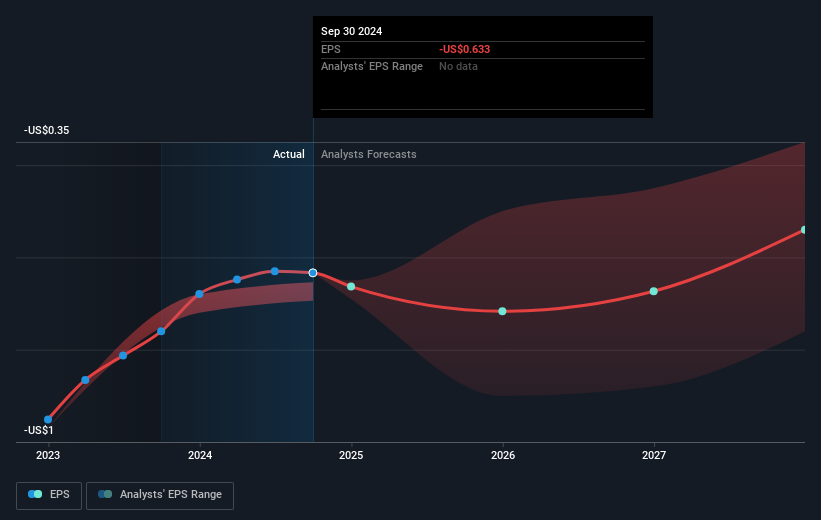

However, despite advancements, Quantum-Si's financial challenges, upon announcing a significant annual net loss for 2023 and low revenues, have likely weighed on its stock performance. The company also announced a US$50 million follow-on equity offering in January 2025, which might have diluted share value. Additionally, a Nasdaq compliance notice in November regarding bid price requirements added potential risks. Collectively, these elements contribute to understanding the company's share performance over the last year.

- Discover whether Quantum-Si is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Understand the uncertainties surrounding Quantum-Si's market positioning with our detailed risk analysis report.

- Are you invested in Quantum-Si already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum-Si might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10