Liu Chong Hing Investment (HKG:194) Will Pay A Dividend Of HK$0.17

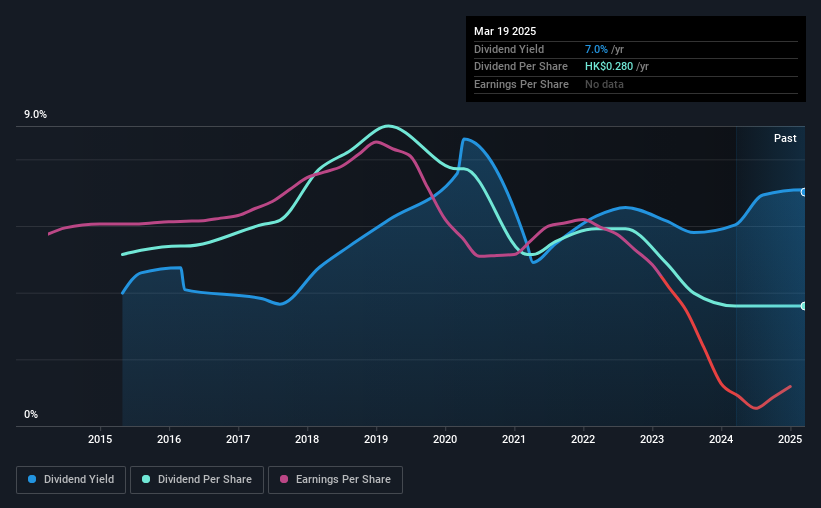

The board of Liu Chong Hing Investment Limited (HKG:194) has announced that it will pay a dividend of HK$0.17 per share on the 6th of June. This means that the annual payment will be 7.0% of the current stock price, which is in line with the average for the industry.

See our latest analysis for Liu Chong Hing Investment

Liu Chong Hing Investment Might Find It Hard To Continue The Dividend

Unless the payments are sustainable, the dividend yield doesn't mean too much. While Liu Chong Hing Investment is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS might fall by 66.6% based on recent performance. While this means that the company will be unprofitable, we generally believe cash flows are more important, and the current cash payout ratio is quite healthy, which gives us comfort.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was HK$0.40 in 2015, and the most recent fiscal year payment was HK$0.28. The dividend has shrunk at around 3.5% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings per share has been sinking by 67% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Liu Chong Hing Investment's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, Liu Chong Hing Investment has 2 warning signs (and 1 which is a bit concerning) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10