Online tool launched to help Singaporeans compare health insurance premiums, plans across providers

SINGAPORE: An online tool to help Singaporeans compare health insurance premiums and plans across different providers, and better understand the long-term MediSave and cash expenses necessary to support their coverage, was launched on Wednesday (Mar 26).

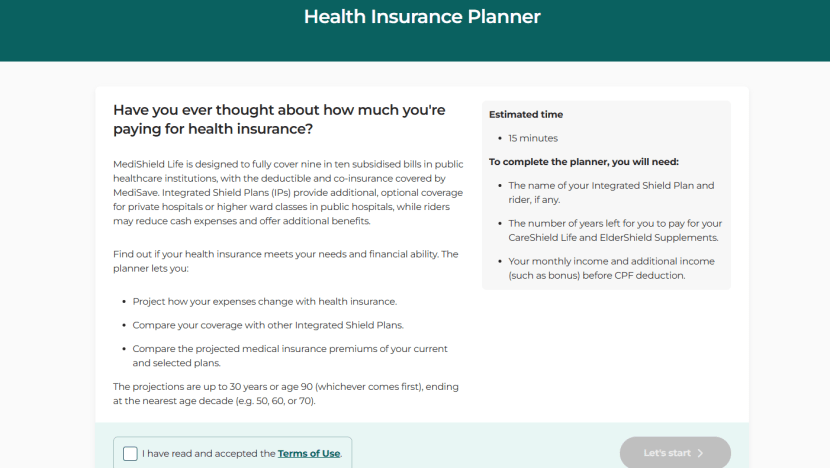

Called the Health Insurance Planner (HIP), the "interactive and personalised" tool is the first of its kind in Singapore, said the Central Provident Fund (CPF) Board and Ministry of Health (MOH) in a joint press release.

The planner can be accessed on the CPF website.

CPF and MOH said the planner is designed to help Singaporeans visualise their long-term MediSave savings and health insurance premiums.

It also allows them to compare key features and costs across Integrated Shield Plans (IPs) based on their preferred ward type, and project up to 30 years of premiums for both their chosen IP and rider.

There are three tiers of healthcare insurance in Singapore - MediShield Life, IPs and riders, the authorities added.

MediShield Life, the national basic health insurance plan available to all Singaporeans, provides "universal and lifelong protection against large hospitalisation bills and outpatient treatments such as cancer and dialysis", they said.

IPs, which are offered by private insurers and purchased by seven in 10 Singaporeans, offer "additional coverage for treatment at private hospitals or unsubsidised wards in public hospitals".

Some Singaporeans also opt to buy riders to reduce the co-payment for IPs, the authorities added.

The premiums for IPs can be paid in part by MediSave, while rider premiums are fully payable in cash.

In a minute-long video posted on social media on Wednesday, Health Minister Ong Ye Kung said that the HIP can help Singaporeans visualise how their total premiums will affect their MediSave and CPF savings.

"When you use the tool, you will find that MediShield Life is the most affordable because it is the universal national insurance scheme. Integrated Shield Plans (are) more expensive, and riders are the most expensive and will really affect your savings."

"Given the complexity of insurance, it can be difficult for individuals to assess and make decisions about their private health insurance coverage," added CPF and MOH.

"The HIP provides a forward-looking, personalised, and user-friendly platform for Singaporeans to review and better understand the long-term MediSave and cash expenses necessary to support their desired health insurance coverage."

CPF and MOH advised the public to contact their insurers or financial advisors if they require more details and advice on their IP and rider.

"Together with existing avenues of information, the HIP is an additional tool to help Singaporeans to make more informed decisions about healthcare insurance."

The Life Insurance Association Singapore and the Insurance and Financial Practitioners Association of Singapore will partner MOH and CPF to coordinate efforts to raise awareness of the tool with the public, the authorities said.

Last October, the MediShield Life Council announced that MediShield Life premiums will increase from April as the government expands the national health insurance scheme.

With higher claims and expansion of coverage, premiums may increase by as much as 35 per cent. The increases will be phased evenly over three years from April this year to March 2028.

Listen:

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10