Institutional investors in Kingsoft Corporation Limited (HKG:3888) see HK$2.6b decrease in market cap last week, although long-term gains have benefitted them.

Key Insights

- Given the large stake in the stock by institutions, Kingsoft's stock price might be vulnerable to their trading decisions

- 51% of the business is held by the top 10 shareholders

- Insider ownership in Kingsoft is 20%

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

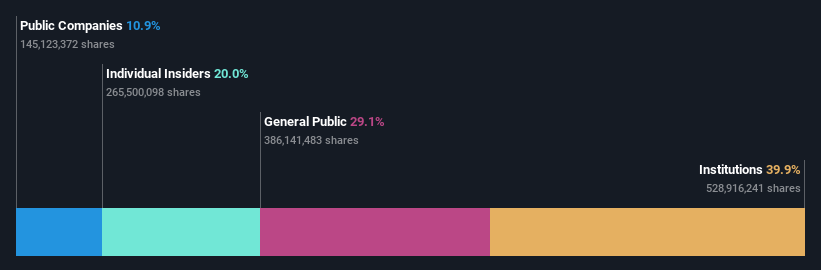

A look at the shareholders of Kingsoft Corporation Limited (HKG:3888) can tell us which group is most powerful. And the group that holds the biggest piece of the pie are institutions with 40% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

Losing money on investments is something no shareholder enjoys, least of all institutional investors who saw their holdings value drop by 5.2% last week. However, the 48% one-year return to shareholders may have helped lessen their pain. But they would probably be wary of future losses.

Let's delve deeper into each type of owner of Kingsoft, beginning with the chart below.

View our latest analysis for Kingsoft

What Does The Institutional Ownership Tell Us About Kingsoft?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

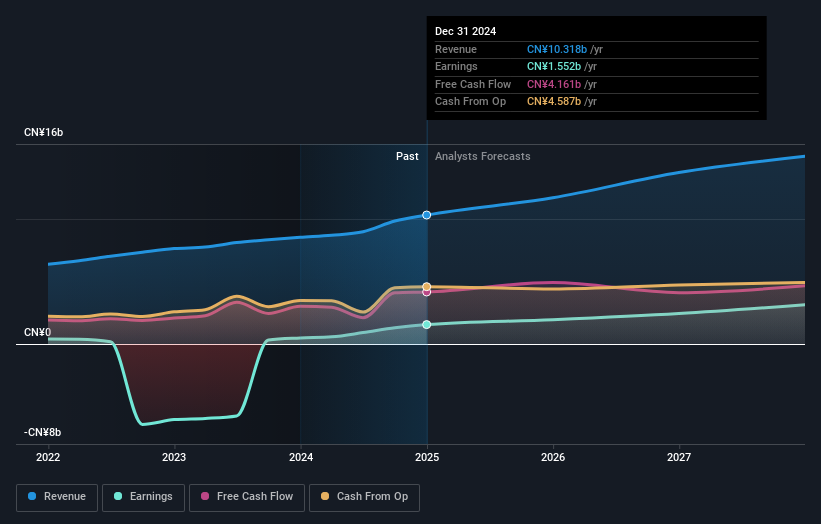

We can see that Kingsoft does have institutional investors; and they hold a good portion of the company's stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Kingsoft's earnings history below. Of course, the future is what really matters.

Kingsoft is not owned by hedge funds. Our data suggests that Jun Lei, who is also the company's Top Key Executive, holds the most number of shares at 13%. When an insider holds a sizeable amount of a company's stock, investors consider it as a positive sign because it suggests that insiders are willing to have their wealth tied up in the future of the company. For context, the second largest shareholder holds about 8.1% of the shares outstanding, followed by an ownership of 6.8% by the third-largest shareholder. Interestingly, the third-largest shareholder, Pak Kwan Kau is also a Member of the Board of Directors, again, indicating strong insider ownership amongst the company's top shareholders.

We also observed that the top 10 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Kingsoft

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of Kingsoft Corporation Limited. It is very interesting to see that insiders have a meaningful HK$9.5b stake in this HK$47b business. Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

With a 29% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Kingsoft. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Public Company Ownership

Public companies currently own 11% of Kingsoft stock. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph .

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future .

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Kingsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10