With the influx of funds and the record-breaking 11.4 million contracts, is the hype wave on the Base chain coming?

Recently, Base, the Ethereum Layer 2 network incubated by Coinbase, has been attracting market attention with rapid momentum. With the continuous influx of funds and users, the ecological activity has increased significantly, and the transaction volume and total locked value (TVL) have been rising steadily, which vaguely reveals the signs of a "big event" coming soon. Industry insiders call it "Base Season", and this wave of enthusiasm may become the highlight of the crypto market in 2025. This article will start with the latest data, analyze the logic behind Base's growth, explore why funds are flocking in, and recommend several investment directions worthy of attention, providing investors with forward-looking insights.

The picture of growth painted by the data

Base’s recent performance can be described as “explosive growth”, and multiple key indicators point to its potential for “big events”.

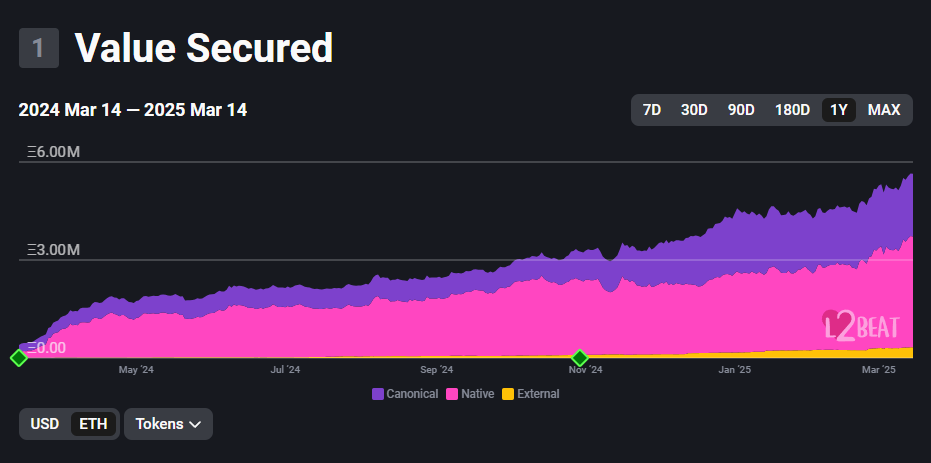

- The rapid growth of TVL: Base's total locked value (TVL) has surged from $518 million at the beginning of 2024 to more than $4 billion today, surpassing Arbitrum and Optimism to become the leader in the Layer 2 field. This shows that funds are flowing in at an accelerated pace, and Base's ecological attractiveness has increased significantly.

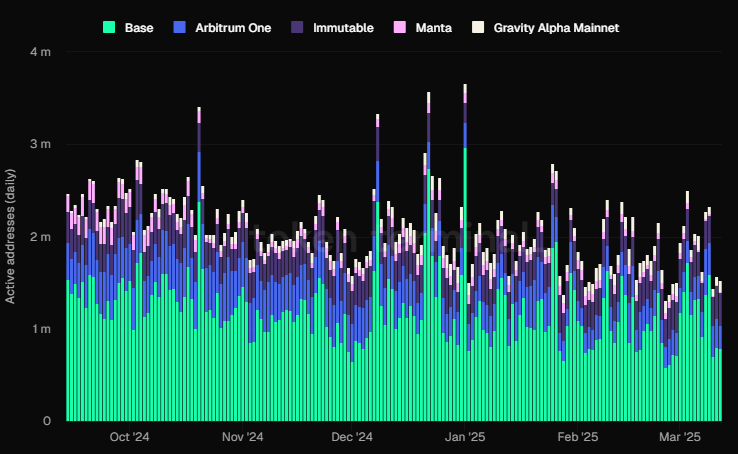

- Active addresses: Base has consistently ranked first in the number of daily active addresses in L2, with a recent average of 796,000 daily active addresses, far exceeding Arbitrum One (243,500), Immutable (121,500), and other networks such as Manta and Gravity Alpha Mainnet (about 10,000 each). The total number of active addresses has exceeded 1.5 million, showing a rapid increase in user participation, especially in recent peak periods, when the number of addresses has exceeded 3.5 million several times, highlighting the vigorous vitality of the Base ecosystem.

