Prosperous Industrial (Holdings) (HKG:1731) Is Looking To Continue Growing Its Returns On Capital

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So when we looked at Prosperous Industrial (Holdings) (HKG:1731) and its trend of ROCE, we really liked what we saw.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Prosperous Industrial (Holdings) is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = US$29m ÷ (US$221m - US$47m) (Based on the trailing twelve months to December 2024).

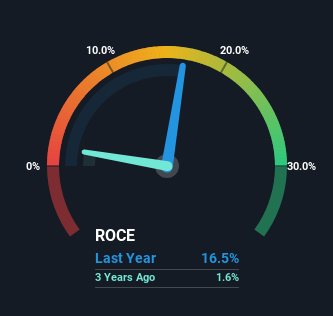

Therefore, Prosperous Industrial (Holdings) has an ROCE of 16%. On its own, that's a standard return, however it's much better than the 13% generated by the Luxury industry.

Check out our latest analysis for Prosperous Industrial (Holdings)

Historical performance is a great place to start when researching a stock so above you can see the gauge for Prosperous Industrial (Holdings)'s ROCE against it's prior returns. If you're interested in investigating Prosperous Industrial (Holdings)'s past further, check out this free graph covering Prosperous Industrial (Holdings)'s past earnings, revenue and cash flow .

So How Is Prosperous Industrial (Holdings)'s ROCE Trending?

The trends we've noticed at Prosperous Industrial (Holdings) are quite reassuring. The data shows that returns on capital have increased substantially over the last five years to 16%. The amount of capital employed has increased too, by 22%. So we're very much inspired by what we're seeing at Prosperous Industrial (Holdings) thanks to its ability to profitably reinvest capital.

The Key Takeaway

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Prosperous Industrial (Holdings) has. Since the stock has returned a staggering 242% to shareholders over the last five years, it looks like investors are recognizing these changes. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

One more thing, we've spotted 1 warning sign facing Prosperous Industrial (Holdings) that you might find interesting.

While Prosperous Industrial (Holdings) may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you're looking to trade Prosperous Industrial (Holdings), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10