Airbnb (NasdaqGS:ABNB) Sees 6% Price Move As Q4 Earnings Hit US$2 Billion

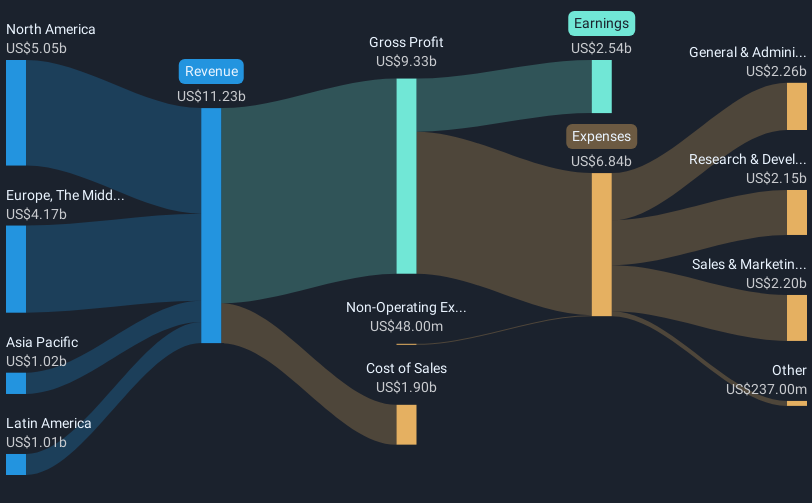

Airbnb (NasdaqGS:ABNB) experienced a 6% increase in share price over the last month, a period that coincided with the company's significant financial announcements. Airbnb's Q4 2024 earnings exceeded previous performance, showing sales of $2.48 billion and net income of $461 million, marking a turnaround from the previous year's losses. Meanwhile, its buyback program reduced outstanding shares by nearly 1%. These actions likely contributed to boosting investor confidence, supporting the share price movement. Concurrently, Airbnb issued positive guidance for Q1 2025, further enhancing investor sentiment. This uptick in share price occurred despite broader market volatility, where major indexes like the Nasdaq fell by 5.5% in February. Meanwhile, easing inflation concerns and a nearly stable S&P 500 provided a mixed backdrop. Overall, the company's internal achievements and strategic financial maneuvers seemed to outweigh broader market challenges, positively impacting its stock trajectory during the month.

Click here and access our complete analysis report to understand the dynamics of Airbnb.

Over the past three years, Airbnb's total shareholder return, inclusive of share price and dividends, was a decline of 8.07%. This performance contrasts with the 13.9% return of the US Hospitality industry over the past year. Significant events over this period include substantial insider selling in recent months, which often signals reduced confidence from within the company. Furthermore, while Airbnb has achieved high-quality earnings, the company's net profit margins have decreased, with recent figures at 23.9%, down from 48.3% the previous year. This decline might reflect increased operational costs or pricing pressures.

Despite repurchasing a total of 19.8 million shares (3.11%), amounting to US$2.68 billion, to enhance shareholder value, Airbnb's stock remains under pressure when compared to its industry peers, being more expensive on a Price-To-Earnings basis. These factors combined may have weighed heavily on the company's total returns over the long term.

- Learn how Airbnb's intrinsic value compares to its market price with our detailed valuation report.

- Explore the potential challenges for Airbnb in our thorough risk analysis report.

- Already own Airbnb? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10