Legendary stock picker Warren Buffett has refused to include cryptocurrencies, including Bitcoin BTC/USD, in his firm Berkshire Hathaway Inc.'s BRK BRK portfolio, but the holding company, interestingly, has exposure to a firm that pitches the apex cryptocurrency as an inflation hedge.

What happened: According to the latest 13F filing, Berkshire Hathaway holds 433,558 shares of financial services company Jefferies Financial Group Inc. JEF, worth nearly $34 million.

The New York City-headquartered firm operates in investment banking and capital markets, and asset management businesses.

Notably, Jefferies holds a sizeable stake in iShares Bitcoin Trust ETF IBIT, the world's largest spot exchange-traded Bitcoin fund. Filings with the SEC revealed that Jefferies owned 1,615,731 shares of IBIT, valued at over $85 million.

See Also: Bitcoin Reeling From Trump’s ‘Liberation Day’ Shock But These Gold-Backed Coins Are Killing It This Year

The investment likely stemmed from its bullish long-term view about the leading digital asset.

Jefferies deemed Bitcoin as a "critical hedge" against fiat debasement and inflation, according to an October 2023 report by CNBC.

The investment bank said Bitcoin's insurance policy narrative gained traction following the U.S. banking crisis earlier in the year, and it recommended a 10% allocation to the asset for U.S. dollar-based long-term global investors.

This optimism sharply contrasted with Buffett’s dismissive attitude toward Bitcoin. The “Oracle of Omaha” called Bitcoin “probably rat poison squared” during Berkshire Hathaway’s annual shareholder meeting in 2018 and predicted a “bad ending” for the cryptocurrency.

Price Action: At the time of writing, Bitcoin was exchanging hands at $83,315.66, down 1.03% in the last 24 hours, according to data from Benzinga Pro. Year-to-date, the asset has slid 11.84%.

Shares of Berkshire Hathaway fell 2.09% in after-hours trading, after closing 0.89% higher at 537.72 during Wednesday’s regular session. Jefferies stock closed 2.99% higher at $55.14.

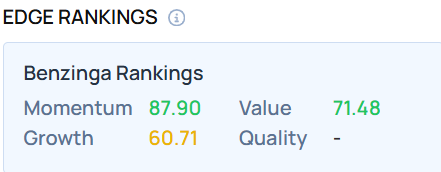

Berkshire Hathaway stock demonstrated a good momentum and value score as of this writing. To see how Jefferies and other financial stocks rank in these categories, visit Benzinga Edge Stock Rankings.

Image via Shutterstock

Read Next:

- OnlyFans Founder’s Startup And HBAR Foundation Enter Race To Acquire Tiktok To Maintain ‘American Ownership And Governance’

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.