Autodesk (NasdaqGS:ADSK) Board Member Betsy Rafael Steps Down After Over A Decade

Autodesk (NasdaqGS:ADSK) recently experienced executive changes with Elizabeth Rafael stepping down from its board, aligning with her conclusion of an advisory role. Over the past week, the company’s share price moved flat despite the broader market's sharp declines following the announcement of new tariffs by President Trump. The tech-heavy Nasdaq Composite fell significantly due to tariff concerns, affecting many companies. However, Autodesk's price movement remained relatively stable, perhaps benefiting from its lesser exposure to immediate tariff impacts relative to other tech companies heavily reliant on international manufacturing.

Buy, Hold or Sell Autodesk? View our complete analysis and fair value estimate and you decide.

The end of cancer? These 21 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

Over the past five years, Autodesk's shares achieved a total return of 68.29%, reflecting its focus on strategic growth and adaptability in an evolving market. A pivotal factor in its longer-term stability has been its transition to a new transaction model, enhancing revenue predictability and boosting cash flow. This shift, alongside investments in cloud and AI, has been crucial for expanding Autodesk's customer ecosystem and supporting long-term growth, beyond fiscal '26. Additionally, the completion of significant share repurchases, totaling US$1.12 billion, underscores the company's confidence in its cash generation abilities, thereby enhancing shareholder value.

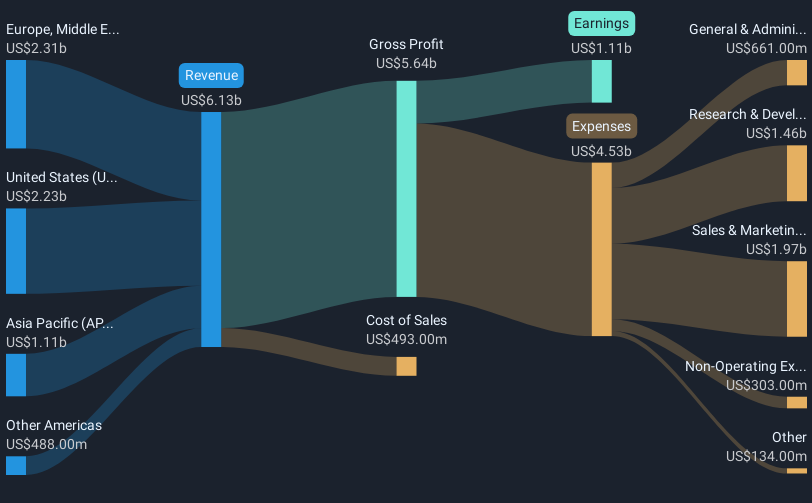

The company’s earnings announcements have consistently reported revenue growth, with full-year revenues rising from US$5.50 billion to US$6.13 billion recently. Despite a tumultuous market landscape, Autodesk exceeded the US Software industry return over the past year. Collaborations with various partners to enhance the Autodesk Construction Cloud functionalities further solidify its standing in high-growth areas like Construction and Fusion, underpinning its sustained market relevance.

The valuation report we've compiled suggests that Autodesk's current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10