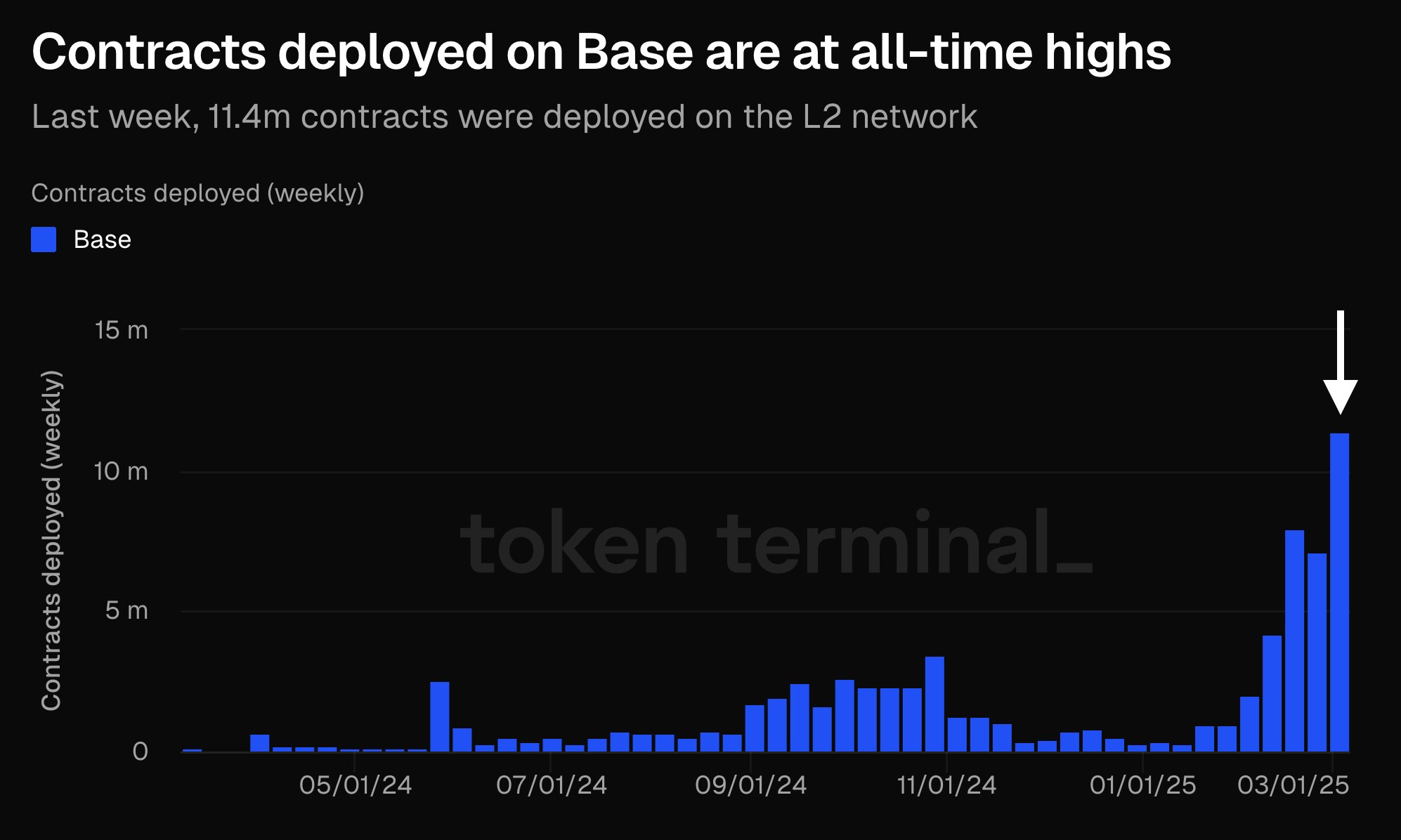

- Contract deployment sets a record: On March 14, 2025, Token Terminal disclosed data on the X platform.

- It is said that the Base network deployed 11.4 million contracts last week, setting a record high. This figure shows that developers favor the Base technology stack, and the diversity and innovation capabilities of the ecosystem are rapidly improving.

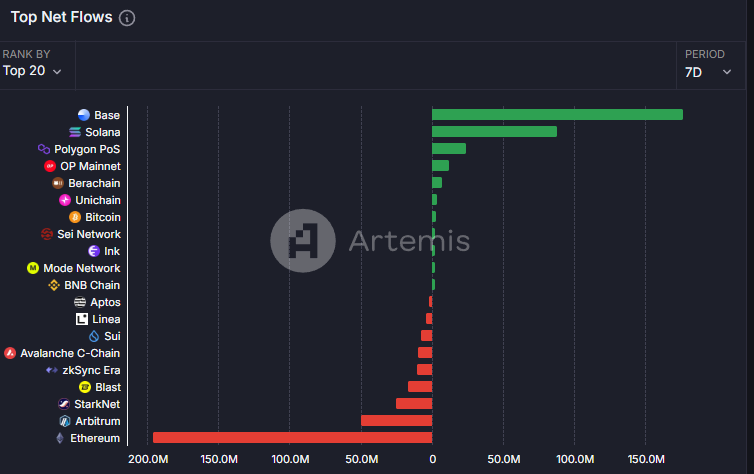

- Astonishing speed of capital inflow: According to the latest data provided by Artemis, in the ranking of net capital inflows (Net Flows) in the past 7 days, Base ranked first with a net inflow of more than 20 billion US dollars, far exceeding the second place Solana (about 15 billion US dollars) and other networks such as Polygon, OP Mainnet and Berachain.

Behind these data, Base's meme coin craze and the prosperity of the DeFi ecosystem have contributed greatly. High activity not only attracts speculative capital, but also provides fertile ground for developers. However, the rapid growth of TVL may be mixed with speculative elements, and occasional network rollbacks under high transaction volume also remind people that Base's infrastructure still needs to be polished. Despite this, these signals together outline a picture that Base may usher in a major turning point, perhaps officially opening the curtain of Base Season in the second quarter of 2025.

