Brookside Energy’s reserves surge 50% to offer barrel loads of production momentum

Special Report: Brookside Energy has delivered a hefty boost to its oil and gas reserves, giving the junior producer strong growth in its near-term revenue-generating assets and long-term reserve base.

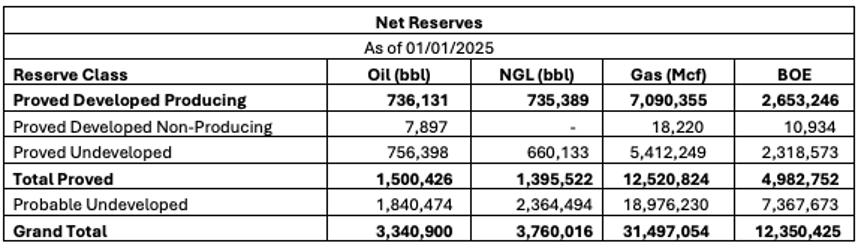

The independently verified FY2024 reserve update has lifted Brookside’s (ASX: BRK) proved developed producing (PDP) net reserves by 50.1 per cent to 2.65 million barrels of oil equivalent (BOE). Total Proved (1P) net reserves climbed 21.8 per cent to 4.98 million BOE, enhancing BRK’s shorter term production profile.

Total Proved plus Probable (2P) Net Reserves increased by 6.8 per cent to 12.35 million BOE, adding volume to the long-term reserve base.

Pumped up production potential

Notably the PDP reserves surged by 1.41 million net BOE, more than double Brookside’s FY24 production of 525,000 barrels.

That’s a 268% replacement rate on a PDP basis, 170% on a 1P basis, and 150% on a 2P basis, demonstrating the junior producer’s consistent organic growth.

Critically, BRK locked in these reserve gains at a finding and development (F&D) cost of just US$16.40 per BOE which is well below the 2023 global public company average of US$20.06 per BOE.

Upwards trajectory

Brookside’s robust reserves uplift follows a strong 2024, including the December quarter’s record net production of almost 2500 BOE per day – a 129% increase on the previous quarter.

That generated $21.1 million in cash receipts from sales for the company, one of only a few ASX-listers operating in the North American oil and gas sector.

Finishing the previous quarter with a strong cash balance of A$11.3 million, the company is ideally placed to pursue its 2025 strategy of further growing inventory and completing more targeted drilling in Oklahoma’s prolific Anadarko Basin, including three new wells at the SWISH project.

Brookside is additionally participating as a non-operator in seven wells within the Gapstow FFD, also in the Andarko Basin, with a cumulative working interest of 20.9%.

Managing director David Prentice said: “We’re definitely excited to have added to our reserves and have opportunities to grow reserves even more.

“With our forecast strong production uplifts and additional inventory developments, we are confident in our ability to deliver sustainable returns for our shareholders.”

This article was developed in collaboration with Brookside Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Explore More

-

Investor Guide: Energy FY2025 featuring Peter Strachan

Investor Guide: Energy FY2025 featuring Peter Strachan

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10