Undiscovered Gems in Asia for March 2025

In the midst of global market turbulence characterized by trade policy uncertainties and fluctuating economic indicators, Asia's markets have shown resilience, with China's recent economic targets and stimulus measures providing a beacon of stability. As investors navigate these complex conditions, identifying stocks that demonstrate strong fundamentals and potential for growth becomes crucial in uncovering undiscovered gems within the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ad-Sol Nissin | NA | 7.54% | 9.63% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| Bonny Worldwide | 37.80% | 14.20% | 37.87% | ★★★★★★ |

| NPR-Riken | 13.68% | 17.25% | 53.40% | ★★★★★☆ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

Click here to see the full list of 2593 stocks from our Asian Undiscovered Gems With Strong Fundamentals screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Johnson Electric Holdings (SEHK:179)

Simply Wall St Value Rating: ★★★★★★

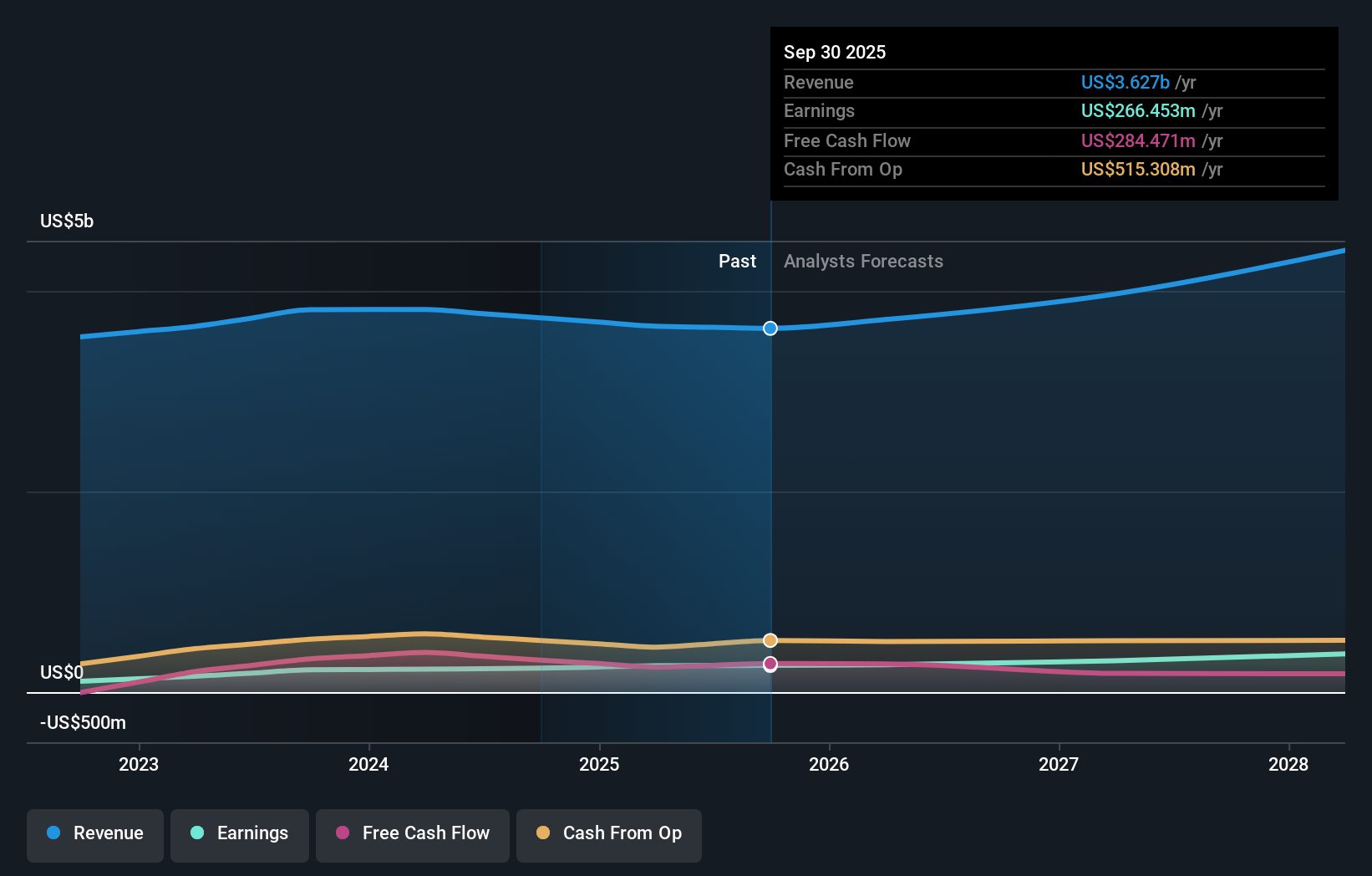

Overview: Johnson Electric Holdings Limited is an investment holding company that specializes in the manufacture and sale of motion systems globally, with a market capitalization of approximately HK$15.34 billion.

