Pi Network price nears all-time low ahead of a 124M token unlock 13 minutes ago

Pi Network price continued its strong downward trend as buyers remained on the sidelines and concerns about the upcoming token unlock grew.

Pi Network (PI) dropped to a low of $0.7012, its lowest level since Feb. 25, and is now down 76% from its all-time high. This decline has led to a $14 billion wipeout, with its market cap crashing from nearly $20 billion to $4.76 billion.

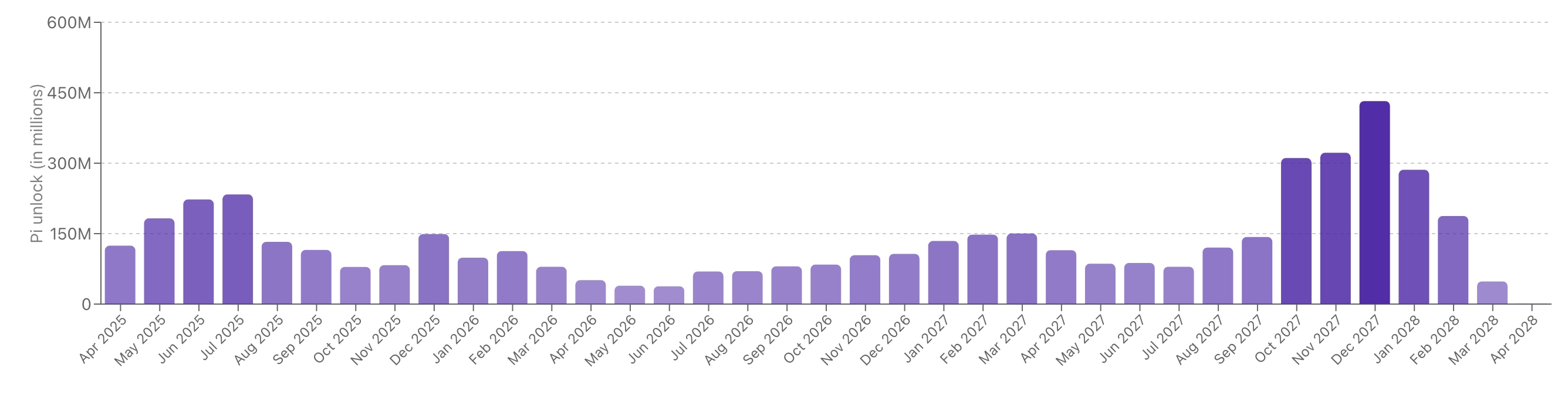

The Pi coin sell-off continued as traders focused on the upcoming token unlock, which is expected to lead to further dilution. According to PiScan, over 124 million Pi coins will be unlocked this month.

These unlocks will increase over the next three months, peaking at 233 million in July. Altogether, the network expects to unlock more than 1.53 billion tokens over the next 12 months, bringing total circulating supply to 8.2 billion.

Pi Network has become one of the most inflationary cryptocurrencies, a trend likely to continue. That’s because the maximum supply is capped at 100 billion Pi coins, while current circulation stands at 6.7 billion.

Token unlocks contribute to inflation by increasing the number of tokens in circulation. Some cryptocurrencies offset these unlocks with a burning mechanism, where tokens are sent to a dead address to reduce supply.

It’s unclear whether Pi has plans to implement such a burning mechanism. One option could be to incinerate all tokens not moved to the mainnet by the June deadline. Another possibility is to burn ecosystem fees.

Perhaps Nicolas Kokkalis, Pi’s co-founder, will address these concerns during the project’s first X Space. He is expected to share the roadmap and outline upcoming features.

Pi Network price has also struggled due to a lack of exchange listings. No major tier-1 exchange has listed the token since its mainnet launch in February.

Pi Network price technical analysis

The four-hour chart shows that Pi coin has been in a persistent downtrend over the past few months and is slowly approaching its all-time low. It remains below the 50-period moving average, a sign that bears are in control for now.

On the positive side, Pi Network has formed a falling wedge pattern, a popular bullish reversal signal. With the two trend lines nearing convergence, it could rebound in April and potentially retest the psychological level at $1. All Pi needs is a single catalyst, such as a major exchange listing.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10