Why does capital favor Base?

Base can attract so much funds, which is inseparable from the strategic support of Coinbase. As the first listed cryptocurrency exchange in the United States, Coinbase has given Base a strong brand effect and user base. Its cooperation with Stripe to introduce USDC support makes Base an ideal choice for low-cost cross-border payments, so traditional funds can easily enter the market. There are even market rumors that Base may be separated from Coinbase and issue independent tokens. This expectation has further ignited the enthusiasm of early users.

On the technical level, Base is built on Optimism's OP Stack. The recently launched Flashblocks technology shortens the block time to 200 milliseconds, and the transaction speed even exceeds Solana. The transaction fee as low as 1 cent compared with Solana's high cost and Ethereum's congestion has become the key to capital favor. In addition, the Base ecosystem covers popular fields such as DeFi, meme coins and SocialFi. Behind the surge in trading volume is the frenzy of speculative capital. Someone on X joked that the dealer may think Solana's cost is too high, and turn his attention to Base's low threshold and high return.

The macro environment also plays a role in fueling the trend. 2025 is the early stage of Trump's new term, and the uncertainty of his policies may prompt funds to flow into the crypto market for risk aversion. As Layer 2 led by Coinbase, Base has become the first choice due to its compliance and stability.

Investment opportunities worth noting

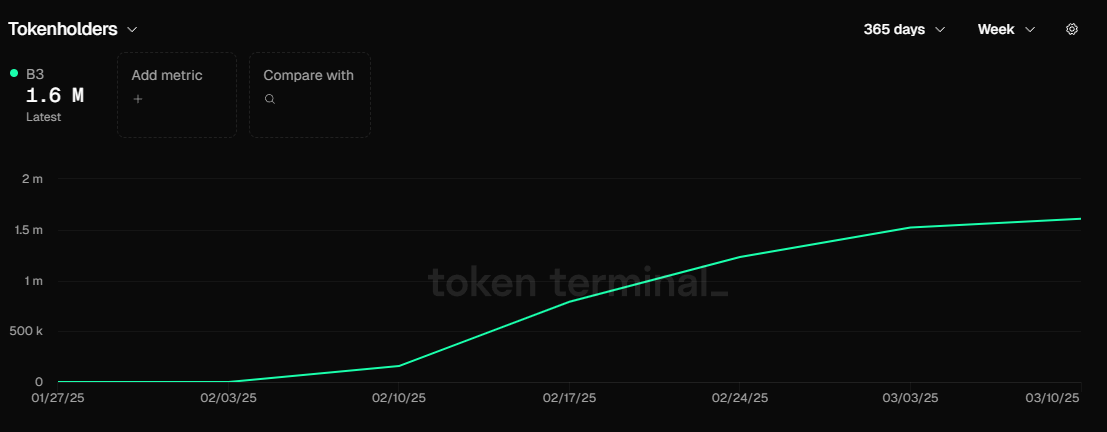

B3

In the wave of Base ecology, several projects stand out and are worthy of investors' attention. The first is $B3, which represents Base's Layer 3 ambitions and mainly serves the gaming field. After launching on Coinbase and Bybit in February 2025, the price of $B3 soared by 50%. Although the subsequent price fell due to the influence of the market, the number of coin holding addresses continued to grow steadily, showing the market's recognition of its prospects. The support of Flashblocks technology and the expansion of Layer 3 application chains may bring new growth space for gaming projects, although their success still depends on user acquisition and ecological integration.

CLANKER

Another highlight is CLANKER. This token launched by the AI-driven @Clanker tool has deployed about 4,700 tokens and its own market value has reached $113.8 million. Discussions on X believe that CLANKER is undervalued, especially in the rebound, and may usher in opportunities due to the expectation of Coinbase listing.

In addition, Aerodrome in the DeFi field should not be missed. As the largest decentralized exchange in Base, its TVL exceeds 1 billion US dollars, accounting for half of the value of ecological lock-up. Yield farming and liquidity incentive mechanisms have attracted the attention of institutions and retail investors. Despite the fierce competition in the DeFi track, its growth is still worth looking forward to.

Investment advice and summary

The arrival of Base Season stems from the explosive growth of TVL and transaction volume, the strategic support of Coinbase, and the resonance of technological innovation and the meme coin craze. The flow of funds from Solana and Bitcoin to Base reflects the market's recognition of its low cost and high potential. However, centralization risks, technical bottlenecks, and regulatory uncertainties remind investors to remain calm.

For investors, in the short term, you may want to pay attention to $CLANKER and $B3 to capture the speculative opportunities brought by meme coins and Layer 3. The key is to control positions to avoid losses caused by high volatility, while keeping up with Coinbase's official dynamics and grasping the market rhythm. Base's growth is not a smooth road, and its future depends on technological upgrades and the continued prosperity of the ecosystem. In this potential feast of wealth, the balance between data-driven insights and risk management may be the key to success.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10