Operations: The company generates revenue primarily from the Auto Parts & Accessories segment, which accounts for $3.73 billion.

Johnson Electric, a player in the auto components sector, has seen its earnings grow by 7.5% over the past year, outpacing the industry average of -19.9%. Despite this growth, sales for the nine months ending December 2024 were US$2.73 billion, down from US$2.87 billion in the previous year due to unfavorable exchange rates impacting results by US$11 million. The company is trading at a significant discount of 58.2% below estimated fair value and has reduced its debt-to-equity ratio from 19.4% to 13.3% over five years, suggesting prudent financial management amidst challenging market conditions.

- Take a closer look at Johnson Electric Holdings' potential here in our health report.

Gain insights into Johnson Electric Holdings' past trends and performance with our Past report.

Zhewen Interactive Group (SHSE:600986)

Simply Wall St Value Rating: ★★★★☆☆

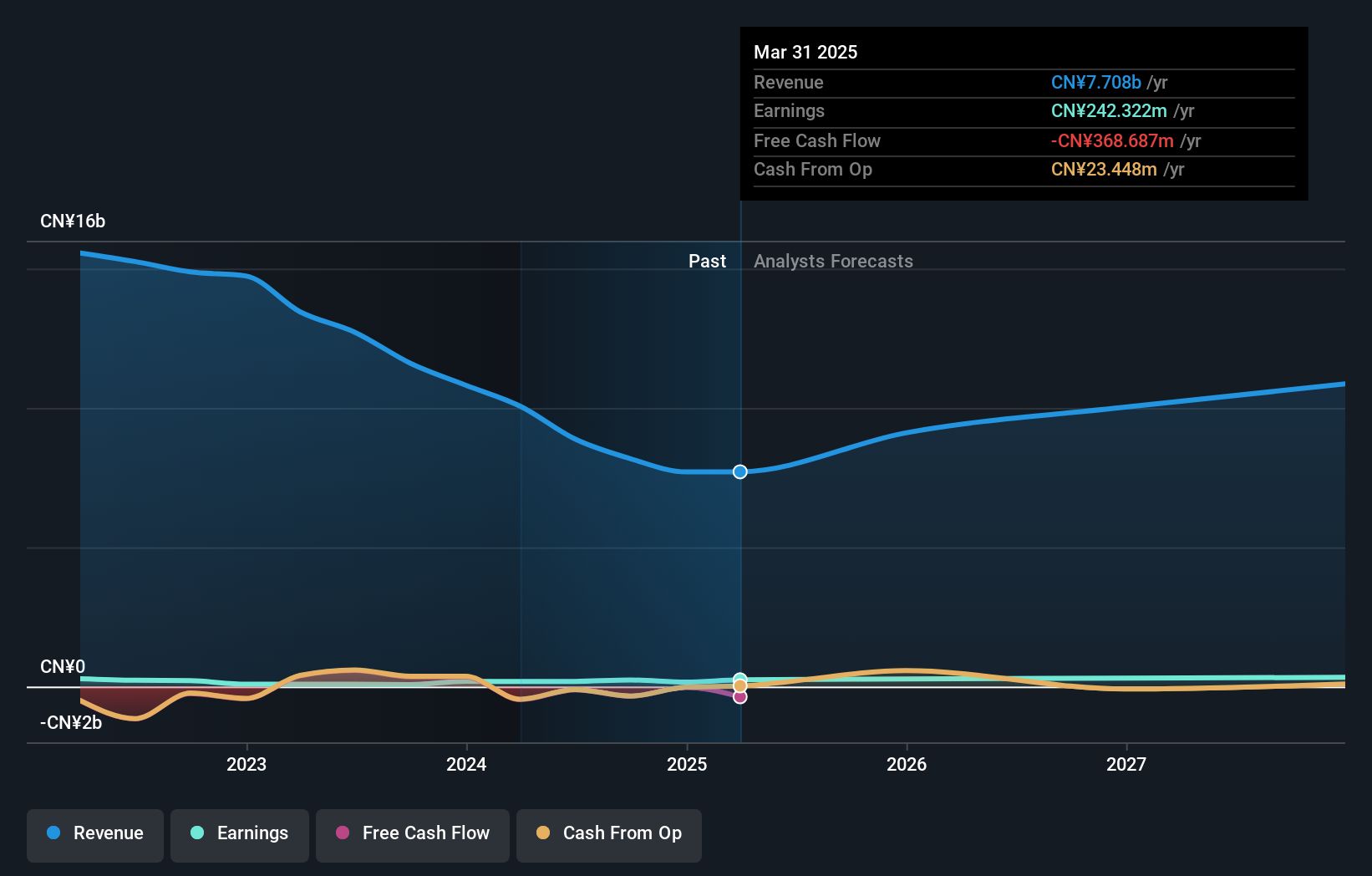

Overview: Zhewen Interactive Group Co., Ltd. offers intelligent marketing solutions in China with a market cap of approximately CN¥14.45 billion.

Operations: The company's primary revenue stream is its Internet Division, generating CN¥8.18 billion. The business focuses on intelligent marketing solutions within this segment.

Zhewen Interactive Group, a smaller player in the media sector, has seen its earnings surge by 233% over the past year, notably outpacing the industry average of -10%. This impressive growth seems partly influenced by a one-off gain of CN¥176M. Despite this boost, the company's debt to equity ratio increased from 12.5% to 23.1% over five years, though its net debt to equity remains satisfactory at 4.8%. While free cash flow is negative, interest coverage isn't an issue as profits comfortably cover payments. Earnings are projected to grow annually by around 21%, indicating potential for future expansion.

