RPM International Inc. (NYSE:RPM) will release earnings results for the third quarter, before the opening bell on Tuesday, April 8.

Analysts expect the Medina, Ohio-based company to report quarterly earnings at 50 cents per share, down from 52 cents per share in the year-ago period. RPM projects to report quarterly revenue at $1.51 billion, compared to $1.52 billion a year earlier, according to data from Benzinga Pro.

On April 3, RPM International reported that it has signed a definitive agreement to acquire U.K.-based Star Brands Group, the maker of The Pink Stuff, for its Rust-Oleum subsidiary.

RPM shares tumbled 3.9% to close at $108.23 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

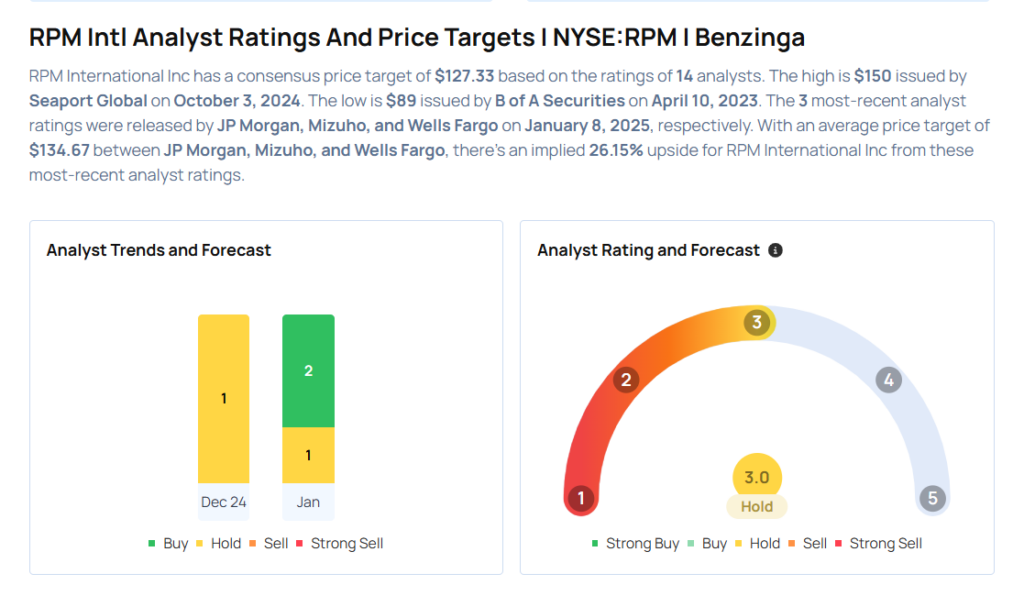

- JP Morgan analyst Jeffrey Zekauskas maintained a Neutral rating and cut the price target from $126 to $124 on Jan. 8, 2025. This analyst has an accuracy rate of 67%.

- Mizuho analyst John Roberts maintained an Outperform rating and cut the price target from $150 to $140 on Jan. 8, 2025. This analyst has an accuracy rate of 75%.

- Wells Fargo analyst Michael Sison upgraded the stock from Equal-Weight to Overweight and raised the price target from $134 to $140 on Jan. 8, 2025. This analyst has an accuracy rate of 66%.

- Morgan Stanley analyst Vincent Sinisi maintained an Equal-Weight rating and boosted the price target from $107 to $125 on Oct. 4, 2024. This analyst has an accuracy rate of 73%.

- Seaport Global analyst Michael Harrison maintained a Buy rating and increased the price target from $140 to $150 on Oct. 3, 2024. This analyst has an accuracy rate of 67%.

Considering buying RPM stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Health Care Stocks With Over 4% Dividend Yields

Photo via Shutterstock