Innovative Industrial Properties (NYSE:IIPR) Announces US$7.60 Annual Dividend and Preferred Payout

Innovative Industrial Properties (NYSE:IIPR) recently announced dividends for the first quarter of 2025 amounting to $1.90 per share for common stock and $0.5625 per share for preferred stock, highlighting its focus on providing returns to shareholders. However, during the past week, the company's share price fell by 6.25%. This decline in stock price is notable against the backdrop of a broader market recovery, as major indexes, including the Dow Jones, experienced gains after a prior sell-off. Despite positive movements elsewhere, IIPR's performance could be reflecting investor concerns unrelated to dividend distribution. While tech stocks like Nvidia and Palantir surged, aided by sector-specific rallies, IIPR did not share in this uptick. Broader economic uncertainties, including tariff implications and inflation fears, might also influence investor sentiment towards real estate investments like IIPR's, contrasting its stock performance against a market partially rebounding from recent declines.

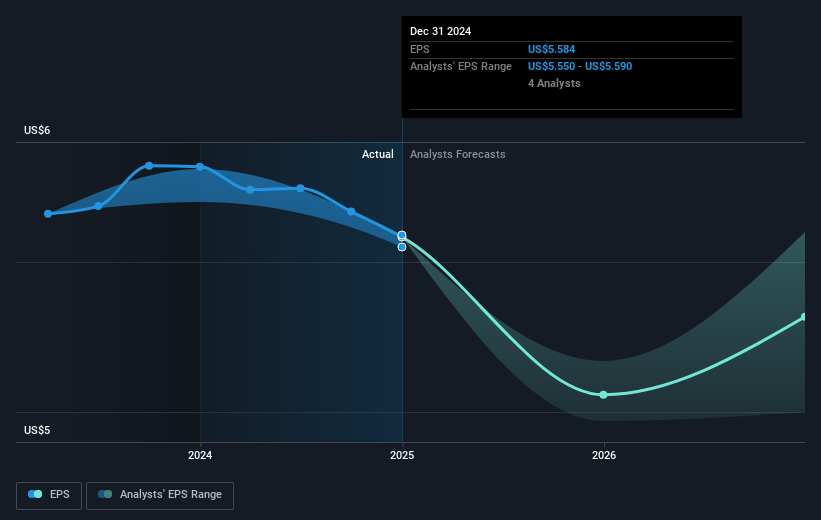

The analysis detailed in our Innovative Industrial Properties valuation report hints at an deflated share price compared to its estimated value.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Over the last five years, Innovative Industrial Properties achieved a total shareholder return of 77.55%. Significant events shaped this performance, beginning with strong profit growth averaging 26.1% annually during this period. The company’s business developments contributed positively, such as the expansion in June 2024 with acquisitions in Ocala, Florida, aimed at enhancing cannabis cultivation facilities. Concurrently, the declaration of regular dividends, like the recent US$1.90 per share, underscores a consistent effort to reward shareholders.

However, recent challenges, including the default by PharmaCann on rent obligations totaling US$4.2 million for six properties, indicate headwinds in maintaining momentum. Additionally, a class-action lawsuit filed in January 2025 against IIP may have affected investor perception, although the allegations are recent. Over the past year, IIPR has underperformed the US market, which saw a 6.6% gain, and the industrial REIT sector, which declined by 13.9%, suggesting sector-specific pressures influencing recent shareholder returns.

Hold shares in Innovative Industrial Properties? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10