- Get an in-depth perspective on Zhewen Interactive Group's performance by reading our health report here.

Evaluate Zhewen Interactive Group's historical performance by accessing our past performance report.

Hengong Precision Equipment (SZSE:301261)

Simply Wall St Value Rating: ★★★★☆☆

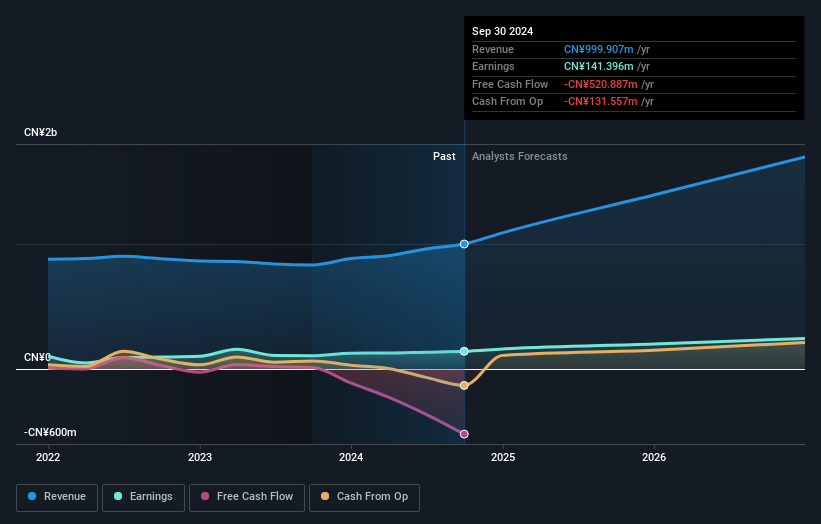

Overview: Hengong Precision Equipment Co., Ltd. specializes in the research, development, production, processing, and sales services of new fluid technology materials both in China and internationally with a market cap of CN¥7.29 billion.

Operations: Hengong Precision Equipment generates revenue primarily through the sales of new fluid technology materials. The company's cost structure includes expenses related to research and development, production, and processing activities. Gross profit margin trends provide insights into its operational efficiency over time.

Hengong Precision Equipment, a small player in the industry, has shown impressive earnings growth of 32.3% over the past year, outpacing its sector's -0.2% performance. Despite a rise in its debt to equity ratio from 30.5% to 70.5% over five years, the net debt to equity remains satisfactory at 11.6%. The company is forecasted for annual earnings growth of 23.72%, though free cash flow is not positive currently due to significant capital expenditures like US$389 million recently recorded, which likely impacts financial flexibility and could be an area of concern moving forward.

- Navigate through the intricacies of Hengong Precision Equipment with our comprehensive health report here.

Learn about Hengong Precision Equipment's historical performance.

Where To Now?

- Click here to access our complete index of 2593 Asian Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Johnson Electric Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10